FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

The following income statement was drawn from the records of Walton, a merchandising firm:

| WALTON COMPANY | |||

| Income Statement | |||

| For the Year Ended December 31 | |||

| Sales revenue (5,000 units × $166) | $ | 830,000 | |

| Cost of goods sold (5,000 units × $85) | (425,000 | ) | |

| Gross margin | 405,000 | ||

| Sales commissions (10% of sales) | (83,000 | ) | |

| Administrative salaries expense | (87,000 | ) | |

| Advertising expense | (33,000 | ) | |

| (45,000 | ) | ||

| Shipping and handling expenses (5,000 units × $1) | (5,000 | ) | |

| Net income | $ | 152,000 | |

Required

-

Reconstruct the income statement using the contribution margin format.

-

Calculate the magnitude of operating leverage.

-

Use the measure of operating leverage to determine the amount of net income Walton will earn if sales increase by 10 percent.

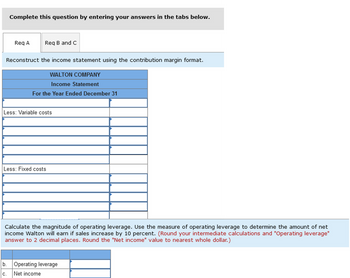

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Req A

Req B and C

Reconstruct the income statement using the contribution margin format.

WALTON COMPANY

Income Statement

For the Year Ended December 31

Less: Variable costs

C.

Less: Fixed costs

Calculate the magnitude of operating leverage. Use the measure of operating leverage to determine the amount of net

income Walton will earn if sales increase by 10 percent. (Round your intermediate calculations and "Operating leverage"

answer to 2 decimal places. Round the "Net income" value to nearest whole dollar.)

b. Operating leverage

Net income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Give me correct answer for this questionarrow_forward11. The following information is available for Bandera Manufacturing Company for the month ending January 31: Cost of goods manufactured $229,440 Selling expenses 76,640 Administrative expenses 40,520 Sales 488,160 Finished goods inventory, January 1 55,160 Finished goods inventory, January 31 50,280 For the month ended January 31, determine Bandera's (a) cost of goods sold, (b) gross profit, and (c) net income.arrow_forwardAt the end of January, Mineral Labs had an inventory of 855 units, which cost $8 per unit to produce. During February the company produced 1,300 units at a cost of $12 per unit. a. If the firm sold 1,650 units in February, what was the cost of goods sold? (Assume LIFO inventory accounting.) Cost of goods sold b. If the firm sold 1,650 units in February, what was the cost of goods sold? (Assume FIFO inventory accounting.) Cost of goods soldarrow_forward

- The following information is available for Bandera Manufacturing Company for the month ending January 31:Cost of goods manufactured $4,490,000Selling expenses 530,000Administrative expenses 340,000Sales 6,600,000Finished goods inventory, January 1 880,000Finished goods inventory, January 31 775,000For the month ended January 31, determine Bandera’s (a) cost of goods sold, (b) gross profit, and (c) net income.arrow_forwardCost of Goods Sold, Profit margin, and Net Income for a Manufacturing Company The following information is available for Bandera Manufacturing Company for the month ending January 31: Cost of goods manufactured $148,080 Selling expenses 49,470 Administrative expenses 26,150 Sales 315,070 Finished goods inventory, January 1 35,600 Finished goods inventory, January 31 32,450 For the month ended January 31, determine Bandera's (a) cost of goods sold, (b) gross profit, and (c) net income. (a) Bandera Manufacturing Company Cost of Goods Sold January 31 Sales $fill in the blank b71124ffbf90fa3_2 Gross profit fill in the blank b71124ffbf90fa3_4 $fill in the blank b71124ffbf90fa3_6 fill in the blank b71124ffbf90fa3_8 $fill in the blank b71124ffbf90fa3_10 (b) Bandera Manufacturing Company Gross Profit January 31 $fill in the blank abf993ffc04afc7_2 fill in the blank abf993ffc04afc7_4 $fill in the blank…arrow_forwardc. For the month ended January 31, determine Bandera Manufacturing's net income. Bandera Manufacturing Company Net Income January 31 Operating expenses: Total operating expenses Feedback Check My Work c. Gross profit minus operating expenses equals net income. Feedback Check My Work Incorrectarrow_forward

