Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

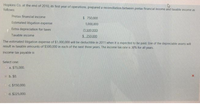

Transcribed Image Text:Hopkins Co. at the end of 2010, its first year of operations, prepared a reconciliation between pretar financial income and taxable income as

follows:

Pretax financial income

S 750.000

Estimated litigation expense

1,000,000

Extra depreciation for taxes

(1.500.000)

Taxable income

5.250.000

The estimated litigation expense of $1,000,000 will be deductible in 2011 when it is expected to be paid. Use of the depreciable assets will

result in taxable amounts of $500,000 in each of the next three years. The income tax rate is 30% for all years.

Income tax payable is

Select one:

a. $75,000.

b. S0.

C $150,000.

d. $225,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- During the current year, Hill Corporation sold equipment for $600,000 (adjusted basis of $360,000). The equipment was purchased a few years ago fo $760,000 and $400,000in MACRS deductions have been claimed. ADS depreciation would have been $300,000. As a result of the sale, the adjustment to taxable income needed to determine current E & P is A) No agjustment is required B) Subtract $100,000 C) Add $100,000 D) Add $80,000 E) None of the abovearrow_forwardneed help with this questionarrow_forwardTroy Ltd., at the end of 2023, its first year of operations, prepared a reconciliation between pre- tax accounting income and taxable income as follows: Pre-tax accounting income $300,000 Excess CCA claimed for tax purposes ... (600, 000) Estimated expenses deductible when paid $200,000 Use of the depreciable assets will result in taxable 500,000 Taxable income ... amounts of $200,000 in each of the next three years. The estimated expenses of $500,000 will be deductible in 2026 when settlement is expected to be made. The enacted tax rate is 25% and is to increase to 30%, starting in 2024. Instructions a) Prepare a schedule of the deferred taxable and deductible amounts. b) Prepare the required adjusting entries to record income taxes for 2023arrow_forward

- Munabhaiarrow_forwardOwearrow_forwardCaramel Company at the end of 2022, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income- 3,000,000 Estimated litigation expense- 4,000,000 Excess tax depreciation- (6,000,000) Taxable Income- 1,000,000 The estimated litigation expense of 4,000,000 will be deductible in 2023 when it is expected to be paid. Th edepreciable assets will result in deductible amounts of 2,000,000 in each of the next three years. The income tax rate is 20% for all years. The amount of deferred tax liability to be recognized for 2022 isarrow_forward

- Chaz Corporation has taxable income in 2022 of $312,600 for purposes of computing the $179 expense and acquired the following assets during the year: Asset Office furniture Computer equipment Delivery truck Qualified real property (MACRS, 15 year, 150% DB) Total Placed in Service September 12 February 10 August 21 September 30 Maximum total depreciation deduction What is the maximum total depreciation deduction that Chaz may deduct in 2022? (Use MACRS Table 1. Table 2. Table 3, Table 4 and Table 5.) Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Basis $ 786,000 936,000 74,000 1,505,000 $ 3,301,000 =arrow_forwardThe information that follows pertains to Esther Food Products: a. At December 31, 2024, temporary differences were associated with the following future taxable (deductible) amounts: Depreciation Prepaid expenses Warranty expenses $ 52,000 22,000 (19,000) b. No temporary differences existed at the beginning of 2024. c. Pretax accounting income was $74,000 and taxable income was $19,000 for the year ended December 31, 2024. d. The tax rate is 25%. Required: Complete the following table given below and prepare the appropriate journal entry to record income taxes for 2024. Complete this question by entering your answers in the tabs below. Calculation General Journal Complete the following table given below to record income taxes for 2024. Note: Amounts to be deducted should be entered with a minus sign. Description Pretax accounting income Permanent differences Income subject to taxation Temporary Differences Income taxable in current year Calculation General Journal Amount Tax Rate $…arrow_forward1. Excess of tax depreciation over book depreciation, $40,000. This $40,000 difference will reverse equally over the years 2017-2020. 2. Deferral, for book purposes, of $20,000 of rent received in advance. The rent will be recognized in 2017. 3. Pretax financial income, $300,000. 4. Tax rate for all years, 40%. Instructions (a) Compute taxable income for 2016. (b) Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2016. (c) Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017, assuming taxable income of $325,000.arrow_forward

- During 2019 and 2020, Faulkner Manufacturing used the sum-of-the-years’-digits (SYD) method of depreciation for its depreciable assets, for both financial reporting and tax purposes. At the beginning of 2021, Faulkner decided to change to the straight-line method for both financial reporting and tax purposes. A tax rate of 25% is in effect for all years.For an asset that cost $11,200 with an estimated residual value of $1,200 and an estimated useful life of 10 years, the depreciation under different methods is as follows: Year Straight Line SYD Difference 2019 $ 1,000 $ 1,818 $ 818 2020 1,000 1,636 636 $ 2,000 $ 3,454 $ 1,454 Required:1. Prepare the journal entry that Faulkner will record in 2021 related to the change.2. Suppose instead that Faulkner previously used straight-line depreciation and changed to sum-of-the-years’- digits in 2021. Prepare the journal entry that Faulkner will record in 2021 related to the change. Please…arrow_forward.(BE 18-7) Myers Corp. purchased depreciable assets costing $30,000 on January 2, 2020. For tax purposes, the company uses CCA in a class that has a 30% rate. For financial reporting purposes, the company uses straight-line depreciation over five years. The enacted tax rate is 25% for all years. This depreciation difference is the only reversing difference the company has. (a) Calculate the amount of capital cost allowance and depreciation expense from 2020 to 2024, as well as the corresponding balances for the carrying amount and undepreciated capital cost of the depreciable assets at the end of each of the years 2020 to 2024. Assume that these assets are considered "eligible equipment" for purposes of the Accelerated Investment Incentive (under the All, instead of using the half-year rule, companies are allowed a first-year deduction using 1.5 times the standard CCA rate). Round to the nearest dollar. (b) Determine the amount of deferred taxes that should be reported in the SFP for…arrow_forwardBlossom Co. at the end of 2024, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income $1500000 Estimated litigation expense 3500000 (2820000) Installment sales Taxable income $2180000 The estimated litigation expense of $3500000 will be deductible in 2026 when it is expected to be paid. Gross profit of $1410000 from the installment sales will be realized in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $1410000 current and $1410000 noncurrent. The income tax rate is 20% for all years. The deferred tax asset to be recognized at the end of 2024 is $0. $136000. $1750000. $700000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education