FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Ef 80.

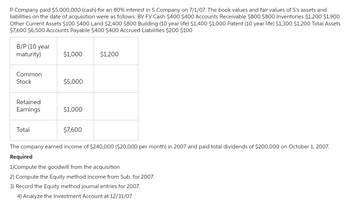

Transcribed Image Text:P Company paid $5,000,000 (cash) for an 80% interest in S Company on 7/1/07. The book values and fair values of S's assets and

liabilities on the date of acquisition were as follows: BV FV Cash $400 $400 Accounts Receivable $800 $800 Inventories $1,200 $1,900

Other Current Assets $100 $400 Land $2,400 $800 Building (10 year life) $1,400 $1,000 Patent (10 year life) $1,300 $1,200 Total Assets

$7,600 $6,500 Accounts Payable $400 $400 Accrued Liabilities $200 $100

B/P (10 year

maturity)

Common

Stock

Retained

Earnings

Total

$1,000

$5,000

$1,000

$7,600

$1,200

The company earned income of $240,000 ($20,000 per month) in 2007 and paid total dividends of $200,000 on October 1, 2007.

Required

1)Compute the goodwill from the acquisition

2) Compute the Equity method Income from Sub. for 2007.

3) Record the Equity method journal entries for 2007.

4) Analyze the Investment Account at 12/31/07

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company that was to be liquidated had the following liabilities: Income Taxes Notes Payable secured by land Accounts Payable $ 15,000 120,000 48,000 Salaries Payable ($18,000 for Employee #1 and $5,000 for Employee #2) Administrative expenses for liquidation The company had the following assets: 23,000 Current Assets Land Building Saved 25,000 Book Fair Value Value $130,000 $115,000 60,000 100,000 175,000 220,000 Total liabilities with priority are calculated to be what amount? Multiple Choice О $106,650. $38,000.arrow_forwardHansen Corporation. a C Corporation (mot a manufacturer) reports the following items in income and expenses for 2021 Gross Revenue $900,000 Dividend Received from 30% owned Corp 200,000 LTCG 30,000 STCL 12000 City of Lee's Summit Bond Interest 10000 COGS 375000 Administrative Expenses 325000 Charitable Contribution 60,000 Compute Hansen's C Corp Taxable income?arrow_forwardA direct quote of €0.1256/Dkr is equivalent to an indirect quote of a . Dkr 7.962/€ b . Dkr 7.8654/€ c . Dkr 0.8654/€ d . Dkr 1.1345/€arrow_forward

- The answer is 1,130.55arrow_forwardNow, assume that the state of the limit order book is as follows just before the call of CBA's opening call auction: Buy Quantity Price $8.08 $8.01 $7.99 $7.96 $7.91 $7.87 $7.84 $7.82 0 0 0 a. $7.96 O b. $8.01 O c. Other O d. $7.99 e. $7.91 1800 800 1100 1900 800 Sell Quantity 1600 1800 1200 0 0 0 0 If no more orders are entered, the call price would be:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education