Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Explain

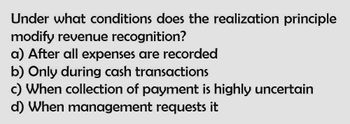

Transcribed Image Text:Under what conditions does the realization principle

modify revenue recognition?

a) After all expenses are recorded

b) Only during cash transactions

c) When collection of payment is highly uncertain

d) When management requests it

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Describe the revenue recognition principle. Give specifics.arrow_forwardWhich of the following is not a criterion to recognize revenue under GAAP? A. The earnings process must be completed. B. A product or service must be provided. C. Cash must be collected. D. GAAP requires that the accrual basis accounting principle be used in the revenue recognition process.arrow_forward41. Realization of revenue occurs when a. the item is formally recorded and reported in the financial statements b. noncash resources are converted into cash or rights to cash c. the actual exchange of noncash resources into cash С. d. when a transaction is both realized and realizable 42.A revenue recognition method that recognizes revenue before the time of sale is a. percentage-of-completion b. installment c. cost recovery d. point of sale С.arrow_forward

- Which of the following states that a transaction is not recorded in the books of accounts unless it is measurable in terms of money? a. Matching principle. b. Revenue recognition principle. c. Time period assumption. d. Monetary unit assumption.arrow_forwardThe principle that states revenue should be recognized when earned, regardless of when cash is received, is called the: a) Cash basis principle b) Revenue recognition principle c) Matching principle d) Accrual basis principlearrow_forwardWhich of the following accounts is not normally part of the revenue and collection cycle?a. Sales.b. Accounts Receivable.c. Cash.d. Purchases Returns and Allowancesarrow_forward

- Discuss, using practical example the effect of prepayment figures on the preparation of a financial statement? Suggest Four reasons why there might be difference between the balance on the receivable ledger control account and the total list of the list of accounts receivable ledger balances.? Discuss, using practical example how revenue expenditure should not be capitalized ?arrow_forwardAs part of a strong internal control system, which of the following accounting duties needsto be separated from cash handling?a. Record keepingb. Filingc. Transaction approvald. Both a and c need to be separated from cash handling.arrow_forwardWhich of the following is not a criterion to recognize revenue under GAAP? GAAP requires that the accrual basis accounting principle be used in the revenue recognition process. The earnings process must be completed. A product or service must be provided. Cash must be collected O O O Oarrow_forward

- Which of the following is not a pervasive expense recognition principle? a. immediate recognition b. systematic and rational allocation c. cash payment d. association of cause and effectarrow_forwardTh e assumption that the eff ects of transactions and other events are recognized when they occur, not when the cash fl ows occur, is called: A . relevance.arrow_forwardThe modified accrual basis ______. Multiple select question. What solution is it below? (A) records receivables (B) is merely a "light" version of the accrual version is not equivalent to the cash basis (C) accrues expenditures when payable (D) does not recognize long-term assets and liabilitiesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning