Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

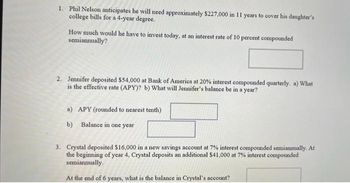

Transcribed Image Text:1. Phil Nelson anticipates he will need approximately $227,000 in 11 years to cover his daughter's

college bills for a 4-year degree.

How much would he have to invest today, at an interest rate of 10 percent compounded

semiannually?

2. Jennifer deposited $54,000 at Bank of America at 20% interest compounded quarterly. a) What

is the effective rate (APY)? b) What will Jennifer's balance be in a year?

a) APY (rounded to nearest tenth)

b) Balance in one year

3. Crystal deposited $16,000 in a new savings account at 7% interest compounded semiannually. At

the beginning of year 4, Crystal deposits an additional $41,000 at 7% interest compounded

semiannually.

At the end of 6 years, what is the balance in Crystal's account?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 6. Calculating Interest Rates. Assume the total cost of a college education will be $290,000 when your child enters çollege in 18 years. You presently have $35,000 to invest. What annual rate of interest must you earn on your investment to cover the cost of your child's college education?arrow_forwardJohn would like to accumulate $100,000 by the time his son starts college in ten years. What amount would he need to deposit now in a deposit account earning 5%, compounded yearly, to accumulate his savings goal? What if interest is compounded semiannually?arrow_forwardAlex will need $9860 per year for four years to support his daughters university tuition (first tuition is paid at the beginning of the 11th year). How much will Alex have to invest at the beginning of each year for the 10 years before his daughter begins her studies if their savings earn compound interest at 6 percent per year? A)$2,378.49 B)$2,593.46 C)$2,697.47 D)$2,400.74 E)$2,544.78arrow_forward

- Abby Ellen wants to attend Ithaca College. She will need $75,000 6 years from today. Assume Abby's bank pays 6% interest compounded semi-annually. What must Abby deposit today to have $75,000 in 6 years?arrow_forwardSam Long anticipates he will need approximately $227,000 in 11 years to cover his 3-year-old daughter’s college bills for a 4-year degree. How much would he have to invest today at an interest rate of 10 percent compounded semiannually? (Do not round intermediate calculations. Round your answer to the nearest cent.)arrow_forwardA.)Your client has recently had a baby girl. He wants to set aside his annual bonus at the end of each year to pay her college costs in 18 years. He expects his bonus to be $5,000 per year and thinks he can earn 6% per year. How much will he have saved at the end of 18 years? B.) How much will he have saved at the end of 18 years if his bonus is received at the beginning of each year?arrow_forward

- Carol wants to invest money in an investment account paying 8% interest compounding semi-annually. Carol would like the account to have a balance of $58,000 three years from now. How much must Carol deposit to accomplish her goal?arrow_forwardBrian would like to accumulate $130,000 for his retirement in 9 years. If he is promised a rate of 4.32% compounded semi-annually by his local bank, how much should he invest today? Round to the nearest centarrow_forwardIf David Jones wants to save for his child's college tuition in 20 years, how much money should he build into his tuition account at the end of each year in order to be able to withdraw 110,000/year for 4 years. Assuming a 4% interest rate before the child goes to college and a 5% interest rate after the child goes to college, calculate yearly contribution to David Jones.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education