FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

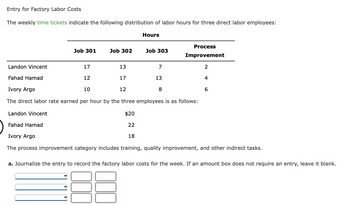

Transcribed Image Text:Entry for Factory Labor Costs

The weekly time tickets indicate the following distribution of labor hours for three direct labor employees:

Job 301

17

12

10

Job 302

13

17

Hours

Landon Vincent

Fahad Hamad

Ivory Argo

The direct labor rate earned per hour by the three employees is as follows:

$20

22

18

12

Job 303

7

13

Process

Improvement

2

4

6

8

Landon Vincent

Fahad Hamad

Ivory Argo

The process improvement category includes training, quality improvement, and other indirect tasks.

a. Journalize the entry to record the factory labor costs for the week. If an amount box does not require an entry, leave it blank.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- eBook Recording Factory Labor Costs A summary of the time tickets for September is as follows: Job No. Amount Job No. Amount 4467 $8,300 4478 $29,980 4470 18,509 4480 33,532 4471 15,670 4497 21,995 Indirect labor 23,240 4501 5,976 a. Determine the amounts of factory labor costs transferred to Work in Process and Factory Overhead for September. Factory labor costs transferred to Work in Process $fill in the blank 1 Factory labor costs transferred to Factory Overhead $fill in the blank 2 b. Illustrate the effect on the accounts and financial statements of the factory labor costs transferred in (a). If no account or activity is affected, select "No effect" from the drop-down list and leave the corresponding number entry box blank. Enter account decreases and cash outflows as negative amounts. Balance Sheet Assets = Liabilities + Stockholders' Equity + = + fill in the blank 7 fill in the blank 8 fill in…arrow_forwardEntry for Factory Labor CostsThe weekly time tickets indicate the following distribution of labor hours for three direct labor employees: Hours Job 301 Job 302 Job 303 ProcessImprovementLandon Vincento 9 18 11 2 Fahad Hamad 11 15 13 1 Ivory Argo 8 20 9 3 The direct labor rate earned per hour by the three employees is as follows:Landon Vincento $35Fahad Hamad 36Ivory Argo 28The process improvement category includes training, quality improvement, and other indirect tasks.Question Content Areaa. Journalize the entry to record the factory labor costs for the week. If an amount box does not require an entry, leave it blank.blank - Select - - Select - - Select - - Select - - Select - - Select - Question Content Areab. Assume that Jobs 301 and 302 were completed but not sold during the week and that Job 303 remained incomplete at the end of the week. How…arrow_forwardThe journal entry to record the Labor Time Tickets includes a debit to the Manufacturing Overhead account of what dollar amount? Materials Labor Requisition Time For Slips Tickets Job No. 429 $ 3,500 $ 4,400 Job No. 430 2,600 3,400 Job No. 431 3,400 4,200 Job No. 432 3,000 4,000 Sub-Total 12,500 16,000 General Use 1,000 1,500 Total Cost $ 13,500 17,500 $17,500 $1,500 $16,000 $13,500arrow_forward

- The weekly time tickets indicate the following distribution of labor hours for three direct labor employees: Hours Process Job 301 Job 302 Job 303 Improvement Tom Couro 9 14 12 1 David Clancy 12 10 13 3 Jose Cano 13 15 17 3 The direct labor rate earned per hour by the three employees is as follows: Tom Couro $30 David Clancy 36 Jose Cano 26 The process improvement category includes training, quality improvement, and other indirect tasks. Required: a. Journalize the entry on July 15 to record the factory labor costs for the week. Refer to the chart of accounts for the exact wording of the account titles. b. Assume that Jobs 301 and 302 were completed but not sold during the week and that Job 303 remained incomplete at the end of the week. How would the direct labor costs for all three jobs be reflected on the financial statements at the end of the week?arrow_forwardEntry for Factory Labor Costs The weekly time tickets indicate the following distribution of labor hours for three direct labor employees: Hours Job 301 Job 302 Job 303 ProcessImprovement Tom Couro 23 10 9 5 David Clancy 13 13 13 3 Jose Cano 13 17 10 4 The direct labor rate earned per hour by the three employees is as follows: Tom Couro $18 David Clancy 25 Jose Cano 21 The process improvement category includes training, quality improvement, and other indirect tasks. a. Journalize the entry to record the factory labor costs for the week. If an amount box does not require an entry, leave it blank. Work in Process Work in Process Factory Overhead Factory Overhead Wages Payable Wages Payable Feedback b. Assume that Jobs 301 and 302 were completed but not sold during the week and that Job 303 remained incomplete at the end of the week. How would the direct labor costs for all three jobs be…arrow_forwardEntries for Direct Labor and Factory Overhead Townsend Industries Inc. manufactures recreational vehicles. Townsend uses a job order cost system. The time tickets from November jobs are summarized as follows: Job 201 $6,240 Job 202 7,000 Job 203 5,210 Job 204 6,7500 Factory supervision 4,000 Factory overhead is applied to jobs on the basis of a predetermined overhead rate of $18 per direct labor hour. The direct labor rate is $40 per hour. a. Journalize the entry to record the factory labor costs. If an amount box does not require an entry, leave it blank. Work in Process Factory Overhead Wages Payable b. Journalize the entry to apply factory overhead to production for November. If an amount box does not require an entry, leave it blank. Work in Process Factory Overheadarrow_forward

