ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

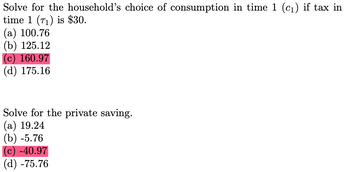

Transcribed Image Text:Solve for the household's choice of consumption in time 1 (c₁) if tax in

time 1 (71) is $30.

(a) 100.76

(b) 125.12

(c) 160.97

(d) 175.16

Solve for the private saving.

(a) 19.24

(b) -5.76

(c) -40.97

(d) -75.76

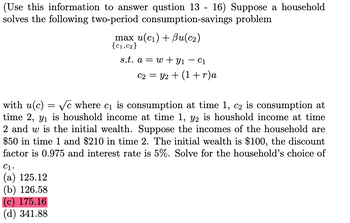

Transcribed Image Text:(Use this information to answer qustion 13 - 16) Suppose a household

solves the following two-period consumption-savings problem

max u(c1) + Bu(c2)

{C1,C2}

s.t. aw Y1 - C1

C2Y2

=

(1+r) a

with u(c) = √c where c₁ is consumption at time 1, c2 is consumption at

time 2, ₁ is houshold income at time 1, y2 is houshold income at time

2 and w is the initial wealth. Suppose the incomes of the household are

$50 in time 1 and $210 in time 2. The initial wealth is $100, the discount

factor is 0.975 and interest rate is 5%. Solve for the household's choice of

C1.

(a) 125.12

(b) 126.58

(c) 175.16

(d) 341.88

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Correct answer is D . I neees steps how to get that anarrow_forwardWhicFof the following might be included as a disbursement on a cash budget? Depreciation on factory Income taxes equipment to be paid A) Yes Yes B) Yes No No Yes D) No No Option (A) Option (B) Option (C) Option (D) 20arrow_forwardKooche Company plans to invest $1,000,000 in projects next year. $700,000 will be provided through debt capital with a before tax cost of 7.3%. The remaining $300,000 will be provided through equity capital at a cost of 6.5%. Kooche's corporate tax rate is 40%. What is the weighted average cost of capital? (a) 5.02% (b) 6.50% (C) 7.06% (d) 13.80%arrow_forward

- A diesel generator for electrical power can be purchased by a remote community for $350,000 and used for 10 years, when its salvage value is $50,000. Alternatively, it can be leased for $42,500 a year. (Remember that lease payments occur at the start of the year.) The community’s interest rate is 7%.(a) What is the interest rate for buying versus leasing? Which is the better choice?(b) The community will spend $80,000 less each year for fuel and maintenance, than it currently spends on buying power. Should it obtain the generator? What is the rate of return for the generator using the best financing plan? Solve it step by step.arrow_forwardAffordability R109 per week. Proteas (R15) Roses (R8) Lavender (R6) No. MU TU WMU MU TU WMU MU TU WMU 1 40 40 32 32 20 20 2 35 75 26 58 18 3 30 105 24 82 15 4 23 128 (b) 101 12 5 18 146 16 117 9 6 15 161 10 127 6 (c) 7 0 (a) 8 135 0 8 -6 155 (d) 135 -4 9 -15 140 (e) 131 -7 Calculate the average utility of 4 protea flowers. Round off to zero decimal places. Do not forget the word "utils". Blank 1 Blank 1 Add your answerarrow_forwardGoogle Jnc. went public on August 20, 2004. The initial public offering price was $108 per share. If the stock traded al $490.92 on August 19, 2011. what would the compound annual return on investment be for the investors who purchased the stock and held it for eight years? (a) 354%(b)44.31%(c) 20.89%(d) 71 %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education