FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

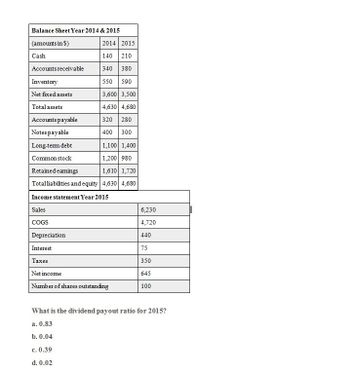

What is the dividend payout ratio for 2015 on these financial accounting question?

Transcribed Image Text:Balance Sheet Year 2014 & 2015

(amounts in $)

2014 2015

Cash

140 210

Accounts receivable

340 380

Inventory

550 590

Net fixed assets

3,600 3,500

Total assets

4,630 4,680

Accounts payable

320 280

Notes payable

400 300

Long-term debt

1,100 1,400

Common stock

1,200 980

Retained eamings

1,610 1,720

Total liabilities and equity 4,630 4,680

Income statement Year 2015

Sales

6,230

COGS

4,720

Depreciation

440

Interest

75

Taxes

350

Net income

645

Number of shares outstanding

100

What is the dividend payout ratio for 2015?

a. 0.83

b. 0.04

c. 0.39

d. 0.02

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- How did they get 12 million from this question? Explainarrow_forwardJUST DEW IT CORPORATION2017 and 2018 Balance Sheets Assets Liabilities and Owners' Equity 2017 2018 2017 2018 Current assets Current liabilities Cash $ 10,150 $ 10,350 Accounts payable $ 74,500 $ 61,250 Accounts receivable 27,100 27,250 Notes payable 48,500 49,250 Inventory 62,900 63,500 Total $ 123,000 $ 110,500 Total $ 100,150 $ 101,100 Long-term debt $ 59,400 $ 64,900 Owners' equity Common stock and paid-in surplus $ 80,000 $ 80,000 Fixed assets Retained earnings 171,750 192,700 Net plant and equipment $ 334,000 $ 347,000 Total $ 251,750 $ 272,700 Total assets $ 434,150 $ 448,100 Total liabilities and owners' equity $ 434,150 $ 448,100 Based on the balance sheets given for Just Dew It, calculate the following…arrow_forwardUse the following information for questions 2-9 Category Accounts payable Accounts receivable Accruals 2016 2017 34,500 37,500 96,000 102,000 13,500 11,250 Additional paid in capital Cash Common Stock@par value COGS Depreciation expense 187,500 204,000 6,000 16,800 10,500 11,550 109,500 144,000 18.000 19,500 Interest expense 13,500 13,800 Inventories 93,000 96,000 Long-term debt 112,500 116,250 Net fixed assets 315,000 ??? Notes payable 49,500 54,000 Operating expenses (excl. depr.) 42,000 52,500 Retained earnings Sales Taxes Net fixed assets in 2017 were $ 1) 331,750 2) 332,750 102,000 114,000 213,000 282,000 8,250 15,750 3) 333,750 4) 344,750 5) 345,750arrow_forward

- Category Prior Year Current Year Accounts payable ??? ??? Accounts receivable 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 Common Stock 94,000 105,000 COGS 328,500 428,571.00 Current portion long-term debt 33,750 35,000 Depreciation expense 54,000 54,035.00 Interest expense 40,500 42,155.00 Inventories 279,000 288,000 Long-term debt 339,577.00 401,377.00 Net fixed assets 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 162,171.00 Retained earnings 306,000 342,000 Sales 639,000 849,094.00 Taxes 24,750 47,192.00 What is the current year's entry for long-term debt on a common-sized balance sheet? (ROUND TO 4 DECIMAL PLACES.)arrow_forwardCategory Prior Year Current Year Accounts payable ??? Accounts receivable 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 Common Stock 94,000 105,000 COGS 328,500 431,516.41 Current portion long-term debt 33,750 35,000 Depreciation expense 54,000 55,946.66 Interest expense 40,500 41,874.31 Inventories 279,000 288,000 Long-term debt 336,467.85 401,942.46 Net fixed assets 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 161,499.58 Retained earnings 306,000 342,000 Sales 639,000 854,554.01 Taxes 24,750 48,384.56 ??? What is the current year's return on equity (ROE)? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign re rounded to 4 decimal places (ex: 0.0924))arrow_forwardThe comparative balance sheets for Metlock Corporation show the following information. December 312020 2019Cash $33,500 $12,900Accounts receivable 12,400 10,000Inventory 12,100 9,000Available-for-sale debt investments –0– 3,000Buildings –0– 29,800Equipment 44,800 19,900Patents 5,000 6,300 $107,800 $90,900Allowance for doubtful accounts $3,100 $4,500Accumulated depreciation—equipment 2,000 4,500Accumulated depreciation—building –0– 6,000Accounts payable 5,000 3,000Dividends payable –0– 4,900Notes payable, short-term (nontrade) 3,000 4,100Long-term notes payable 31,000 25,000Common stock 43,000 33,000Retained earnings 20,700 5,900 $107,800 $90,900 Additional data related to 2020 are as follows. 1. Equipment that had cost $11,000 and was 40% depreciated at time of disposal was sold for $2,500.2. $10,000 of the long-term note payable was paid by issuing common stock.3. Cash dividends paid were $4,900.4. On January…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education