ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

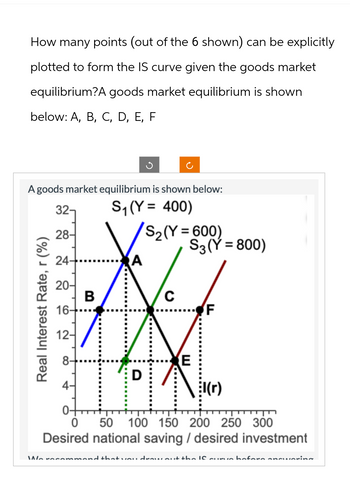

Transcribed Image Text:How many points (out of the 6 shown) can be explicitly

plotted to form the IS curve given the goods market

equilibrium?A goods market equilibrium is shown

below: A, B, C, D, E, F

32-

A goods market equilibrium is shown below:

S₁ (Y= 400)

28-

Real Interest Rate, r (%)

S2(Y=600)

S3 (Y = 800)

226

24-

A

20-

B

C

16-

12-

E

4-

0-

0

l(r)

F

50 100 150 200 250 300

Desired national saving / desired investment

We recommend that you drow out the IS curve before answering

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Mary is a corn farmer in Iowa. If she does not irrigate her field, she can produce 120 bushels of corn per acre. If she applies 4 inches of irrigation water, she can produce 140 bushels of corn per acre. The application of 8, 12, and 16 inches of irrigation water can result in 160, 180, and 200 bushels of corn per acre, respectively. Graph the relationship between the amount of water applied and corn yield for Mary. What is the slope?arrow_forwardQUESTION 39 48 44 40 36 32 28 24 20 16 12 O 8 4 E.Q a) 12 b) 20 c) 24 d) 30 0 8 16 24 39. The shift from AE1 to AE2 will cause equilibrium income to change to: 32 40 Q AE2 AE1arrow_forwardEssentials Final x + s/Microeconomic%20Essentials%20Final%200SA.pdf W 8 / 18 90% + QUESTION 12 Consider the following scenario: Q (4 Marks) Steven owns his own auto repair shop. He uses his own premises as a workshop. If he had rented his premises to someone else, he would have received R18 000 in rent. He initially invested R50 000 in his business to buy tools and machines. If he had invested the money, he could have earned 10% per year on the money, which is R5 000 per year. If he did not work for himself, he could have earned a salary of R60 000. His expenditure for the year consisted of the following: Oil, petrol, sparkplugs, fan belts and other materials: R70 000 Salary for two junior mechanics: R35 000 Admin costs: R15 000 Assume that the total revenue of the auto shop is R230 000. Calculate Steve's economic profit. a) R203 000 b) R110 000 c) R27 000 d) R32 000 DOLL 11 ENG 2024/0arrow_forward

- Handwritten solution not required correct answer will get instant upvote.arrow_forward6arrow_forward10. Suppose in our model, lifespans increased due to a productivity in- crease. What would likely happen to hours worked and leisure over the lifetime of a represent ative consumer. (a) Let's consider one of two common ways of implementing this change. Suppose the increase raised both lifespans and the amount of years consumers are healthy enough to work by the same amount, how would that likely affect the measured numbered of hours work by prime aged adults within a given year? What would likely hap- pen to the retirement age? (b) Let's consider the other way to implement it. Suppose the change in lifetimes came about changes in technology that delayed death but did not extend the amount of years consumers are healthy enough to work. What would likely happen to hours worked within a year? What would happen to the retirement age? (c) In the US, the generalized stylized fact is that the actual age of retirement is not increasing. Nor are hours worked per week. Why are both of the above…arrow_forward

- 3. Consider the economic model of an individual's labor-leisure choice with the following components: C represents units of the consumption good L represents hours of leisure H represents hours of paid work p represents the unit price of the consumption good w represents the hourly wage rate Y represents nonlabor income T represents total time available U(C, L) represents the individual's utility function MUC denotes the marginal utility of consumption MUL denotes the marginal utility of leisure Unless otherwise instructed, assume that consumption and leisure are normal goods. Whenever graphi the model, put C on the vertical axis and L on the horizontal axis. What is the slope of the budget line? -(MUC/MUL) O-(MUL/MUC) O-W O -(w/p) O-(w+Y)/parrow_forwardMary is a corn farmer in Iowa. If she does not irrigate his field, she can produce 120 bushels of corn per acre. If she applies 4 inches of irrigation water, she can produce 140 bushels of corn per acre. The application of 8, 12, and 16 inches of irrigation water can result in 160, 180, and 200 bushels of corn per acre, respectively. Graph the relationship between the amount of water applied and corn yield for Mary (Assume a straight-line relationship). Find and interpret the slope and Y interceptarrow_forwardC-town brewery brews two beers: Expansion Draft and Burning River. Expansion draft sells for $14 per barrel while Burning River sells for $10 per barrel. Producing a barrel of Expansion Draft takes 5 pounds of corn and 8 pounds of hops. Producing a barrel of Burning River requires 2 pounds of corn, 8 pounds of rice, and 7 pounds of hops. The brewery has 770 pounds of corn, 490 pounds of rice, and 320 pounds of hops. Assuming a linear relationship, use the Excel Solver to determine the optimal mix of Expansion Draft and Burning River that maximizes C - town's revenue. Decision for expansion draft Decision for burning river Total sales Resources Used Corn Rice Hopsarrow_forward

- (Use this information to answer qustion 13 - 16) Suppose a household solves the following two-period consumption-savings problem max u(c1) + Bu(c2) {C1,C2} s.t. aw Y1 - C1 C2Y2 = (1+r) a with u(c) = √c where c₁ is consumption at time 1, c2 is consumption at time 2, ₁ is houshold income at time 1, y2 is houshold income at time 2 and w is the initial wealth. Suppose the incomes of the household are $50 in time 1 and $210 in time 2. The initial wealth is $100, the discount factor is 0.975 and interest rate is 5%. Solve for the household's choice of C1. (a) 125.12 (b) 126.58 (c) 175.16 (d) 341.88arrow_forwarda, b and carrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education