FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

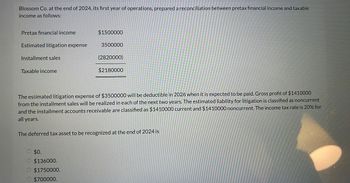

Transcribed Image Text:Blossom Co. at the end of 2024, its first year of operations, prepared a reconciliation between pretax financial income and taxable

income as follows:

Pretax financial income

$1500000

Estimated litigation expense

3500000

(2820000)

Installment sales

Taxable income

$2180000

The estimated litigation expense of $3500000 will be deductible in 2026 when it is expected to be paid. Gross profit of $1410000

from the installment sales will be realized in each of the next two years. The estimated liability for litigation is classified as noncurrent

and the installment accounts receivable are classified as $1410000 current and $1410000 noncurrent. The income tax rate is 20% for

all years.

The deferred tax asset to be recognized at the end of 2024 is

$0.

$136000.

$1750000.

$700000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information is available for Metlock Inc. for 2024: Excess of tax depreciation over book depreciation, $77,200. This $77,200 difference will reverse equally over the next 4 years. 1. 2 3. (a) Deferral, for book purposes, of $26,000 of subscription income received in advance. The subscription income will be earned in 2025. Pretax financial income, $206,000. Tax rate for all years, 20%. Your answer is correct. Compute taxable income for 2024. (b) Taxable income 154800 Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2024. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.) Account Titles and Explanation deprecation Debit Creditarrow_forwardThe pretax financial income of Tamarisk Company differs from its taxable income throughout each of 4 years as follows. Year PretaxFinancial Income Taxable Income Tax Rate 2020 $295,000 $180,000 35 % 2021 320,000 217,000 20 % 2022 335,000 264,000 20 % 2023 435,000 592,000 20 % Pretax financial income for each year includes a nondeductible expense of $29,300 (never deductible for tax purposes). The remainder of the difference between pretax financial income and taxable income in each period is due to one depreciation temporary difference. No deferred income taxes existed at the beginning of 2020. Prepare the Income stmt for 2021 beginning with income before income taxesarrow_forwardTaxable income and pretax financial income would be identical for Blue Co. except for its treatments of gross profit on installment sales and estimated costs of warranties. The following income computations have been prepared. Taxable income 2024 2025 2026 Excess of revenues over expenses (excluding two temporary differences) $154,000 $191.000 $88,100 Installment gross profit collected 8,500 8,500 8,500 Expenditures for warranties Taxable income (4,500) $158,000 (4,500) $195,000 (4,500) $92,100 Pretax financial income 2024 2025 2026 Excess of revenues over expenses (excluding two temporary differences) Installment gross profit recognized $154,000 $191,000 $88,100 25,500 -0- -0- Estimated cost of warranties Income before taxes (13,500) $166,000 -0- -0- $191,000 $88,100 The tax rates in effect are 2024, 20%; 2025 and 2026, 25%. All tax rates were enacted into law on January 1, 2024. No deferred income taxes existed at the beginning of 2024. Taxable income is expected in all future years.…arrow_forward

- Current Attempt in Progress The following information is available for Bramble Corporation for 2024 (its first year of operations). 1. Excess of tax depreciation over book depreciation, $42,400. This $42,400 difference will reverse equally over the years 2025-2028. 2. Deferral, for book purposes, of $20,300 of rent received in advance. The rent will be recognized in 2025. 3. Pretax financial income, $272,300. 4. Tax rate for all years, 30%. (a) Your answer is correct. Compute taxable income for 2024. Taxable income $ 250200 Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2024. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Income Tax Expense Deferred Tax Asset Deferred Tax Liability Income Tax Payable Debit…arrow_forwardGreenville Industries uses the accrual basis to account for all sales transactions. Sales for 2022 total $590,000. Included in this amount is $80,000 in receivables from sales on installment. Installment sales are considered revenue for book purposes, but not for tax purposes. Operating expenses total $180,000 and are treated the same for book and tax purposes. What is Greenville's book basis in the installment sale receivable? Group of answer choices $40,000 $80,000 $180,000 $0arrow_forwardSubject :- Account At the end of 2024, its first year of operations, Blossom Company prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income $2,890,000 Estimated litigation expense 3890000 Extra depreciation for taxes (5892000) Taxable income $888,000 The estimated litigation expense of $3890000 will be deductible in 2025 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1964000 in each of the next 3 years. The income tax rate is 20% for all years. The deferred tax asset at the end of 2024 to be recognized isarrow_forward

- Sheridan Co. at the end of 2020, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income $2615000 Estimated litigation expense 3615000 Extra depreciation for taxes (5622000) Taxable income $ 608000 The estimated litigation expense of $3615000 will be deductible in 2021 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1874000 in each of the next 3 years. The income tax rate is 20% for all years.Income taxes payable is $121600. $401400. $601400. $0.arrow_forwardTaxable income and pretax financial income would be identical for Sweet Co. except for its treatments of gross profit on installment sales and estimated costs of warranties. The following income computations have been prepared. Taxable income 2024 2025 2026 Excess of revenues over expenses (excluding two temporary differences) $166,000 $212,000 $97,900 Installment gross profit collected 8,000 8,000 8,000 Expenditures for warranties Taxable income (5,200) (5,200) (5,200) $168,800 $214,800 $100,700 Pretax financial income 2024 2025 2026 Excess of revenues over expenses (excluding two temporary differences) $166,000 $212,000 $97,900 Installment gross profit recognized 24,000 -0- -0- Estimated cost of warranties (15,600) -0- -0- Income before taxes $174,400 $212,000 $97,900 The tax rates in effect are 2024, 20%; 2025 and 2026, 25%. All tax rates were enacted into law on January 1, 2024. No deferred income taxes existed at the beginning of 2024. Taxable income is expected in all future…arrow_forwardCrane Co. at the end of 2020, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income Estimated litigation expense Installment sales Taxable income $1170000 $1180000. $352000. $234000. $590000. 2950000 (2360000) $1760000 The estimated litigation expense of $2950000 will be deductible in 2022 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $1180000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $1180000 current and $1180000 noncurrent. The income tax rate is 20% for all years. The income tax expense isarrow_forward

- Pharoah Co. at the end of 2020, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income $1320000 Estimated litigation expense 3200000 Installment sales (2560000) Taxable income $1960000 The estimated litigation expense of $3200000 will be deductible in 2022 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $1280000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $1280000 current and $1280000 noncurrent. The income tax rate is 20% for all years.The deferred tax asset to be recognized is $128000 current. $640000 noncurrent. $0. $128000 noncurrent.arrow_forwardNonearrow_forward30. Wildhorse Co. at the end of 2020, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income $1470000 Estimated litigation expense 3450000 Installment sales (2760000) Taxable income $2160000 The estimated litigation expense of $3450000 will be deductible in 2022 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $1380000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $1380000 current and $1380000 noncurrent. The income tax rate is 20% for all years.The deferred tax asset to be recognized is $0. $138000 noncurrent. $690000 noncurrent. $138000 current.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education