FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

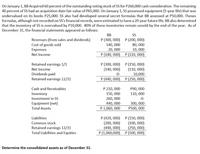

Transcribed Image Text:On January 1, BB Acquired 60 percent of the outstanding voting stock of SS for P260,000 cash consideration. The remaining

40 percent of SS had an acquisition date fair value of P65,000. On January 1, SS possessed equipment (5-year life) that was

undervalued on its books P25,000. SS also had developed several secret formulas that BB assessed at P50,000. Theses

formulas, although not recorded on SS's financial records, were estimated to have a 20-year future life. BB also determined

that the inventory of SS is overvalued by P10,000. 80% of these inventories remain unsold by the end of the year. As of

December 31, the financial statements appeared as follows:

ВВ

SS

Revenues (from sales and dividends)

Cost of goods sold

P (300, 000) P (200, 000)

140, 000

20, 000

80, 000

10, 000

Expenses

Net Income

P (140, 000) P (110, 000)

Retained earnings 1/1

P (300, 000) P (150, 000)

(110, 000)

10,000

Net Income

(140, 000)

Dividends paid

Retained earnings 12/31

-0-

P (440, 000)

P (250, 000)

Cash and Receivables

P 210, 000

Р90, 000

110, 000

Inventory

150, 000

260, 000

440, 000

P 1,060, 000

Investment in SS

-0-

Equipment (net)

Total Assets

300, 000

P500, 000

Liabilities

P (420, 000) P (150, 000)

(200, 000)

(440, 000)

P (1,060,000)

(100, 000)

(250, 000)

P (500, 000)

Common stock

Retained earnings 12/31

Total Liabilities and Equities

Determine the consolidated assets as of December 31.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please don't provide answer in image format thank youarrow_forwardW Co. acquired the intangible assets listed below for a total lump sum price of P400,000. Intangible asset Service mark Order and production backlogs In-house research and development Fair value P160,000 120,000 80,000 120,000 How much is the initial measurement of the masthead? Masthead Your answer On January 1, 20x1, M Co. incurred P500,000 in registering a patent. It was initially estimated that the useful life of the asset is 20 years, equal to its legal life. However, on January 1, 20x6, M assessed that the useful life of the patent was only 15 years starting on the date of registration. How much is the amortization expense in 20x6? Your answerarrow_forwardPlease answer it properlyarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education