FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

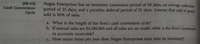

Transcribed Image Text:(16-11)

Cash Conversion

Negus Enterprises has an inventory conversion period of 50 days, an average collection

period of 35 days, and a payables deferral period of 25 days. Assume that cost of goods

sold is 80% of sales.

Cycle

a. What is the length of the firm's cash conversion cycle?

b. If annual sales are $4,380,000 and all sales are on credit, what is the firm's investment

in accounts receivable?

C. How many times per year does Negus Enterprises turn over its inventory?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Your consulting firm was recently hired to improve the performance of RP Inc, which is highly profitable but has been experiencing cash shortages due to its high growth rate. As one part of your analysis. you want to determine the firm's cash conversion cycle. Using the following information and a 365-day year, what is the firm's present cash conversion cycle? Average inventory Annual sales Annual cost of goods seld Average accounts receivable Average accunts payable P5.000 P00.000 PH0,000 P0,000 F5000 140.6 days 120.6 days 133.6 days 148.0 days O 126.9 daysarrow_forwardDreamz Unlimited INC has accounts payable days of 30 , inventory days of 60 , and accounts receivable days of 35 . What is its Cash conversion cycle?arrow_forwardSuppose that Freddie's Fries has annual sales of $620,000; cost of goods sold of $495, 000; average inventories of $21,000; average accounts receivable of $37,000, and an average accounts payable balance of $32, 000. Assuming that all of Freddie's sales are on credit, what will be the firm's cash cycle? (Round your answer to 2 decimal places.) a. 37.26. b. 60.86. c. 1.82. d. 13.66.arrow_forward

- Inmoo Company's average age of accounts receivable is 89 days, the average age of accounts payable is 40 days, and the average age of inventory is 48 days. Assuming a 365-day year, what is the length of its cash conversion cycle? Please explain process and show calculations.arrow_forwardSam & Sons management estimates that it takes the company 34 days on average to pay its suppliers. Management also knows that the company has days’ sales in inventory of 57 days and days’ sales outstanding of 35 days. How does Sam & Sons' cash conversion cycle compare with the industry average of 69 days? Sam & Sons' cash conversion cycle is_____ days Cash conversion cycle is (?) the industry average. The firm is (?) than other firms in the industry in managing its working capital.arrow_forwardProvide correct solutionarrow_forward

- Average account receivables-60 days, Inventories-85 days, Average account payable-55 days Company spends Rs.21, 00,000 annually and can earn 10% on its investments. (i) Find out cash cycle and cash turnover assuming 360 days in a year, (ii) Minimum amount of cash required to meet the payment. Also calculate the above, if inventory age is reduced to 75 days. What will be the savings for the company?arrow_forwardWatts Industries' carries 87 days in Inventory, and collects its Accounts Receivable in 75 days. If the firm pays its Accounts Payable in 26 days, what is Watts' Cash Conversion Cycle?arrow_forwardNonearrow_forward

- Berry Manufacturing turns over its inventory 8 times each year, has an Average Payment Period of 35 days and has an Average Collection Period of 60 days. The firm’s annual sales are $3.5 million. Assume there is no difference in the investment per dollar of sales in inventory, receivable, and payables and that there is a 365-day year. A. Calculate the Firm’s Operating Cycle. B. Calculate the Firm’s Cash Conversion Cycle. C. Calculate the Firm’s Daily Cash Operating Expenditure.arrow_forward2arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education