Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

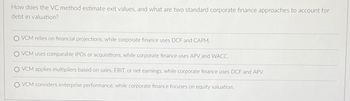

Transcribed Image Text:How does the VC method estimate exit values, and what are two standard corporate finance approaches to account for

debt in valuation?

O VCM relies on financial projections, while corporate finance uses DCF and CAPM.

VCM uses comparable IPOs or acquisitions, while corporate finance uses APV and WACC.

VCM applies multipliers based on sales, EBIT, or net earnings, while corporate finance uses DCF and APV.

VCM considers enterprise performance, while corporate finance focuses on equity valuation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Which of the following statements is correct? A. The optimal dividend policy is the one that satisfies management, not shareholders. B. The use of debt financing has no effect on earnings per share (EPS) or stock price. C. Stock price is dependent on the projected EPS and the use of debt, but not on the timing of the earnings stream. D. The riskiness of projected EPS can impact the firm's value. E. Dlvidend policy is one aspect of the firm's financial policy that is determined solely by the shareholders. Reset Selectionarrow_forwardWhich of these is a main characteristic of debt capital?(a) Investors in debt participate in the ownership of the firm.(b) Investors in debt are paid interest.(c) Debt is more risky for the investor and less risky for the firm.(d) If dividends are not paid, this can lead to foreclosure, legal proceeding and financial distress.arrow_forwardAs a micro-enterprise, which sets of financing are the most likely to be used? *A. Banks and venture capitalistsB. Tax holidays and leasesC. Retained earnings and convertible securitiesD. Public issuance of equity and debtarrow_forward

- Generally speaking, the cost of debt is cheaper than the cost of equity. Does it imply that a firm should increase its debt-to-equity ratio to as high as possible such that its corporate cost of capital can be minimized?arrow_forwardHow does a firm's dividend policy reflect its approach to financial decision-making, and what are the two primary strategies discussed in this context? A. Explain the concept of treating dividends as the residual part of a financing decision. B. Outline the key characteristics and principles of an active dividend policy strategy. C. Compare and contrast the implications of these two strategies on a firm's overall financial management. D. Provide examples illustrating situations where each strategy may be suitable for a firm. E. Assess the potential impact of a firm's dividend policy on investor perceptions and shareholder value. Choose the correct options (A, B, C, D, or E) to complete the statement, considering the various aspects of a firm's dividend policy and its significance in financial decision-making.arrow_forward1.) What value due financial ratios offer investors in reviewing the financial performance of firms?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education