Concept explainers

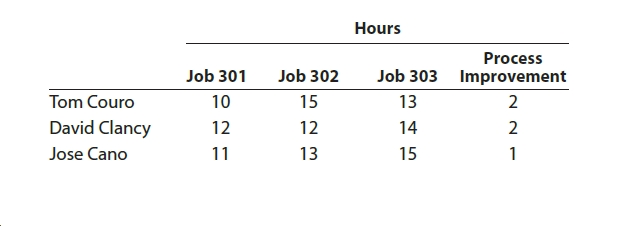

The weekly time tickets indicate the following distribution of labor hours for three direct labor employees:

See Attachment

The direct labor rate earned per hour by the three employees is as follows:

Tom Couro $32

David Clancy 36

Jose Cano 28

The process improvement category includes training, quality improvement, and other indirect tasks.

a.

b. Assume that Jobs 301 and 302 were completed but not sold during the week and that Job 303 remained incomplete at the end of the week. How would the direct labor costs for all three jobs be reflected on the financial statements at the end of the week?

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

- Required information [The following information applies to the questions displayed below.] At the end of June, the job cost sheets at Ace Roofers show the following costs accumulated on three jobs. At June 30 Direct materials Direct labor Overhead applied Additional Information Job 5 $ 15,800 8,800 4,400 Job 6 $ 33,400 15,000 7,500 Job 7 $ 27,400 Total transferred cost 21,800 10,900 a. Job 5 was started in May, and the following costs were assigned to it in May: direct materials, $6,400; direct labor, $2,200; and applied overhead, $1,300. Job 5 was finished in June. b. Job 6 and Job 7 were started in June; Job 6 was finished in June, and Job 7 is to be completed in July. c. Overhead cost is applied with a predetermined rate based on direct labor cost. The predetermined overhead rate did not change across these months. 4. What is the total cost transferred to Finished Goods Inventory in June?arrow_forwardJournalize the entry to record the factory labor costs Journalize the entry to apply factory overhead to production for November.arrow_forwardJournalize the entriesarrow_forward

- Entry for Factory Labor CostsThe weekly time tickets indicate the following distribution of labor hours for three direct labor employees: Hours Job 301 Job 302 Job 303 ProcessImprovementLandon Vincento 9 18 11 2 Fahad Hamad 11 15 13 1 Ivory Argo 8 20 9 3 The direct labor rate earned per hour by the three employees is as follows:Landon Vincento $35Fahad Hamad 36Ivory Argo 28The process improvement category includes training, quality improvement, and other indirect tasks.Question Content Areaa. Journalize the entry to record the factory labor costs for the week. If an amount box does not require an entry, leave it blank.blank - Select - - Select - - Select - - Select - - Select - - Select - Question Content Areab. Assume that Jobs 301 and 302 were completed but not sold during the week and that Job 303 remained incomplete at the end of the week. How…arrow_forwardThe journal entry to record the Labor Time Tickets includes a debit to the Manufacturing Overhead account of what dollar amount? Materials Labor Requisition Time For Slips Tickets Job No. 429 $ 3,500 $ 4,400 Job No. 430 2,600 3,400 Job No. 431 3,400 4,200 Job No. 432 3,000 4,000 Sub-Total 12,500 16,000 General Use 1,000 1,500 Total Cost $ 13,500 17,500 $17,500 $1,500 $16,000 $13,500arrow_forwardAt the end of April, Cavy Company had completed Jobs 766 and 765. The individual job cost sheets reveal the following information: Job Direct Materials Direct Labor Machine Hours Job 765 $7,000 $2,100 25 Job 766 11,628 3,672 68 Job 765 produced 150 units, and Job 766 consisted of 340 units. Assuming that factory overhead is applied using machine hours at a rate of $153 per hour. a. Determine the balance on each job cost sheet.Job 765 fill in the blank 1 of 2$Job 766 fill in the blank 2 of 2$ b. Determine the cost per unit for each job at the end of April. Round your answers to the nearest cent.Job 765 fill in the blank 1 of 2$Job 766 fill in the blank 2 of 2$arrow_forward

- Job Costs Using Activity-Based Costing Heitger Company is a job-order costing firm that uses activity-based costing to apply overhead to jobs. Heitger identified three overhead activities and related drivers. Budgeted information for the year is as follows: Activity Cost Driver Amount of Driver Materials handling $88,800 Number of moves 4,000 Engineering 117,600 Number of change orders 8,000 Other overhead 174,800 Direct labor hours 46,000 Heitger worked on four jobs in July. Data are as follows: Job 13-43 Job 13-44 Job 13-45 Job 13-46 Beginning balance $23,400 $19,200 $4,700 $0 Direct materials $5,800 $9,600 $13,400 $10,100 Direct labor cost $950 $1,010 $1,590 $110 Job 13-43 Job 13-44 Job 13-45 Job 13-46 Number of moves 46 46 33 Number of change orders 35 37 17 23 Direct labor hours 950 1,010 1,590 110 By July 31, Jobs 13-43 and 13-44 were completed and sold. Jobs 13-45 and 13-46 were still in process.arrow_forwardThe weekly time tickets indicate the following distribution of labor hours for three direct labor employees: Hours Job 301 Job 302 Job 303 ProcessImprovement Landon Vincent 17 13 9 4 Fahad Hamad 10 13 13 3 Ivory Argo 11 17 8 5 The direct labor rate earned per hour by the three employees is as follows: Landon Vincent $23 Fahad Hamad 17 Ivory Argo 20 The process improvement category includes training, quality improvement, and other indirect tasks. Question Content Area a. Journalize the entry to record the factory labor costs for the week. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select - - Select - - Select -arrow_forwardRequired information [The following information applies to the questions displayed below.] At the end of June, the job cost sheets at Ace Roofers show the following costs accumulated on three jobs. At June 30 Direct materials. Direct labor Overhead applied Additional Information Job 5 $ 15,800 8,800 4,400 Job 6 $ 33,400 15,000 7,500 Job 7 $ 27,400 21,800 10,900 a. Job 5 was started in May, and the following costs were assigned to it in May: direct materials, $6,400; direct labor, $2,200; and applied overhead, $1,300. Job 5 was finished in June. Direct materials requisitioned in June b. Job 6 and Job 7 were started in June; Job 6 was finished in June, and Job 7 is to be completed in July. c. Overhead cost is applied with a predetermined rate based on direct labor cost. The predetermined overhead rate did not change across these months. Required 1. What is the total cost of direct materials requisitioned in June?arrow_forward

- What was the amount of direct materials charged to Job 17 as at the end of June?arrow_forwardOxford Company uses a job order costing system. This month, the system accumulated labor time tickets totaling $24,600 for direct labor and $4,300 for indirect labor. The journal entry to record direct labor consists of a: Multiple Choice Debit Payroll Expense $24,600; credit Cash $24,600. Debit Payroll Expense $24,600; credit Factory Wages Payable $24,600. Debit Work in Process Inventory $24,600; credit Factory Wages Payable $24,600. Debit Work in Process Inventory $28,900; credit Factory Wages Payable $28,900. Debit Work in Process Inventory $4,300; credit Factory Wages Payable $4,300.arrow_forward4arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education