FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

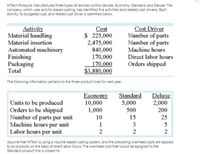

Transcribed Image Text:HITech Products manufactures three types of remote-control devices: Economy, Standard, and Deluxe. The

company, which uses activity-based costing, has identified five activities (and related cost drivers). Each

activity, its budgeted cost, and related cost driver is identified below.

Activity

Material handling

Material insertion

Cost

$ 225,000

2,475,000

840,000

170,000

Cost Driver

Number of parts

Number of parts

Machine hours

Automated machinery

Finishing

Packaging

Total

Direct labor hours

170.000

$3,880,000

Orders shipped

The following information pertains to the three product lines for next year:

Economy

10,000

1,000

Standard

5,000

500

Deluxe

2,000

200

Units to be produced

Orders to be shipped

Number of parts per unit

Machine hours per unit

Labor hours per unit

10

15

25

1

3

5

2

2

Assume that HiTech is using a volume-based costing system, and the preceding overhead costs are applied

to all products on the basis of direct labor hours. The overhead cost that would be assigned to the

Standard product line is closest to:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- what is the predetermind rate?arrow_forwardXYZ Co. manufactures three types of remote-control devices: X, Y, and Z. The company, which uses activity-based costing, has identified five activities (and related cost drivers). Each activity, its budgeted cost, and related cost driver is identified below. Activity Cost Cost Driver Material handling $225,000 Number of parts Material insertion 2,475,000 Number of parts Automated machinery 840,000 Machine hours Finishing 170,000 Direct labor hours Packaging 170,000 Orders shipped Total $3,880,000 The following information pertains to the three product lines for next year: Y Units to be produced 10,000 5,000 2,000 Orders to be shipped 1,000 500 200 Number of parts per unit 10 15 25 Machine hours per unit 1 5 Labor hours per unit 2 2 What is pool rate for the material-insertion activity?arrow_forwardFoam Products, Incorporated, makes foam seat cushions for the automotive and aerospace industries. The company's activity-based costing system has four activity cost pools, which are listed below along with their activity measures and activity rates: Activity Cost Pool Supporting direct labor Batch processing Order processing Customer service Activity Measure Number of direct labor-hours Number of batches Number of orders Number of customers Activity Rate $ 11 per direct labor-hour $ 92 per batch $ 272 per order $ 2,609 per customer The company just completed a single order from Interstate Trucking for 1,500 custom seat cushions. The order was produced in two batches. Each seat cushion required 0.4 direct labor-hours. The selling price was $141.90 per unit, the direct materials cost was $105 per unit, and the direct labor cost was $14.70 per unit. This was Interstate Trucking's only order during the year. Required: Calculate the customer margin on sales to Interstate Trucking for the…arrow_forward

- Activity-Based Costing Cardio Care Inc. manufactures stationary bicycles and treadmills. The products are produced in the Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: Activity Activity Rate Fabrication $22 per machine hour (mh) Assembly $14 per direct labor hour (dlh) Setup $40 per setup Inspecting $20 per inspection Production scheduling $16 per production order Purchasing $4 per purchase order The activity-base usage quantities and units produced for each product were as follows: Stationary Bicycle Treadmill Machine hours 2,210 1,090 Direct labor hours 470 200 Setups 40 10 Inspections 650 370 Production orders 60 40 Purchase orders 150 80 Units produced 1,000 1,000 Use the activity rate and usage information to compute the total…arrow_forwardGreenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 231,000 11,000 MHs Machine setups Number of setups $ 180,000 300 setups Production design Number of products $ 94,000 2 products General factory Direct labor-hours $ 260,000 10,000 DLHs Activity Measure Product Y Product Z Machining 9,000 2,000 Number of setups 60 240 Number of products 1 1 Direct labor-hours 9,000 1,000 11. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product Y and…arrow_forwardGreenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 227,700 11,000 MHs Machine setups Number of setups $ 153,900 270 setups Production design Number of products $ 91,000 2 products General factory Direct labor-hours $ 257,000 10,000 DLHs Activity Measure Product Y Product Z Machining 8,700 2,300 Number of setups 60 210 Number of products 1 1 Direct labor-hours 8,700 1,300 7. Which of the four activities is a batch-level activity? multiple choice Machining activity General…arrow_forward

