Pirate Corporation acquired 60 percent ownership of Ship Company on January 1, 20X8, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 40 percent of the book value of Ship Company.

| Item | Pirate Corporation | Ship Company | ||

|---|---|---|---|---|

| Debit | Credit | Debit | Credit | |

| Cash | $ 27,000 | $8,000 | ||

| 65,000 | 22,000 | |||

| Inventory | 40,000 | 30,000 | ||

| Buildings and Equipment | 500,000 | 235,000 | ||

| Investment in Row Company | 40,000 | |||

| Investment in Ship Company | 108,000 | |||

| Cost of Goods Sold | 150,000 | 110,000 | ||

| Depreciation Expense | 30,000 | 10,000 | ||

| Interest Expense | 8,000 | 3,000 | ||

| Dividends Declared | 24,000 | 15,000 | ||

| Accumulated Depreciation | $ 140,000 | $ 85,000 | ||

| Accounts Payable | 63,000 | 20,000 | ||

| Bonds Payable | 100,000 | 50,000 | ||

| Common Stock | 200,000 | 100,000 | ||

| 208,000 | 60,000 | |||

| Other Comprehensive Income from Ship Company (OCI)—Unrealized Gain on Investments | 6,000 | |||

| Unrealized Gain on Investments (OCI) | 10,000 | |||

| Sales | 220,000 | 148,000 | ||

| Income from Ship Company | 15,000 | |||

| $ 952,000 | $ 952,000 | $ 473,000 | $ 473,000 |

Additional Information

Ship purchased stock of Row Company on January 1, 20X8, for $30,000 and classified the investment as available-for-sale securities. The value of Row’s securities increased to $40,000 at December 31, 20X8.

