FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

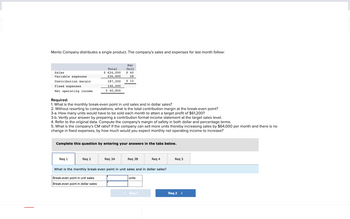

Transcribed Image Text:Menlo Company distributes a single product. The company's sales and expenses for last month follow:

Sales

Variable expenses.

Contribution margin

Fixed expenses

Net operating income

Total

$ 624,000

436,800

187,200

146,400

$ 40,800

Required:

1. What is the monthly break-even point in unit sales and in dollar sales?

Req 1

2. Without resorting to computations, what is the total contribution margin at the break-even point?

3-a. How many units would have to be sold each month to attain a target profit of $61,200?

Req 2

Per

Unit

3-b. Verify your answer by preparing a contribution format income statement at the target sales level.

4. Refer to the original data. Compute the company's margin of safety in both dollar and percentage terms.

5. What is the company's CM ratio? If the company can sell more units thereby increasing sales by $64,000 per month and there is no

change in fixed expenses, by how much would you expect monthly net operating income to increase?

$ 40

28

$ 12

Complete this question by entering your answers in the tabs below.

Break-even point in unit sales

Break-even point in dollar sales

Req 3A

Req 3B

What is the monthly break-even point in unit sales and in dollar sales?

units

Req 4

< Req 1

Req 5

Req 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I need help with Req 4 and Req 5.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I need help with Req 4 and Req 5.

Solution

by Bartleby Expert

Knowledge Booster

Similar questions

- Please answer complete question, otherwise skip it,,, Please provide answer in text (Without image)arrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $ 33.00 18.00 $ 15.00 Sales (8,800 units) Variable expenses Contribution margin Fixed expenses Net operating income Required: (Consider each case independently): Total $ 290,400 158,400 132,000 54,100 $ 77,900 1. What would be the revised net operating income per month if the sales volume increases by 40 units? 2. What would be the revised net operating income per month if the sales volume decreases by 40 units? 3. What would be the revised net operating income per month if the sales volume is 7,800 units? 1. Revised net operating income 2. Revised net operating income 3. Revised net operating incomearrow_forwardThe following information relates to Oil Change Company. Oil Change Co. Projected Net Income For a Week Sales (160 cars serviced at $24 per car) Variable Expenses (160 cars at $9 per car) Contribution Margin Fixed Expenses Net Income Calculate the following: (i) Unit Contribution: (ii) Total Contribution: (iii) Break Even Point in Units (iv) Break Even Point in Dollars (v) Net Profit: $3,840 - 1,440 2,400 - 2,400 $ 0arrow_forward

- Dhapaarrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $31.00 18.00 $ 13.00 Sales (8,600 units) Variable expenses Contribution, margin Fixed expenses Net operating income Total $ 266,600 154,800 111,800 Required: (Consider each case independently): 1. Revised net operating income 2. Revised net operating income 3. Revised net operating income 56,000 $ 55,800 1. What would be the revised net operating income per month if the sales volume increases by 90 units? 2. What would be the revised net operating income per month if the sales volume decreases by 90 units? 3. What would be the revised net operating income per month if the sales volume is.7,600 units?arrow_forwardplease step by step solution.arrow_forward

- im.9arrow_forwardMenlo Company distributes a single product. The company's sales and expenses for last month follow: Total Per Unit Sales $ 608, 000 $ 40 Variable expenses 425, 600 28 Contribution margin 182, 400 $ 12 Fixed expenses 154,800 Net operating income $ 27,600 Required: 1. What is the monthly break-even point in unit sales and in dollar sales? 2. Without resorting to computations, what is the total contribution margin at the break-even point? 3- a. How many units would have to be sold each month to attain a target profit of $ 50, 400? 3-b. Verify your answer by preparing a contribution format income statement at the target sales level. 4. Refer to the original data. Compute the company's margin of safety in both dollar and percentage terms. 5. What is the company's CM ratio? If the company can sell more units thereby increasing sales by S 50,000 per month and there is no change in fixed expenses, by how much would you expect monthly net operating income to increase?arrow_forwardI need requirement 4 and 5 onlyarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education