Personal Finance

13th Edition

ISBN: 9781337669214

Author: GARMAN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

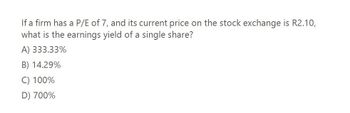

What is the earnings yield of a single share on these financial accounting question?

Transcribed Image Text:If a firm has a P/E of 7, and its current price on the stock exchange is R2.10,

what is the earnings yield of a single share?

A) 333.33%

B) 14.29%

C) 100%

D) 700%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ratio Analysis MJO Inc. has the following stockholders equity section of the balance sheet: On the balance sheet date, MJOs stock was selling for S25 per share. Required: Assuming MJOs dividend yield is 1%, what are the dividends per common share? Assuming MJOs dividend yield is 1% and its dividend payout is 20%, what is MJOs net income?arrow_forwardNeed help please this financial accounting questionarrow_forwardWhat is the stock's current price ?arrow_forward

- A firm’s common stock has D1 = $1.50, P0 = $30.00, g = 5%, and F = 4%. If the firmmust issue new stock, what is its cost of new external equity?arrow_forwardA firm has common stock with D1 = $3.00; P0 = $30; g = 5%; andF = 4%. If the firm must issue new stock, what is its cost of externalequity, re? (15.42%)arrow_forwardWhat is the price earnings ratio?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub