Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

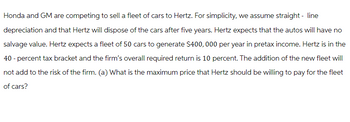

Transcribed Image Text:Honda and GM are competing to sell a fleet of cars to Hertz. For simplicity, we assume straight - line

depreciation and that Hertz will dispose of the cars after five years. Hertz expects that the autos will have no

salvage value. Hertz expects a fleet of 50 cars to generate $400,000 per year in pretax income. Hertz is in the

40-percent tax bracket and the firm's overall required return is 10 percent. The addition of the new fleet will

not add to the risk of the firm. (a) What is the maximum price that Hertz should be willing to pay for the fleet

of cars?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- J.B. Enterprises is considering the purchase of new equipment with a cost of $1,000,000. If the equipment is purchased, the incremental net cash flows are expected to be $300,000 per year for five years. These net cash flows already reflect the of the equipment and the company’s 40% tax rate. However, there are liability risks associated with the use of this product. The board of directors estimates a “cost of worry” of $25,000 per year. Calculate the net present value of this project incorporating the cost of worry if the company’s cost of capital is 10%. a. $42,466 b. $340,909 c. $375,000 d. $61,420arrow_forwardPlease solve it as soon as possible! . Consider an asset with an initial cost of $100,000 and no salvage value. Compute the difference in the present value of the tax shields if CCA is calculated at 20% declining balance compared to if CCA is calculated using a five-year, straight line write off. For your calculation use 30% as the tax rate and 16% as the required return. (The half-year rule applies.) The difference, to the nearest dollar, is A S1.724 B $4,129 C S4.483 d. 59,517 e.$49,969arrow_forwardGenesis Corporation want to purchase a piece of machinery for $150,000 that will cost $20,000 to have it delivered and installed. Based on past information, they believe they can sell the machinery for $25,000 in 5 years. The company’s marginal tax rate is 34%. If the applicable CCA rate is 20% and the required return on this project is 15%, what is the present value of the CCA tax shield?arrow_forward

- Daily Enterprises is purchasing a $10.2 million machine. It will cost $51,000 to transport and install the machine. The machine has a depreciable life of five years and will have no salvage value. The machine will generate incremental revenues of $3.9 million per year along with incremental costs of $1.5 million per year. If Daily's marginal tax rate is 21%, what are the incremental earnings (net income) associated with the new machine? The annual incremental earnings are $ (Round to the nearest dollar.)arrow_forwardThe management of Origami Company, a wholesale distributor of beachwear products, is considering purchasing a $30,000 machine that would reduce operating costs in its warehouse by $5,000 per year. At the end of the machine's eight-year useful life, it will have no scrap value. The company's required rate of return is 11%. (Ignore income taxes.) Required: 1. Determine the net present value of the investment in the machine. (Hint: Use Microsoft Excel to calculate the discount factor(s).) (Do not round intermediate calculations and round your final answer to the nearest dollar amount. Negative amount should be indicated by a minus sign.) Net present value 2. What is the difference between the total undiscounted cash inflows and cash outflows over the entire life of the machine? Net cash flowarrow_forwardYou are contemplating the replacement of an old printing machine with a new model costing $63,000. The old machine, which originally cost $40,000, has 6 years of expected life remaining and the current book value of $14,000 versus the current market value of $21,000. The firm's corporate tax rate is 24 percent. If the company sells the old machine at the market value, what is the initial after-tax cash outlay for the new printing machine purchase?arrow_forward

- Daily Enterprises is purchasing a $9.6 million machine. It will cost $45,000 to transport and install the machine. The machine has a depreciable life of 5 years and will have no salvage value. The machine will generate incremental revenues of $4.2 million per year along with incremental costs of $1.2 million per year. If Daily's marginal tax rate is 28%, what are the incremental earnings (net income) associated with the new machine?arrow_forwardThe Carter Corporation, a firm in the 25% marginal tax bracket, with a 15% required rate of return or discount rate, is considering a new project. This project involves the introduction of a new product. This product is expected to last 5 years and then, because it is somewhat of a fad product, it will be terminated. Cost of new plant and equipment:$380,000,000 Shipping and installation costs: 20,000,000 Unit sales: YearUnits Sold 1 2,000,000 2 2,000,000 3 2,000,000 4 1,500,000 5 1,500,000 Sales price per unit: $800/unit in years 1-3 and $600/unit in years 4 and 5 Variable cost per unit: $400/unit throughout the five years Annual fixed costs: $250,000,000 There will be an initial working capital requirement of $2,000,000 just to get production started. At the conclusion of the project, the plant and equipment can be sold for $100,000,000. The plant and equipment will be depreciated over five years on a straight-line basis to a zero-salvage value. Required: a)…arrow_forwardllana Industries, Inc., needs a new lathe. It can buy a new high-speed lathe for $0.97 million. The lathe will cost $31,300 to run, will save the firm $127,700 in labour costs, and will be useful for 10 years. Suppose that for tax purposes, the lathe will be in an asset class with a CCA rate of 25%. llana has many other assets in this asset class. The lathe is expected to have a 10-year life with a salvage value of $91,000. The actual market value of the lathe at that time will also be $91,000. The discount rate is 15% and the corporate tax rate is 35%. What is the NPV of buying the new lathe? (Round your answer to the nearest cent.) NPV $arrow_forward

- Lobster Seafood Corp. is planning to build a new shipping depot. The initial cost of the investment is $1.18 million. Efficiencies from the new depot are expected to generate an annual after-tax cost reduction of $105,000 forever. The corporation has a total value of $65 million and has outstanding debt of $45 million. What is the NPV of the project if the firm has an aftertax cost of debt of 5.8 percent and a cost equity of 12.6 percent? $244,843 $150,409 $480,584 $67,715arrow_forward28) The Wolf's Den Outdoor Gear is considering replacing the equipment it uses to produce tents. The equipment would cost $1.4 million and lower manufacturing costs by an estimated $215,000 a year. The equipment will be depreciated over 8 years using straight-line depreciation to a book value of zero. The required rate of return is 15 percent and the tax rate is 21 percent. The equipment will be used for 8 years and thereafter will be worthless. What is the annual operating cash flow from this proposed project?arrow_forwardThe Lesseis Company has an opportunity to invest in one of two mutally exclusive machines that will produce a product the company will need for the next 8 years Machine A has an after-tax cost of $8 million but will provide after-tux inflows of $4.9 million per year for 4 years. If Machine A were replaced, its after-tax cost would be million $8.7 million due to inflation and its after-tax rash inflows would increase to $5,1 million due to production efficiencies. Machine B has an after-tax cost of $13.2 million and will provide after- tax inflows of $4,5 million for 8 years. per year If the WACC is 8%, which machine should be acquired? Enter your answers in millions, For example, on answer of $10, 550, 000 should be entered as 10.55. Do not rand intermediate calculations. Round your answers to two decimal places. millines millians, rather millions created by Machine Machine A is the better project and will increase the company's value by $ then the $ B.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education