- Activity-Based Costing CardioTrainer Equipment Company manufactures stationary bicycles and treadmills. The products are produced in the Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: Activity Activity Rate Fabrication $22 per machine hour (mh) Assembly $12 per direct labor hour (dlh) Setup $40 per setup Inspecting $18 per inspection Production scheduling $8 per production order Purchasing $5 per purchase order The activity-base usage quantities and units produced for each product were as follows: Stationary Bicycle Treadmill Machine hours 1,680 1,070 Direct labor hours 243 131 Setups 45 131 Inspections 158 94 Production orders 60 32 Purchase orders 240 98 Units produced 500 350 Use the activity rate and usage information to compute the total activity costs and the activity…arrow_forwardFoam Products, Incorporated, makes foam seat cushions for the automotive and aerospace industries. The company’s activity-based costing system has four activity cost pools, which are listed below along with their activity measures and activity rates: Activity Cost Pool Activity Measure Activity Rate Supporting direct labor Number of direct labor-hours $ 14 per direct labor-hour Batch processing Number of batches $ 90 per batch Order processing Number of orders $ 287 per order Customer service Number of customers $ 2,608 per customer The company just completed a single order from Interstate Trucking for 2,900 custom seat cushions. The order was produced in three batches. Each seat cushion required 0.4 direct labor-hour. The selling price was $142.30 per unit, the direct materials cost was $110 per unit, and the direct labor cost was $14.40 per unit. This was Interstate Trucking’s only order during the year. Required: Calculate the customer margin for Interstate Trucking.arrow_forwardMunoz Manufacturing produces two keyboards, one for laptop computers and the other for desktop computers. The production process is automated, and the company has found activity-based costing useful in assigning overhead costs to its products. The company has identified five major activities involved in producing the keyboards. Activity Materials receiving & handling Production setup Quality inspection Assembly Packing and shipping Allocation Base Cost of material Number of setups Number of parts Inspection time Number of orders Activity measures for the two kinds of keyboards follow: Allocation Rate 2% of material cost $112.00 per setup $7.00 per part $1.20 per minute $ 8.00 per order Laptops. Desktops Labor Cost $ 1,350 Material Cost Number of Setups 1,240 $ 6,500 7,100 31 Number of Parts 50 13 28 Inspection Time 6,800 minutes 4,600 minutes Number of Orders 62 22 Required a. Compute the cost per unit of laptop and desktop keyboards, assuming that Munoz made 200 units of each type of…arrow_forward

- FDC-11063 Incorporated, manufactures and sells two products: Product Z1 and Product Z8. The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Activity Cost Pools Activity Measures Labor-related DLHS Estimated Overhead Cost $ 145,000 Expected Activity Product Z1 Product Z8 Total 4,000 2,000 6,000 Machine setups Order size setups MHS 68,360 1,069,190 1,100 300 1,400 2,700 3,100 5,800 $ 1,282,550 The activity rate for the Order Size activity cost pool under activity-based costing is closest to: Multiple Choice О $98.53 per MH О $257.34 per MH $184.34 per MH $196.13 per MHarrow_forwardHaresharrow_forwardQ8 Lens Care Incorporated (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 3.60 per part Manufacturing supervision Hours of machine time $ 14.92 per hour Assembly Number of parts $ 3.90 per part Machine setup Each setup $ 57.10 per setup Inspection and testing Logged hours $ 46.10 per hour Packaging Logged hours $ 20.10 per hour LCI currently sells the B-13 model for $4,475 and the F-32 model for $4,580. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 165.10 $ 76.08 Number of parts 172 132 Machine hours 8.50 4.32 Inspection…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education