FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

please answer within the format by providing formula the detailed working

Please provide answer in text (Without image)

Please provide answer in text (Without image)

Please provide answer in text (Without image)

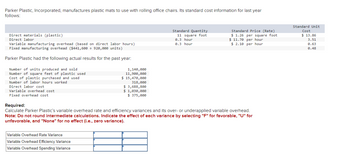

Transcribed Image Text:Parker Plastic, Incorporated, manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year

follows:

Direct materials (plastic)

Direct labor

Variable manufacturing overhead (based on direct labor hours)

Fixed manufacturing overhead ($441,600 + 920,000 units)

Parker Plastic had the following actual results for the past year:

Number of units produced and sold

Number of square feet of plastic used

Cost of plastic purchased and used

Number of labor hours worked

Direct labor cost

Variable overhead cost

Fixed overhead cost

1,140,000

11,900,000

$ 15,470,000

Variable Overhead Rate Variance

Variable Overhead Efficiency Variance

Variable Overhead Spending Variance

318,000

$3,688,800

$ 1,030,000

$ 375,000

Standard Quantity

11 square foot

0.3 hour

0.3 hour

Standard Price (Rate)

$ 1.26 per square foot

$11.70 per hour

$ 2.10 per hour

Required:

Calculate Parker Plastic's variable overhead rate and efficiency variances and its over- or underapplied variable overhead.

Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, "U" for

unfavorable, and "None" for no effect (i.e., zero variance).

Standard Unit

Cost

$ 13.86

3.51

0.63

0.48

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Will you please provide the formulas (explanation) to understand the results or numbers that were added in the solution?arrow_forwardWhat information is provided by this statement? Describe the steps to create the statement - choose either the direct or indirect method in your response.arrow_forwardPlease provide the introductory part and answer for question D.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education