Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

How many dollars worth of sales are generated?

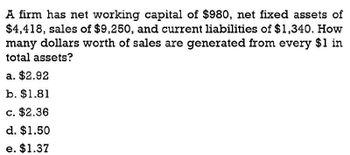

Transcribed Image Text:A firm has net working capital of $980, net fixed assets of

$4,418, sales of $9,250, and current liabilities of $1,340. How

many dollars worth of sales are generated from every $1 in

total assets?

a. $2.92

b. $1.81

c. $2.36

d. $1.50

e. $1.37

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Chasse Building Supply Inc. reported net cash provided by operating activities of $243,000, capital expenditures of $112,900, cash dividends of $35,800, and average maturities of long-term debt over the next 5 years of $122,300. What is Chasses free cash flow and cash flow adequacy ratio? a. $94,300 and 0.77, respectively c. $130,100 and 1.06, respectively b. $94,300 and 0.82, respectively d. $165,900 and 1.36, respectivelyarrow_forwardA firm has net working capital of $460, net fixed assets of $2,206, sales of $5,700, and current liabilities of $770. How many dollars worth of sales are generated from every $1 in total assets? O a. $2.58 O b. $1.66 O c. $1.92 O d. $1.67 O e. $2.14arrow_forwardGive true answerarrow_forward

- Please give me answer accountingarrow_forwardAMT. Inc.'s net income for this quarter is $500,000. The publicized return on assets (ROA) is 34.5 % . Estimate the firm's total asset to the closet possible. a. $1,500,000 c. $2,450,000 b. $ 1,450,000 d. $2,005,500arrow_forwardA firm has net working capital of $25,089. Long-term debt is $106,286.6, total assets are $151,838, and net fixed assets are $113,878.5. What is the amount of the total liabilities? O 134,340.90 -134,340.90 119,157.10 O 37,959.50 O 144,246.10arrow_forward

- Please I need this general account question answerarrow_forwardA company has net income of $300,000, net sales of $2,500,000, and total assets of $2,000,000. Its return on total assets equals a. 6.7%. c. 8.3%. e. 15.0%. b. 12.0%. d. 80.0%.arrow_forward14. Briggs Company has operating income of $33,516, invested assets of $133,000, and sales of $478,800. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin ____ % b. Investment turnover ____ c. Return on investment ____ %arrow_forward

- Suppose a firm has the following information: Operatingcurrent assets = $2.7 million; operating current liabilities =$1.5 million; long-term bonds = $3 million; net plant andequipment = $7.8 million; and other long-term operating assets =$1 million. How much is tied up in net operating workingcapital (NOWC)? ($1.2 million) How much is tied up in total netoperating capital? ($10 million)arrow_forwardA return on assets of 5.15% means that a company is earning: O a. a $5.15 return on every $100 of assets minus liabilities. O b. a $5.15 return on every $100 of total assets. O c. a $5.15 return on every $100 of current assets. O d. a $5.15 return on every $100 invested in long-term assets.arrow_forwardBlazer corporation had provided correct answer general accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning