Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

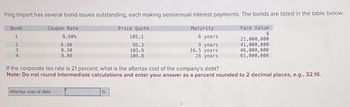

Transcribed Image Text:Ying Import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in the table below.

Bond

Coupon Rate

Maturity

Face Value.

$

8.60%

6.90

8.30

8.80

3

Aftertax cost of debt

Price Quote

105.1

95.3

103.9

105.8

%

6 years

9 years

16.5 years

26 years

If the corporate tax rate is 21 percent, what is the aftertax cost of the company's debt?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

21,000,000

41,000,000

46,000,000

61,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation relationships) The 11-year, $1,000 par value bonds of Waco Industries pay 7 percent interest annually. The market price of the bond is $955, and the market's required yield to maturity on a comparable-risk bond is 6 percent. a. Compute the bond's yield to maturity. b. Determine the value of the bond to you given the market's required yield to maturity on a comparable-risk bond. c. Should you purchase the bond? a. What is your yield to maturity on the Waco bonds given the current market price of the bonds? % (Round to two decimal places.)arrow_forward(Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation) The 15-year $1,000 par bonds of Vail Inc. pay 9 percent interest. The market's required yield to maturity on a comparable-risk bond is 6 percent. The current market price for the bond is $1,100. a. Determine the yield to maturity. b. What is the value of the bonds to you given the yield to maturity on a comparable-risk bond? c. Should you purchase the bond at the current market price? ---------------------------------------------------------------------------------------------------------------------------------------- a. What is your yield to maturity on the Vail bonds given the current market price of the bonds? % (Round to two decimal places.)arrow_forwardYing Import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in the following table. Coupon Bond Rate Price Quote Maturity Face Value $ 1 6.4% 106.36 6 years 44,000,000 234 7.9 114.92 9 years 39,000,000 7.6 113.47 16.5 years 59,000,000 7.2 102.71 26 years 66,000,000 If the corporate tax rate is 24 percent, what is the aftertax cost of the company's debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Cost of debt %arrow_forward

- Review the Bond Table below; all bonds have semi-annual payments. Security. Coupon Rate Face Value 0.00% $1,000 4.50% 5.00% 1-yr Treasury 5-yr Treasury 10-yr Treasury 5-yr Corporate (rated A) 10-year Corporate 8.40% (rated BBB) Multiple Choice O 4.80% O If a company wanted to issue a new Corporate Bond (10 years, A rating) for full price, what coupon rate would it have to offer? 6.90% 6.50% 7.75% 7.50% $1,000 $1,000 $1,000 None of the above $1,000 Price $ 965.90 $991.18 $976.94 $912.46 $1,044.66arrow_forwardA brand has bonds on the market with 19 years to maturity, a YTM of 11.0 percent, a par value of $1,000, and a current price of $1,206.50. The bonds make semiannual payments. What must the coupon rate be on these bonds? A. 13.71% B. 13.61% C. 27.27% D. 11.28% E. 22.60%arrow_forwardYing Import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in the table below. Bond Coupon Rate Price Quote Maturity Face Value 1 8.50% 106.0 5 years $19,000,000 2 6.50 94.4 8 years 39,000,000 3 8.20 104.8 15.5 years 44,000,000 4 8.70 94.6 25 years 59,000,000 If the corporate tax rate is 25 percent, what is the aftertax cost of the company’s debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

- (Bond valuation relationships) A bond of Visador Corporation pays $70 in annual interest, with a $1,000 par value. The bonds mature in 18 years. The market's required yield to maturity on a comparable-risk bond is 8.5 percent. a. Calculate the value of the bond. b. How does the value change if the market's required yield to maturity on a comparable-risk bond (i) increases to 12 percent or (ii) decreases to 4 percent? c. Interpret your finding in parts a and b. Question content area bottom Part 1 a. What is the value of the bond if the market's required yield to maturity on a comparable-risk bond is 8.5 percent? $enter your response here (Round to the nearest cent.)arrow_forwardHaswell Enterprises' bonds have a 10-year maturity, a 6.25% semiannual coupon, and a par value of $1,000. The going interest rate (rd) is 6%, based on semiannual compounding. What is the bond's price? Select the correct answer. a. $1,013.98 b. $1,018.60 c. $1,009.36 d. $1,016.29 e. $1,011.67arrow_forwardA BBB-rated corporate bond has a yield to maturity of 9.8%. A U.S. Treasury security has a yield to maturity of 8.4%. These yields are quoted as APRS with semiannual compounding. Both bonds pay semiannual coupons at an annual rate of 9.1% and have five years to maturity. a. What is the price (expressed as a percentage of the face value) of the Treasury bond? b. What is the price (expressed as a percentage of the face value) of the BBB-rated corporate bond? c. What is the credit spread on the BBB bonds? a. What is the price (expressed as a percentage of the face value) of the Treasury bond? The price of the Treasury security as a percentage of face value is ☐ %. (Round to two decimal places.)arrow_forward

- K (Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation relationships) The 13-year, $1,000 par value bonds of Waco Industries pay 7 percent interest annually. The market price of the bond is $855, and the market's required yield to maturity on a comparable-risk bond is 10 percent. a. Compute the bond's yield to maturity. b. Determine the value of the bond to you given the market's required yield to maturity on a comparable-risk bond. c. Should you purchase the bond? a. What is your yield to maturity on the Waco bonds given the current market price of the bonds? % (Round to two decimal places.)arrow_forwardYing Import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in the table below. Coupon Rate 8.80% Face Value $ 22,000,000 36,000,000 41,000,000 56,000,000 Bond 1 2 3 4 6.80 8.50 9.00 Aftertax cost of debt Price Quote 106.3 94.1 105.1 94.9 If the corporate tax rate is 23 percent, what is the aftertax cost of the company's debt? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. % Maturity 4 years 7 years 14.5 years 24 yearsarrow_forwardYing Import has several bond issues outstanding, each making semiannual Interest payments. The bonds are listed in the following table. If the corporate tax rate is 31 percent, what is the aftertax cost of Ying's debt? (Do not round your intermediate calculations.) Bond Coupon Rate Price Quote 102 111 103 116 1234 4 6.3% 7 6.1 6.8 4.19% 5.78% 3.79% 3.83% 3.99% Maturity 7 years 12 years 21.5 years 32.5 years Face Value $ 21,000,000 40,000,000 47,000,000 58,000,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education