Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

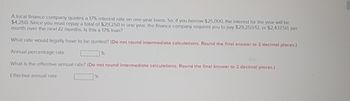

Transcribed Image Text:A local finance company quotes a 17% Interest rate on one-year loans. So, if you borrow $25.000, the interest for the year will be

$4,250. Since you must repay a total of $29.250 in one year, the finance company requires you to pay $29,250/12, or $2.43750, per

month over the next 12 months. Is this a 17% loan?

What rate would legally have to be quoted? (Do not round intermediate calculations. Round the final answer to 2 decimal places)

Annual percentage rate

1%

What is the effective annual rate? (De not round intermediate calculations. Round the final answer to 2 decimal places)

Effective annual rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Someone buys a car for 12,000$ and puts 25% down. They then get a simple interest amortized loan for the rest of the amount at 7% for 4 years. Their month payment is 215.52, and total interest in 1344.96. What are the loan fees for this if the lender states that APR of the loan is 7.2%?arrow_forwardWhat is the present value of the following set of cash flows at an interest rate of 8% p.a. compounded annually? End of Year 1 $1,150 End of Year 2 $2,300 End of Year 3 $5,100 Select one: a. $7,401.20 b. $7,085.23 c. $8,550.00 d. $7,805.23arrow_forwardYou are looking at a one-year loan of $12,500. The interest rate is quoted as 9.5 percent plus four points. A point on a loan is 1 percent (one percentage point) of the loan amount. Quotes similar to this one are common with home mortgages. The interest rate quotation in this example requires the borrower to pay four points to the lender up front and repay the loan later with 9.5 percent interest. What rate would you actually be paying here?arrow_forward

- A payday loan is structured to obscure the true interest rate you are paying. For example, in Washington, you pay a $30 "fee" for a two-week $200 payday loan (when you repay the loan, you pay $230). What is the effective annual interest rate for this loan? (Assume 26 bi-weekly periods per year.) The effective annual interest rate is%. (Round to two decimal places.)arrow_forwardA finance company uses the discount method of calculating interest. The loan principal is $5,000, the interest rate is 10%, and repayment is expected in two years. You will receivearrow_forwardA floating rate mortgage loan is made for $185,000 for a 30-year period at an initial rate of 12 percent interest. However, the borrower and lender have negotiated a monthly payment of $1,480. Required: a. What will be the loan balance at the end of year 1? b. If the interest rate increases to 13 percent at the end of year 2, how much is the payment plus negative amortization in year 2 and year 5 if the payment remains at $1,480?arrow_forward

- Question 5. Attached is a similar question answeredarrow_forwardA floating rate mortgage loan is made for $170,000 for a 30-year period at an initial rate of 12 percent interest. However, the borrower and lender have negotiated a monthly payment of $1,360. Required: a. What will be the loan balance at the end of year 1? b. If the interest rate increases to 13 percent at the end of year 2, how much is the payment plus negative amortization in year 2 and year 5 if the payment remains at $1,360? Complete this question by entering your answers in the tabs below. Required A Required B What will be the loan balance at the end of year 1? Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. Loan balancearrow_forwardYou plan to borrow $37,200 at a 7.2% annual interest rate. The terms require you to amortize the loan with 7 equal end-of-year payments. How much interest would you be paying in Year 2? O a. $2,678.40 O b. $2,370.79 O c. $2,404.40 O d. $6,950.78 Oe. $6,483.94arrow_forward

- A $178,000 mortgage loan is offered at an APR of 4%. Follow the instructions below the table. The loan payment formula was used to calculate the monthly payments for the loans and results are reported in the table below. You do NOT have to verify the given payment entries (you already used the formula for calculating payments in the first part Loan term in years Monthly Payment on $178,000 loan (in $) Total amount paid back over the full loan term (in $) Interest over the full loan term (in $) Difference in monthly payment from option above (in $) t = 15 years Pmt = $ 1316.64 F = I = No entry here t = 30 years Pmt = $ 849.80 F = I = Difference in MONTHLY payment t = 40 years Pmt = $ 743.93 F = I = Difference in MONTHLY payment t = 50 years Pmt = $ 686.56 F = I = Difference in MONTHLY payment For each loan term option, calculate the total amount paid back over the…arrow_forwardyou have just borrowed $51,107 at an annual interest of 7.6% and must repay the loan in equal installments at the end of each of the next 7 years. By how much would you reduce the amount you owe (that is, principal) at the end of the first year? (Hint: Compute annual loan payment first and then the loan amortization schedule for the first year.) Group of answer choices $5,798.23 $5,790.23 $5,792.23 $5,796.23 $5,794.23arrow_forwardYou plan to borrow $32,200 at an 8.2% annual interest rate. The terms require you to amortize the loan with 7 equal end-of-year payments. How much interest would you be paying in Year 2? Oa. $5,755.17 Ob. $2,346.29 $2,384.99 Od. $2,640.40 O$6,227.10arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education