FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Saved

cat oncem ca Szemchens

0

Help

Save & Ex

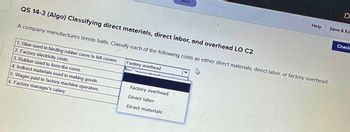

QS 14-3 (Algo) Classifying direct materials, direct labor, and overhead LO C2

A company manufactures tennis balls. Classify each of the following costs as either direct materials, direct labor, or factory overhead.

1. Glue used in binding rubber cores to felt covers.

2. Factory electricity costs.

3. Rubber used to form the cores.

4. Indirect materials used in making goods.

5. Wages paid to factory machine operators.

6. Factory manager's salary.

Factory overhead

Factory overhead

Direct labor

Direct materials

h

Check

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide solutionarrow_forwardPlease help me with show all calculation thankuarrow_forwardWhich of the following costs is best classified as a fixed cost with respect to volume of activity? (See your Chapter 20 notes, page 5) Direct labor Electricity used to heat, light, and cool a factory Cleaning supplies used in an automobile assembly plant Straight-line depreciation expense of a machine used in a factory Total cost of salaries paid to quality inspectors in a manufacturing plant Tires used in an automobile manufacturing plantarrow_forward

- Please do not give solution in image format thankuarrow_forwarda. Determine the tvio production department factory overhead rates. Pattern Department per dlh HIP Jad b. Use the tvo production department factory overhead rates to dezermine the factory overheed per unit for each product. Cut and Sevw Department Small glove per unit nAr iinitarrow_forwardNeed help with this questionarrow_forward

- solve all correctly and completely with all working thanks answer in textarrow_forwardThe costs listed below are related to a manufacturer of all-natural ice cream. Indicate whether the costs are direct materials (DM), direct labor (DL) or overhead (OH). maintenance on factory building mixing department wages factory maintenance laborarrow_forwardMatch the costs for Oracle in producing computer servers to the appropriate cost types below.A. Raw MaterialsB. Direct LaborC. Overhead CostD. N/A1. Employee Wages for Soldering electronic pieces ________________Why? ________________________________________________________________________________________________________________________________________2. Sales Commissions for Salespersons ________Why? ________________________________________________________________________________________________________________________________________3. Soldering Materials purchased in bulk at the beginning of the year ________Why? ________________________________________________________________________________________________________________________________________4. Motherboards and Processors ________________Why? ________________________________________________________________________________________________________________________________________5. Salaries for the supervisor overseeing the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education