FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

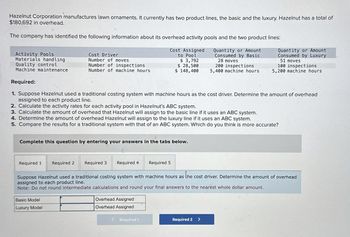

Transcribed Image Text:Hazelnut Corporation manufactures lawn ornaments. It currently has two product lines, the basic and the luxury. Hazelnut has a total of

$180,692 in overhead.

The company has identified the following information about its overhead activity pools and the two product lines:

Activity Pools

Materials handling

Quality control

Machine maintenance

Cost Driver

Cost Assigned

to Pool

Number of moves

Number of inspections

Number of machine hours

$ 3,792

$ 28,500

$ 148,400

Quantity or Amount

Consumed by Basic

28 moves

200 inspections

5,400 machine hours

Quantity or Amount

Consumed by Luxury

51 moves

100 inspections

5,200 machine hours

Required:

1. Suppose Hazelnut used a traditional costing system with machine hours as the cost driver. Determine the amount of overhead

assigned to each product line.

2. Calculate the activity rates for each activity pool in Hazelnut's ABC system.

3. Calculate the amount of overhead that Hazelnut will assign to the basic line if it uses an ABC system.

4. Determine the amount of overhead Hazelnut will assign to the luxury line if it uses an ABC system.

5. Compare the results for a traditional system with that of an ABC system. Which do you think is more accurate?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3 Required 4

Required 5

Suppose Hazelnut used a traditional costing system with machine hours as the cost driver. Determine the amount of overhead

assigned to each product line.

Note: Do not round intermediate calculations and round your final answers to the nearest whole dollar amount.

Basic Model

Luxury Model

Overhead Assigned

Overhead Assigned

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- go.2arrow_forwardHazelnut Corporation manufactures lawn ornaments. It currently has two product lines, the basic and the luxury. Hazelnut has a total of $143,484 in overhead. The company has identified the following information about its overhead activity pools and the two product lines: Quantity or Amount Consumed by Basic Activity Pools Materials handling Quality control Machine maintenance Cost Driver Number of moves Number of inspections Number of machine hours Required 1 Complete this question by entering your answers in the tabs below. Basic Model Luxury Model Required 2 Required 3 Required 4 Required: 1. Suppose Hazelnut used a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. 2. Calculate the activity rates for each activity pool in Hazelnut's ABC system. 3. Calculate the amount of overhead that Hazelnut will assign to the basic line if it uses an ABC system. 4. Determine the amount of overhead Hazelnut will assign…arrow_forwardRamapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below. Number of Direct Labor Hours Machine Hours Product Units Per Unit Per Unit Blinks 963 5 7 4 Dinks 1,983 4 8 All of the machine hours take place in the Fabrication department, which has an estimated overhead of $81,600. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $107,600. Ramapo Company uses a single plantwide overhead rate to apply all factory overhead costs based on direct labor hours. The factory overhead allocated per unit of Blinks is O a. $59.37 Ob. $538.03 Oc. $74.20 Od. $14.50arrow_forward

- Ramapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below. Number of Direct Labor Hours Machine Hours Product Units Per Unit Per Unit Blinks 972 4 4 Dinks 1,877 3 9 All of the machine hours take place in the Fabrication department, which has an estimated overhead of $114,400. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $94,200. Ramapo Company uses a single plantwide overhead rate to apply all factory overhead costs based on direct labor hours. The factory overhead allocated per unit of Blink is Oa. S10.75 Оb. 565.74 Oc. S87.64 Od. $376.85arrow_forwardRamapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are as follows: Number of Direct Labor Hours Machine Hours Per Unit Per Unit Product Units Blinks 916 Dinks 2,222 1 5 7 7 All of the machine hours take place in the Fabrication department, which has an estimated overhead of $87,300. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $89,600. a. $60.91 b. $73.55 c. $14.71 d. $89.61 Ramapo Company uses a single plantwide overhead rate (rounded to the nearest cent) to apply all factory overhead costs based on direct labor hours. The factory overhead allocated per unit of Blinks isarrow_forwardTemple Lights, Inc. produces Hanukkah menorahs in its Cutting and Molding departments. The Maintenance and Security departments support the production of the menorahs. Costs from the Maintenance Department are allocated based on machine hours, and costs from the Security Department are allocated based on asset value. Information about each department is provided in the following table: Maintenance Department Production departments' total costs Feedback Security Department 2,000 Machine hours 800 Asset value $1,390 $2,000 $37,440 Department cost $16,640 Determine the total cost of each production department after allocating all support department costs to the production departments using the reciprocal services method. Cutting Department 7,200 $2,500 $64,000 Cutting Molding Department Department X Molding Department 10,800 $5.500 $81,000 Check My Work The reciprocal services method considers all inter-support-department service, and thus is the most accurate of the three support…arrow_forward

- Ramapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below. Product Number ofUnits Direct Labor HoursPer Unit Machine HoursPer Unit Blinks 984 2 7 Dinks 2,096 8 7 All of the machine hours take place in the Fabrication department, which has an estimated overhead of $107,300. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $85,100. Ramapo Company uses a single plantwide overhead rate to apply all factory overhead costs based on direct labor hours. The factory overhead allocated per unit of Blinks isarrow_forwardMartay Creations produces winter scarves. The scarves are produced in the Cutting and Sewing departments. The Maintenance and Security departments support these production departments, and allocate costs based on machine hours and square feet, respectively. Information about each department is provided in the following table: Department Total Cost Number of Employees Machine Hours Square Feet Maintenance Department $2,200 5 40 600 Security Department 4,500 3 0 500 Cutting Department 21,200 21 3,600 2,400 Sewing Department 24,900 19 5,400 3,000 Using the sequential method and allocating the support department with the highest costs first, allocate all support department costs to the production departments. Then compute the total cost of each production department. Line Item Description CuttingDepartment SewingDepartment…arrow_forwardAltex Inc. manufactures two products: car wheels and truck wheels. To determine the amount of overhead to assign to each product line, the controller, Robert Hermann, has developed the following information. Estimated wheels produced Direct labor hours per wheel (al) Your answer is correct. Overhead rate $ eTextbook and Media (a2) Total estimated overhead costs for the two product lines are $752,600. Car Car wheels 41,000 Calculate overhead rate. (Round answer to 2 decimal places, eg 12.25) $ 1 Truck wheels $ Truck 10,000 3 Compute the overhead cost assigned to the car wheels and truck wheels, assuming that direct labor hours is used to allocate overhead costs. 10.60 per direct labor hour Attempts: 1 of 5 usedarrow_forward

- A-6arrow_forwardRedfern Audio produces audio equipment including headphones. At the Campus Facility, it produces two wireless models, Standard and Enhanced, which differ both in the materials and components used and in the labor skill required. Data for the Campus Plant for the third quarter follow. Units produced Machine-hours Direct labor-hours Direct materials costs Direct labor costs Manufacturing overhead Total costs Standard 29,700 17,820 22,275 $ 594,000 356,400 Predetermined overhead rate Enhanced 9,900 11,880 22,275 $ 891,000 757,350 Total Required: Compute the predetermined overhead rate assuming that Redfern Audio uses direct labor costs to allocate overhead costs. Note: Round your answer to 2 decimal places. % of direct labor cost 39,600 29,700 44,550 $ 1,485,000 1,113,750 730, 620 $ 3,329,370arrow_forwardRamapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below. Product Number ofUnits Direct Labor HoursPer Unit Machine HoursPer Unit Blinks 1,107 5 8 Dinks 1,916 6 5 All of the machine hours take place in the Fabrication department, which has an estimated overhead of $104,200. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $76,800. Ramapo Company uses a single plantwide overhead rate to apply all factory overhead costs based on direct labor hours. The factory overhead allocated per unit of Blinks is a.$384.03 b.$63.77 c.$14.45 d.$53.15arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education