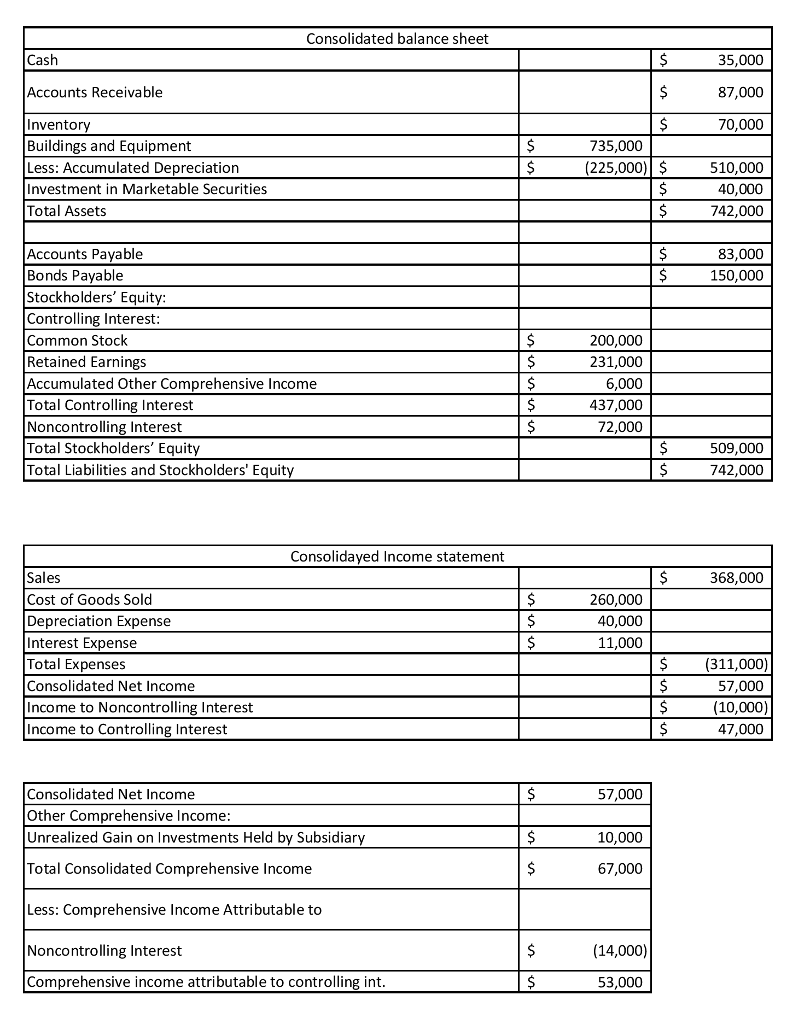

Prepare a consolidated

SOLUTION:-

Step by stepSolved in 2 steps with 1 images

- Phone Corporation acquired 70 percent of Smart Corporation’s common stock on December 31, 20X4, for $98,000. At that date, the fair value of the noncontrolling interest was $42,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: Item Phone Corporation Smart Corporation Cash $ 52,300 $ 39,000 Accounts Receivable 99,000 59,000 Inventory 136,000 92,000 Land 66,000 49,000 Buildings & Equipment 417,000 268,000 Less: Accumulated Depreciation (151,000) (73,000) Investment in Smart Corporation 98,000 Total Assets $ 717,300 $ 434,000 Accounts Payable $ 141,500 $ 27,000 Mortgage Payable 300,800 288,000 Common Stock 72,000 40,000 Retained Earnings 203,000 79,000 Total Liabilities & Stockholders’ Equity $ 717,300 $ 434,000 At the date of the business combination, the book values of Smart’s assets and liabilities approximated fair value except for inventory, which had a fair value of…arrow_forwardSFFN Corp. purchased the entire business of AZC, Inc. including all its assets and liabilities for $1,800,000. Below is information related to the two companies: SFFN AZC Fair value of assets $ 3,050,000 $ 1,600,000 Fair value of liabilities 2,575,000 800,000 Reported assets 2,800,000 1,400,000 Reported liabilities 2,500,000 750,000 Net Income for the year 460,000 250,000 How much goodwill will SFFN recognize as a result of its acquisition of AZC? Select one: a. $-0- b. $1,225,000 c. $1,150,000 d. $200,000 e. $1,000,000arrow_forwardJam Ltd acquired all the equity in Cab Ltd on 31 December 20X4 for $360 000. At the control date, the equity of Cab was recorded as Paid-up capital of $260 000 and Retained profits of $30 000. The purchase price was based on the agreed fair values of Cab's identifiable assets and liabilities on that date. The following items were not at fair value in Cab's financial statements on the control date. Inventory Property (Cost of $250 000, Accumulated depreciation of $40 000) Carrying amount ($) 32 000 210 000 Fair value ($) 24 000 252 000 Other information: • Both Cab and the group entity account for its property by the cost model, and apply straight-line depreciation to the property. The property in Cab Ltd is expected to have a remaining life of 21 years from 31 December 20X4, and no residual value. Cab sold goods to Jam for $5,000 during FY20X5, the cost of these inventories was 4,000. All these inventories were still on hand by Jam by 31 December 20X5, the year-end. . Required: Prepare…arrow_forward

- Professor Corporation acquired 70 percent of Scholar Corporation's common stock on December 31, 20X4, fr $102,200. The fair value of the noncontrolling interest at that date was determined to be $43,800. Data from the balance sheets of the two companies Included the following amounts as of the date of acquisition: Item Cash Accounts Receivable Inventory Land Buildings & Equipment Less: Accumulated Depreciation. Investment in Scholar Corporation Total Assets Accounts Payable Mortgage Payable Common Stock Retained Earnings Total Liabilities & Stockholders' Equity Professor Corporation $ 50,300 90,000 Scholar Corporation $21,000 44,000 130,000 75,000 60,000 30,000 410,000 250,000 (150,000) (80,000) 102,200 $ 692,500 $340,000 $ 152,500 $ 35,000 250,000 180,000 80,000 40,000 210,000 85,000 $ 692,500 $340,000 At the date of the business combination, the book values of Scholar's assets and liabilities approximated fair value except for Inventory, which had a fair value of $81,000, and…arrow_forwardManjiarrow_forwardMainline Produce Corporation acquired all the outstanding common stock of Iceberg Lettuce Corporation for $30,000,000 in cash. The book values and fair values of Iceberg's assets and liabilities were as follows: Current assets Property, plant, and equipment Current liabilities Book Value $ 10,200,000 21,000,000 1,800,000 7,200,000 11,800,000 Fair Value $ 13,200,000 Other assets Long-term liabilities Required: 27,000,000 2,800,000 7,200,000 10,800,000 Calculate the amount paid for goodwill. (Enter your answer in millions (i.e. 5,000,000 should be entered as 5).) Amount paid for goodwill millionarrow_forward