- Job Costs Using Activity-Based Costing Heitger Company is a job-order costing firm that uses activity-based costing to apply overhead to jobs. Heitger identified three overhead activities and related drivers. Budgeted information for the year is as follows: Activity Cost Driver Amount of Driver Materials handling $88,800 Number of moves 4,000 Engineering 117,600 Number of change orders 8,000 Other overhead 174,800 Direct labor hours 46,000 Heitger worked on four jobs in July. Data are as follows: Job 13-43 Job 13-44 Job 13-45 Job 13-46 Beginning balance $23,400 $19,200 $4,700 $0 Direct materials $5,800 $9,600 $13,400 $10,100 Direct labor cost $950 $1,010 $1,590 $110 Job 13-43 Job 13-44 Job 13-45 Job 13-46 Number of moves 46 46 33 Number of change orders 35 37 17 23 Direct labor hours 950 1,010 1,590 110 By July 31, Jobs 13-43 and 13-44 were completed and sold. Jobs 13-45 and 13-46 were still in process.arrow_forwardThe weekly time tickets indicate the following distribution of labor hours for three direct labor employees: Hours Job 301 Job 302 Job 303 ProcessImprovement Landon Vincent 17 13 9 4 Fahad Hamad 10 13 13 3 Ivory Argo 11 17 8 5 The direct labor rate earned per hour by the three employees is as follows: Landon Vincent $23 Fahad Hamad 17 Ivory Argo 20 The process improvement category includes training, quality improvement, and other indirect tasks. Question Content Area a. Journalize the entry to record the factory labor costs for the week. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select - - Select - - Select -arrow_forwardEntries and schedules for unfinished jobs and completed jobs Hildreth Company uses a job order cost system. The following data summarize the operations related to production for April, the first month of operations: Materials purchased on account, $147,000. Materials requisitioned and factory labor used: Job No. Materials Factory Labor 101 $ 19,320 $19,500 102 $ 23,100 28,140 103 $ 13,440 14,000 104 $ 38,200 36,500 105 $ 18,050 15,540 106 $ 18,000 18,700 For general factory use $ 9,000 20,160 Factory overhead costs incurred on account, $6,000. Depreciation of machinery and equipment, $4,100. The factory overhead rate is $40 per machine hour. Machine hours used: Job No. Machine Hours 101 154 102 160 103 126 104 238 105 160 106 174 Total 1,012 Jobs completed: 101, 102, 103, and 105. Jobs were shipped, and customers were billed as follows: Job 101, $62,900; Job…arrow_forward

- Subject:- accountingarrow_forward9/7/22, 5:21 PM Entry for Factory Labor Costs Instructions The weekly time tickets indicate the following distribution of labor hours for three direct labor employees: Landon Vincent 9 Fahad Hamad 11 Ivory Argo Process Job 301 Job 302 Job 303 Improvement 18 11 2 13 1 9 8 Landon Vincent $35 Fahad Hamad 36 Ivory Argo 28 15 CengageNOWv2 | Online teaching and leaming resource from Cengage Leaming Hours 20 Chart of Accounts The direct labor rate earned per hour by the three employees is as follows: 3 The process improvement category includes training, quality improvement, and other indirect tasks. Required: a. Journalize the entry on July 15 to record the factory labor costs for the week. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for joumal explanations. Every line on a joumal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. b. Assume that Jobs…arrow_forwardEntries for Direct Labor and Factory Overhead Schumacher Industries Inc. manufactures recreational vehicles. Schumacher Industries uses a job order cost system. The time tickets from June jobs are summarized as follows: Job 11-101 Job 11-102 Job 11-103 Job 11-104 Job 11-105 Factory supervision Factory overhead is applied to jobs on the basis of a predetermined overhead rate of $30 per direct labor hour. The direct labor rate is $14 per hour. $2,040 1,380 1,090 1,680 1,090 950 a. Journalize the entry to record the factory labor costs. If an amount box does not require an entry, leave it blank. Work in Process Factory Overhead Wages Payable Work in Process Factory Overhead ✓ 7,280 950 ✓ b. Journalize the entry to apply factory overhead to production for June. If an amount box does not require an entry, leave it blank. 17.30 X 8,230 17.30 Xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education