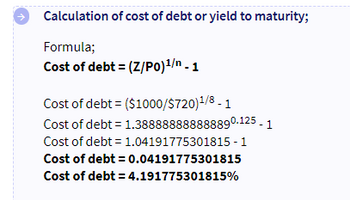

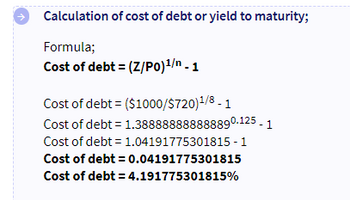

"Heart Limited has one bond in issue expiring in eight years, paying 0 coupon and has a face value of $1000. It is currently traded at $720, Beta =1.2, risk free rate is 2%, historic market risk premium is 5.5%. Assume the ratio of debt to equity is 2:1, and corporate tax rate is 20%."

(c) Determine the WACC for Heart Limited.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Hi, how do you derive to this formula? please enlighten, thankyou

Suppose Jack, president of Heart Limited has hired you to advise on the firm’s cost of capital.

(a) Based on the most recent financial statements, Heart’s total liabilities are $8 million. Total interest expense for the coming year will be about $1 million. Jack therefore reasons, “We owe $8 million, and we will pay $1 million interest. Therefore, our cost of debt is obviously $1 million/8 million = 12.5%.” Appraise Jack’s statement.

(b) The company paid $1 million of dividends in the past year. Its market capitalization was $10 million. Based on his own analysis, Jack suggests that the company increases its use of equity financing, because “debt costs 12.5 percent, but equity only costs 10 percent; thus, equity is cheaper.” Appraise Jack’s statement.

Hi, how do you derive to this formula? please enlighten, thankyou

Suppose Jack, president of Heart Limited has hired you to advise on the firm’s cost of capital.

(a) Based on the most recent financial statements, Heart’s total liabilities are $8 million. Total interest expense for the coming year will be about $1 million. Jack therefore reasons, “We owe $8 million, and we will pay $1 million interest. Therefore, our cost of debt is obviously $1 million/8 million = 12.5%.” Appraise Jack’s statement.

(b) The company paid $1 million of dividends in the past year. Its market capitalization was $10 million. Based on his own analysis, Jack suggests that the company increases its use of equity financing, because “debt costs 12.5 percent, but equity only costs 10 percent; thus, equity is cheaper.” Appraise Jack’s statement.

- Ying Import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in the table below. Coupon Rate Maturity Face Value $ 8.90% Bond 1 2 3 6.80 8.60 9.20 Aftertax cost of debt Price Quote 106.8 93.4 105.8 96.5 % 4 years 6 years 14.5 years 25 years If the corporate tax rate is 25 percent, what is the aftertax cost of the company's debt? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. 28,000,000 31,000,000 36,000,000 55,000,000arrow_forwardDengararrow_forwardYing Import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in the following table. Bond 1 2 3 4 Coupon Rate Price Quote 5.1% 6.7 Cost of debt 6.6 5.9 104.86 113.62 112.17 101.41 Maturity 5 years 8 years 15.5 years 25 years % Face Value $ If the corporate tax rate is 24 percent, what is the aftertax cost of the company's debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) 59,000,000 54,000,000 74,000,000 81,000,000arrow_forward

- The LBJ Corporation issues a bond which has a coupon rate of 9.20%, a yield to maturity of 10.55%, a face value of $1,000, and a market price of $850. Therefore, the annual interest payment is: O $101.75. O $102. $96.50 O$92arrow_forwardEzzell Enterprises' noncallable bonds currently sell for $1,218.00. They have a 5-year maturity, semi-annual coupon rate of 12.00%, and a par value of $1000. What is the bond's capital gain or loss yield?Round your answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72.arrow_forwardMLK Bank has an asset portfolio that consists of $180 million of 15-year, 10.5 percent annual coupon, $1,000 bonds that sell at par. b-1. The duration of these bonds is 8.1702 years. What are the predicted bond prices in each of the four cases using the duration rule? (the cases being ± 0.10 percent and ± 2.00 percent)arrow_forward

- Perry Inc.'s bonds currently sell for $1,070. They have a 6-year maturity, an annual coupon of $85, and a par value of $1,000. What is their current yield? Select the correct answer. ○ a. 7.94% b. 9.54% ○ c. 8.74% ○ d. 8.34% O e. 9.14%arrow_forwardCharlie Corporation is a chemical company. The company issued an outstanding bond with a P100,000 par value at 15-year maturity date. The coupon rate is 8%, and interest is paid quarterly. The required nominal interest rate on this borrowings has now increased to 16 percent . What is the current market value of the bond? Rules in solving: a. For the "PV FACTOR in computing the PV of the coupon and PV for the maturity value/ principal use until 8-9th decimal place" before multiplying the coupon payment or future value.Example: ___x 2.123456789 or 22.12345678b. For "COMPOUNDED RATES" include all decimals in the rate (do not round off).Example semi-annual: 13%/2 =0.065c. For the "VALUE OF THE BOND/ PRICE OF THE BOND" round off your answers and final answers into whole numbers.Example: 824.59= 825arrow_forwardInventive Response has bonds outstanding that mature in 8.5 years, have a 4 percent coupon, and pay interest annually. These bonds have a face value of $1,000 and a current market price of $1,180.30. What is the company’s after-tax cost of debt if its tax rate is 21 percent? 1.35 percent 1.70 percent 2.15 percent 2.65 percent 3.40 percentarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education