- Penny Manufacturing Company acquired 75 percent of Saul Corporation stock at underlying book value. At the date of acquisitior fair value of the noncontrolling Interest was equal to 25 percent of Saul's book value. The balance sheets of the two companies fc January 1, 20X1, are as follows: Cash Accounts Receivable. Inventory Buildings and Equipment Less: Accumulated Depreciation Investment in Saul Corporation Total Assets PENNY MANUFACTURING COMPANY Balance Sheet January 1, 20x1 Cash Accounts Receivable Inventory Buildings and Equipment Less: Accumulated Depreciation Total Assets $ 231,500 Accounts Payable 75,000 Bonds Payable. 113,000 Common Stock 618,000 Additional Paid-In Capital (139,000) Retained Earnings 233,250 $ 1,131,758 Total Liabilities and Equities $ 159,750 380,000 181,000 31,000 380,000 $ 1,131,750 SAUL CORPORATION Balance Sheet January 1, 20x1 $ 61,000 Accounts Payable 115,000 Bonds Payable 193,000 Common Stock ($10 par) 618,000 Additional Paid-In Capital (239,000)…arrow_forwardPeanut Company acquired 90 percent of Snoopy Company's outstanding common stock for $310,500 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $345,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December 31, 20X8, follow: Cash Accounts Receivable Inventory Investment in Snoopy Company Land Buildings and Equipment Cost of Goods Sold Depreciation Expense Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Snoopy Company Total Peanut Company Debit $ 174,000 181,000 211,000 353,700 206,000 707,000 187,000 41,000 220,000 89.000 $2,369,700 Credit $450,000 63,000 188,000 492,000 313,900 789,000 73.800 $2,369,700 Snoopy Company Debit $ 87,000 82,000 76,000 95,000 188,000 120,000 9,000 27,000 34,000 $718,000 Credit $18,000 48,000 69,000 196,000 149,000 238,000 0 $718,000 Required: a. Prepare any equity…arrow_forwardi need the answer quicklyarrow_forward

- Northern Equipment Corporation purchased all the outstanding common stock of Pioneer Equipment Rental for $5,600,000 in cash. The book values and fair values of Pioneer’s assets and liabilities were Book Value Fair ValueAccounts Receivable $ 750,000 $ 650,000Buildings 4,100,000 4,800,000Equipment 110,000 200,000Accounts Payable (750,000) (750,000)Net assets $ 4,210,000 $ 4,900,000Required:1. Calculate the amount Northern Equipment should report for goodwill.2. Record Northern Equipment’s acquisition of Pioneer Equipment Rental.arrow_forwardSagararrow_forwardOn January 1, 20X4, Pierce Corporation acquired 90 percent of Sharp Company's voting stock, at underlying book value. The fair value of the noncontrolling interest was equal to 10 percent of the book value of Sharp at that date. Pierce uses the equity method in accounting for its ownership of Sharp. On December 31, 20X4, the trial balances of the two companies are as follows: Item Current Assets Depreciable Assets Investment in Sharp Depreciation Expense Other Expenses Dividends Declared Accumulated Depreciation Current Liabilities Long-Term Debt Common Stock Retained Earnings Sales Income from Subsidiary Required: Pierce Company Debit $ 200,000 300,000 139,500 30,000 100,000 30,000 $ 799,500 Credit $ 120,000 62,000 75,000 100,000 120,000 300,000 22,500 $ 799,500 Sharp Corporation Debit $ 120,000 225,000 25,000 60,000 10,000 $ 440,000 Credit $ 75,000 25,000 90,000 75,000 65,000 110,000 $ 440,000 1) Provide all consolidating entries required as of December 31, 20X4, to prepare…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education