Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

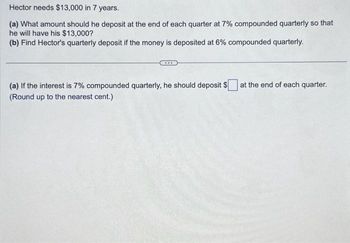

help!! Hector needs $13,000 in 7 years. (a) What amount should he deposit at the end of each quarter at 7% compounded quarterly so that he will have his $13,000? (b) Find Hector's quarterly deposit if the money is deposited at 6% compounded quarterly. (a) If the interest is 7% compounded quarterly, he should deposit $ (Round up to the nearest cent.) at the end of each quarter.

Transcribed Image Text:Hector needs $13,000 in 7 years.

(a) What amount should he deposit at the end of each quarter at 7% compounded quarterly so that

he will have his $13,000?

(b) Find Hector's quarterly deposit if the money is deposited at 6% compounded quarterly.

(a) If the interest is 7% compounded quarterly, he should deposit $

(Round up to the nearest cent.)

at the end of each quarter.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please show full steps along with concept.arrow_forwardAn insurance settlement of $3 million must replace Trixie Eden's income for the next 30 years. What income will this settlement provide at the end of each month if it is invested in an annuity that earns 8.1%, compounded monthly? (a) Decide whether the problem relates to an ordinary annuity or an annuity due. ordinary annuityannuity due (b) Solve the problem. (Round your answer to the nearest cent.) $arrow_forwardDerrick recently graduated. He owes $17,525 in student loans with APR of 4.6% compounded monthly. He is expected to pay off his loan in 15 years. Round answer to two decimal points a. Under the current terms of his loan what is Derricks minimum payment? b. What is the total amount Derrick will pay when the loan is complete? c. How much will Derrick pay in interest? d. Derrick wants to pay more than the required monthly amount for his loan. Assuming the same conditions of the original student loan what would Derrick new monthly payment would be if he pay off loan in 10 years e. What is the total amount Derrick will pay if they pay off the loan in 10 years? f. With the 10 year loan how much will Derrick pay in interest?arrow_forward

- 5) George wants to purchase a new house that costs $185, 500. The terms of the sale are 10% down payment and the rest to be paid off at a 5.75% interest rate compounded monthly for 30 years. paying $974.28 for his monthly payment b.) how much will george pay in interest for the life of the loanarrow_forwardAn investor wants to save money to purchase real estate. He deposits $550 at the end of each year in an ordinary annuity that pays 4% interest, compounded annually. Answer each part. Do not round any intermediate computations nor answers. If necessary, refer to the list of financial formulas. (a) Find the total value of the annuity at the end of the 1 year. st 24 (b) Find the total value of the annuity at the end of the 2 nd year. (c) Find the total value of the annuity at the end of the 3 rd year.arrow_forwardChase Boyd plans to borrow $6,000 for 4 years. The loan will be repaid with a single payment after four years, and the interest on the loan will be computed using the simple interest method at an annual rate of 11 percent. How much will Chase have to pay in four years? $ How much will he have to pay at maturity if he's required to make annual interest payments at the end of each year? $arrow_forward

- Hank made payments of $106 per month at the end of each month for 30 years to purchase a piece of property. He promptly sold it for $99,810. What annual interest rate would he need to earn on an ordinary annuity for a comparable rate of return? ◻️٪ (Round to the nearest hundredth as needed.)arrow_forwardHow much should Joseph have in a savings account that is earning 2.50% compounded monthly, if he plans to withdraw $2,050 from this account at the end of every month for 6 years? Round to the nearest centarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education