Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

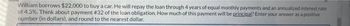

Transcribed Image Text:William borrows $22,000 to buy a car. He will repay the loan through 4 years of equal monthly payments and an annualized interest rate

of 4.3%. Think about payment #32 of the loan obligation. How much of this payment will be principal? Enter your answer as a positive

number (in dollars), and round to the nearest dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You borrow $155,000; the annual loan payments are $12, 490.89 for 30 years. What interest rate are you being charged? Round your answer to the nearest whole number. How do i do this on a finance calculator (BA II Plus)arrow_forwardYou have just purchased a car and taken out a $50,000 loan. The loan has a five-year term with monthly payments and an APR of 6.0%. a. How much will you pay in interest, and how much will you pay in principal, during the first month, second month, and first year? (Hint: Compute the loan balance after one month, two months, and one year.) b. How much will you pay in interest, and how much will you pay in principal, during the fourth year (i.e., between three and four years from now)? (Note: Be careful not to round any intermediate steps less than six decimal places.) a. How much will you pay in interest, and how much will you pay in principal, during the first month, second month, and first year? (Hint: Compute the loan balance after one month, two months, and one year.) During the first month, you will pay $ in principal. (Round to the nearest cent.)arrow_forwardkindly answer in good formarrow_forward

- Derrick recently graduated. He owes $17,525 in student loans with APR of 4.6% compounded monthly. He is expected to pay off his loan in 15 years. Round answer to two decimal points a. Under the current terms of his loan what is Derricks minimum payment? b. What is the total amount Derrick will pay when the loan is complete? c. How much will Derrick pay in interest? d. Derrick wants to pay more than the required monthly amount for his loan. Assuming the same conditions of the original student loan what would Derrick new monthly payment would be if he pay off loan in 10 years e. What is the total amount Derrick will pay if they pay off the loan in 10 years? f. With the 10 year loan how much will Derrick pay in interest?arrow_forwardStarting next year, you will need $5,000 annually for 4 years to complete your education. (One year from today you will withdraw the first $5,000.) Your uncle deposits an amount today in a bank paying 7% annual interest, which will provide the needed $5,000 payments. How large must the deposit be? Do not round intermediate calculations. Round your answer to the nearest cent. $ b. How much will be in the account immediately after you make the first withdrawal? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardPLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULAS3.- Andres Rosas wants to know how much he must deposit today, so that in 5 years he will have the amount (FV) of 88,180.00, which he needs to pay for a trip, a) if the account pays 6.125% interest compoundable semiannually; b) if the account pays 7.65% compoundable monthly. The formula must be cleared to find the initial value (PV). Note:In the image, this is the original exercise, it is in Spanish, but it is easy to understand. Very important Note:It is necessary that you make a solution approach and then the result. Above all, to check the procedure and/or the formulas used, especially when you use excel. TO CONSIDER THE YEAR AS 360 DAYS (WHICH IS COMMERCIAL) (only if required)arrow_forward

- Starting next year, you will need $15,000 annually for 4 years to complete your education. (One year from today you will withdraw the first $15,000.) Your uncle deposits an amount today in a bank paying 5% annual interest, which will provide the needed $15,000 payments. How large must the deposit be? Do not round intermediate calculations. Round your answer to the nearest cent. $ How much will be in the account immediately after you make the first withdrawal? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardSuppose you get a student loan for $8,000, and your payments are deferred until after you graduate, 2 years from now. Then, you will make 15 yearly payments (starting 2 years from now). What are your payments? The interest rate is 8%/year. a. $845 b. $ 934 c. $ 976 d. $1,009arrow_forwardTo start a new business, Alysha intends to borrow $25.000 from a local bank. If the bank asks her to repay the loan in 5 equal annual instalments of $6,935.24, determine the bank's effective annual interest rate on the ipan transaction. With annual compounding, what nominal rate would the bank quote for this loan?arrow_forward

- You borrow $22541 to buy a car. You will have to repay this loan by making equal monthly payments for 14 years. The bank quoted an APR of 6%. How much is your monthly payment (in $ dollars)? I'm not sure how the answer is 198.6394, Can you explain that to me on the financial calculator, please? Thank you :)arrow_forwardWatch the video and then solve the problem given below. Click here to watch the video. You are considering a loan with an annual rate of 8%. The mortgage is $130,000 with 180 monthly payments of $1242.35 for 15 years. Complete the first two months of the amortization table. (Simplify your answers. Round to the nearest cent as needed.) Payment number Interest payment Principal payment Balance of loan 1arrow_forwardAfter making twenty-seventh payment of $423.83 on your car loan, you wanted to find out how much is left of your original 6 years loan at 6.8% compounded monthly of $25,000.00. What is the amount of the remaining balance of your car loan? The remaining balance of your car loan would be S (Round to 2 decimal places.) Submit Question Next Pagearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education