FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

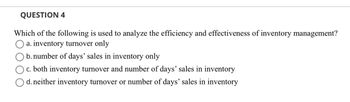

Transcribed Image Text:QUESTION 4

Which of the following is used to analyze the efficiency and effectiveness of inventory management?

a. inventory turnover only

b. number of days' sales in inventory only

c. both inventory turnover and number of days' sales in inventory

d. neither inventory turnover or number of days' sales in inventory

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardWhat does a very high inventory turnover ratio signify? Please provide your own example to explain your point.arrow_forwardQUESTION 7 The perpetual and periodic inventory systems are designed to ensure that inventory accounts are increased for the cost of purchases during the period and decreased for the cost of the sales during the period. True O Falsearrow_forward

- 17. Models of inventory systems frequently consider the relationships among a beginning inventory, a production quantity, a demand or sales, and an ending inventory. For a given production period j, let * 2, d, beginning inventory for period j (ending inventory from period j-1 production quantity in period j demand in period j ending inventory for period j a. Write the mathematical relationship or model that shows ending inventory as a function of beginning inventory, production, and demand. b. What constraint should be added if production capacity for period j is given by C, ? e. What constraint should be added if inventory requirements for period j mandate an ending inventory of at least 1;?arrow_forwardPART 1: Raw Materials Inventory Turnover A. How is this ratio calculated? What does the ratio show? Using the data below (Sunn Corporation) , calculate and discuss the implications of Sunn's RM Inventory Turnover. Days' Sales in Raw Materials Inventory B. How is this ratio calculated? What does the ratio show? Using the data below (Sunn Corporation) calculate and discuss the implications of Sunn's Days' Sales in RM Inventoryarrow_forward9 and 10arrow_forward

- Which inventory system would allow a business to determine inventory shrinkage (breakage, theft, etc.)? OLIFO O Perpetual O FIFO O Periodicarrow_forwardplease help solve 21arrow_forward1.At a time of declining prices, which cost flow assumption will result in the highest ending inventory? A. FIFO B. LIFO C. Weighted average D. Either A or C 2. When the cost of inventory is rising, which inventory cost flow method will produce the lowest amount of cost of goods sold? A. FIFO B. Weighted Average. C. All methods will produce the same amount of cost of goods sold. D. LIFO 200 The inventory records for Raymond Co. reflected the following Beginning Inventory @ May 1 200 units @ $1.00 First Purchase @ May 7 Second Purchase @ May 17 Third Purchase @ May 23 Sales @ May 31 B. $1.15 C. $1.14 D. $1.31 B. $130 C. $324 D. $340 300 units @ $1.10 = 400 units @ $1.20 100 units @ $1.30 = 120 900 units @ $1.50 1350 30 go 3. Determine the weighted average cost per unit for May. A. $1.22 .4.Determine the amount of cost of goods sold assuming the LIFO cost flow method. A. $1,140 B. $1,040 C. $1,000 D. $940 5. Determine the amount of gross margin assuming the FIFO cost flow method. A. $114arrow_forward

- A company experiences inventory shrinkage and records the proper entry to account for it. As a result of this entry: Select one: a. gross profit will decrease and net income will decrease b. gross profit will increase and net income will increase c. gross profit will increase and net income will decrease d. gross profit will decrease and net income will increasearrow_forwardWhich cost flow assumption generally results in the highest reported amount for ending inventory when inventory costs are rising? Explain.arrow_forwardQUESTION 11 Match the term on the left to the appropriate description on the right. v Cost of goods available for sale (COGAS) A. A valuation rule applied to ending inventory. v LIFO reserve B. The maximum value that cost of goods sold (COGS) can be in a period. C. The amount by which inventory measured under FIFO would exceed inventory measured under LIFO v Lower-of-cost-or-market v Inventory turnover ratio. D. An inventory cost flow assumption. E. A measure for evaluating a company's inventory management. v FIFO (first-in, first out) v Periodic inventory F. A system for calculating COGS based on ending inventory value.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education