Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

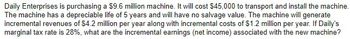

Transcribed Image Text:Daily Enterprises is purchasing a $9.6 million machine. It will cost $45,000 to transport and install the machine.

The machine has a depreciable life of 5 years and will have no salvage value. The machine will generate

incremental revenues of $4.2 million per year along with incremental costs of $1.2 million per year. If Daily's

marginal tax rate is 28%, what are the incremental earnings (net income) associated with the new machine?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Laurel's Lawn Care Limited has a new mower line that can generate revenues of $135,000 per year. Direct production costs are $45,000, and the fixed costs of maintaining the lawn mower factory are $17, 500 a year. The factory originally cost $0.90 million and is being depreciated for tax purposes over 20 years using straight-line depreciation. Calculate the operating cash flows of the project if the firm's tax bracket is 25% . Note: Enter your answer in dollars not in millions.arrow_forwardSpectacular Flooring (SF) is a wood flooring wholesale company. SF is considering building a new inventory warehouse for $500,000. The warehouse would allow SF to increase their pre-tax cash flows by $100,000 each year. The company would plan to use the warehouse for 10 years before selling it for $200,000. The company uses straight-line depreciation. SF’s tax rate is 20%, and the required rate of return is 10%. What is the Net Present Value (NPV) of the proposed investment? Select one: a. $90,119 b. $77,108 c. ($55,591) d. $105,541 e. $19,517arrow_forwardDaily Enterprises is purchasing a $14,000,000 machine. The machine will depreciated using straight-line depreciation over its 10 year life and will have no salvage value. The machine will generate revenues of $8,000,000 per year along with costs of $3,000,000 per year. If Daily's marginal tax rate is 28%, what will be the cash flow in each of years one to 10 (the cash flow will be the same each year)? Enter your answer below rounded to the nearest whole number. Numberarrow_forward

- The Lumber Yard is considering adding a new product line that is expected to increase annual sales by $352,000 and expenses by $244,000. The project will require $153,000 in fixed assets that will be depreciated using the straight-line method to a zero book value over the 9-year life of the project. The company has a marginal tax rate of 21 percent. What is the depreciation tax shield? Multiple Choice O $20,145 $3,570 $8.213 $22.680 ER 540arrow_forwardProven Specialist will spend $850,000 on a piece of equipment that will manufacture fine wire for the electronics industries. The shipping and installation charges will be $220,000 and net working capital will increase to $28,000. The equipment will replace an existing machine that has a salvage value of $85,000 and a book value of $122,000. If Proven Specialist has a current marginal tax rate of 32 percent, what is the net investment?arrow_forwardThe Lesseig Company has an opportunity to invest in one of two mutually exclusive machines that will produce a product the company will need for the next 8 years. Machine A has an after-tax cost of $9.9 million but will provide after-tax inflows of $4.2 million per year for 4 years. If Machine A were replaced, its after-tax cost would be $11.8 million due to inflation and its after-tax cash inflows would increase to $4.5 million due to production efficiencies, Machine B has an after-tax cost of $13.1 million and will provide after-tax inflows of $3.6 million per year for 8 years. If the WACC is 7%, which machine should be acquired? Explain. Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answers to two decimal places. Machine -Select- is the better project and will increase the company's value by $ millions, rather than the s millions created by Machine -Select-.arrow_forward

- The Wet Corp. has an investment project that will reduce expenses by $30,000 per year for 3 years. The project's cost is $35,000. If the asset is part of the 3-year MACRS category (33.33% first year depreciation) and the company's combined tax rate is 33%, what is the cash flow from the project in year 1? (Do not round intermediate calculations. Round your answer to the nearest dollar amount.) Multiple Choice $23,400 $24,730 $23,950 $25,410arrow_forwardGluon Incorporated is considering the purchase of a new high pressure glueball. It can purchase the glueball for $150,000 and sell its old low-pressure glueball, which is fully depreciated, for $26,000 The new equipment has a 10-year useful life and will save $34,000 a year in expenses before tax. The opportunity cost of capital is 11%, and the firm's tax rate is 21%. What is the equivalent annual saving from the purchase if Gluon can depreciate 100% of the investment immediately. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Answer is complete but not entirely correct. Equivalent annual savings $ 16,934.51arrow_forwardKarsted Air Services is now in the final year of a project. The equipment originally cost $23 million, of which 100% has been depreciated. Karsted can sell the used equipment today for $6 million, and its tax rate is 20%. What is the equipment's after-tax salvage value? Write out your answer completely. For example, 13 million should be entered as 13,000,000. Round your answer to the nearest dollar. $arrow_forward

- Quick Computing installed its previous generation of computer chip manufacturing equipment 3 years ago. Some of that older equipment will become unnecessary when the company goes into production of its new product. The obsolete equipment, which originally cost $38.50 million, has been depreciated straight-line over an assumed tax life of 5 years, but it can be sold now for $17.70 million. The firm’s tax rate is 30%. What is the after-tax cash flow from the sale of the equipment?arrow_forwardLaurel’s Lawn Care Limited has a new mower line that can generate revenues of $132,000 per year. Direct production costs are $44,000, and the fixed costs of maintaining the lawn mower factory are $17,000 a year. The factory originally cost $1.10 million and is being depreciated for tax purposes over 25 years using straight-line depreciation. Calculate the operating cash flows of the project if the firm’s tax bracket is 25%. Operating Cash Flow = _________arrow_forwardAcefacto Inc., has asked for you to calculate the after-tax salvage value of an asset it plans on using in a construction project. The project will be depreciated straight line to a value of$670,000at the end of the project's and assets ten year life. Ace's marginal tax rate is32%. The firm will have to pay$8,047,675to buy the asset. You have estimated that they could sell the asset for$787,309to a Brazilian firm at the end of the project. Answer in dollars and cents.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education