Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

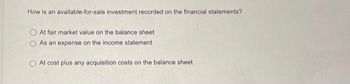

Transcribed Image Text:How is an available-for-sale investment recorded on the financial statements?

At fair market value on the balance sheet

As an expense on the income statement

At cost plus any acquisition costs on the balance sheet

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- choose from the following accounts: Accumulated Other Comprehensive Income Allowance for Investment Impairment Bond Investment at Amortized Cost Cash Commission Expense Dividends Receivable Dividend Revenue FV-NI Investments FV-OC|Investments Gain on Disposal of Investments - FV-NI Gain on Disposal of Investments - FV-OCI Gain on Sale of Investments GST Receivable Interest Expense Interest Income Interest Payable Interest Receivable Investment in Associate Investment Income or Loss Loss on Discontinued Operations Loss on Disposal of Investments FV-NI Loss on Disposal of Investments FV-OCI Loss on Impairment Loss on Sale of Investments No Entry Note Investment at Amortized Cost Other Investments Recovery of Loss from Impairment Retained Earnings Unrealized Gain or Loss Unrealized Gain or Loss - OCIarrow_forwardWhat factors should be considered in determining the issue price of a debenture. and Provide some examples of items that would be adjusted directly against equity, rather than beingincluded as part of profit or loss.arrow_forwardWhich of the following results in an increase in the Equity in the Investee Income acct. when applying the equity method? Amortizations of purchase price over book value on date of purchase Amortization since date of purchase of purchase price over book value on date of purchase Sale of portion of the investment at a gain to the investor Investors share of gross profit from intra-entity inventory sale for the prior year Sale of a portion of the investment at a lossarrow_forward

- Calculate the EBIT which should be used for the EV / EBIT multiple given the information below: Net revenues Cost of sales Gross Profit Selling, general and administrative expenses Amortization expense Restructuring costs Acquisition-related costs Asset impairment charges Gain on sales of assets Operating income Interest expense, net Loss on early extinguishment of debt Other expense, net Income (loss) before taxes (Benefit) provision for income taxes Net income (loss) Select one: 1,394,8 1,444.4 1,474.3 S 1,419.6 5,248.1 1,746.0 3,502.1 2,027.8 During fiscal 2050, the company sold assets relating to the Cutey brand for a total disposal price of $29.2. The Company allocated $4.2 of goodwill to the brand as part of the sale. The Company recorded a gain of $24.8 which has been reflected in Gain on sales of assets in the Consolidated Statement of Operations for the fiscal year ended June 30, 2050. 79.5 86.9 174.0 5.5 (24.8) 1,153.2 81.9 3.1 30.4 1,037.8 (40.4) 1,078.2arrow_forwardResidual interest in the asset of an entity that remains after deducting its liabilities is? a. Liabilities b. Expense c. Owner’s Equity d. Assetsarrow_forwardwhat is the asset turnover return on total assets return on stockholdres' equityarrow_forward

- What is the fair-value option for reporting equity method investments? How do the equity method and fair-value accounting differ in recognizing income from an investee?arrow_forwardExplain the adjustments made in the equity method when the fair value of the net assets underlying an investment exceeds their book value at acquisition.arrow_forwardPlease describe how to account for market value and unrealized gains and losses for each of these investment categories: held-to-maturity, trading, and available-for-sale.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education