- J Coronado, Ltd. is a local coat retailer. The store’s accountant prepared the following income statement for the month ended January 31: Sales revenue $ 751,000 Cost of goods sold 585,780 Gross margin 165,220 Operating expenses Selling expense $ 24,430 Administrative expense 50,650 75,080 Net operating income $ 90,140 Coronado sells its coats for $250 each. Selling expenses consist of fixed costs plus a commission of $6.50 per coat. Administrative expenses consist of fixed costs plus a variable component equal to 5% of sales. (a) Prepare a contribution format income statement for January. (Round per unit cost to 2 decimal places, e.g. 52.75 and all other answers to 0 decimal places, e.g. 5,275.) Per Unit select an income statement item $enter a dollar…arrow_forwardA company had $270,000 in sales; $150,000 in goods available for sale; ending finished goods inventory of $30,000, and selling and administrative expenses of $65,000. Which of the following statements is true? 1. Net income was 28% of sales 2. The costs of goods sold was $137,000 3. The beginning finished goods inventory is not determinable. 4. The gross income was $93,000arrow_forwardThe income statement for the RUN-84979 company, an atletic shoe retailer, for the first quarter of the year is presented below: RUN-84979 Income Statement Sales $151,200 54,600 96,600 Cost of goods sold Gross margin Selling and administrative expenses Selling Administration $45,400 29,096 74,496 Net operating income $ 22,104 On average, an athletic shoe sells for $72. Variable selling expenses are $14 per athletic shoe, and the remaining selling expenses are fixed. The variable administrative expenses are 8% of sales with the remainder being fixed. How much is the total contribution margin for RUN-84979 for the first quarter?arrow_forward

- Cost of Goods Sold, Profit Margin, and Net Income for a Manufacturing Company The following information is available for Bandera Manufacturing Company for the month ending January 31: Cost of goods manufactured $4,490,000 Selling expenses 530,000 Administrative expenses 340,000 Sales 6,600,000 Finished goods inventory, January 1 880,000 Finished goods inventory, January 31 775,000 a. For the month ended January 31, determine Bandera Manufacturing’s cost of goods sold. Bandera Manufacturing CompanyCost of Goods SoldJanuary 31 $- Select - - Select - $- Select - - Select - $- Select - b. For the month ended January 31, determine Bandera Manufacturing’s gross profit. Bandera Manufacturing CompanyGross ProfitJanuary 31 $- Select - - Select - $- Select - c. For the month ended January 31, determine Bandera Manufacturing’s net income. Bandera Manufacturing CompanyNet IncomeJanuary 31…arrow_forwardKlum's Fashions sold merchandise for $45,000 cash during the month of July. Returns that month totaled $1,000. If the company's gross profit rate is 40%, Compute the following: a) Net sales revenue b) Cost of goods soldarrow_forwardThe income statement comparison for Forklift Material Handling shows the income statement for the current and prior year. FORKLIFT MATERIAL HANDLINGIncome statement Comparison Current Year Prior Year (Amounts in thousands) Sales $33,700 $24,750 Cost of goods sold 21,905 16,830 Gross profit $11,795 $7,920 Expenses: Wages $8,775 $6,189 Utilities 700 300 Repairs 169 325 Selling 505 300 Total Expenses $10,149 $7,114 Operating income ? ? Operating income % ? ? Total assets (investment base) $4,400 $1,400 Return on investment ? ? Residual income (8% cost of capital) ? ? A. Determine the operating income (loss) (dollars) for each year. If required round final answers to two decimal places. Current Year Prior Year Operating income (loss) $fill in the blank 1 $fill in the blank 2 B. Determine the operating income (loss) (percentage) for each year. If required round final answers to two…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education