FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

At December 31, 20X7, what is the estimated cost of missing inventory?

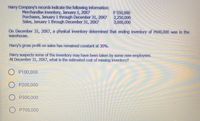

Transcribed Image Text:Harry Company's records indicate the following information:

Merchandise inventory, January 1, 20X7

Purchases, January 1 through December 31, 20X7 2,250,000

Sales, January i through December 31, 20X7

P 550,000

3,000,000

On December 31, 20X7, a physical inventory determined that ending inventory of P600,000 was in the

warehouse.

Harry's gross profit on sales has remained constant at 30%.

Harry suspects some of the inventory may have been taken by some new employees.

At December 31, 20X7, what is the estimated cost of missing inventory?

O P100,000

O P200,000

O P300,000

O P700,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Oriole Company's record of transactions concerning part WA6 for the month of September was as follows. Purchases September 1 (balance on hand) 3 (a1) نا 12 292 2 16 300 200 @ 300 @ 300 @ 500 @ 300 @ $13.00 Average-cost per unit $ @ 13.10 13.25 13.30 13.30 13.40 Sales September 4 17 27 30 400 600 300 200 Calculate average-cost per unit. Assume that perpetual inventory records are kept in units only. (Round answer to 2 decimal places, eg. 2.76.)arrow_forward26. The following data refer to Issue Company’s ending inventory: Item code Quantity Unit Cost Unit Market Small 100 $56 $59 Medium 420 38 44 Large 600 44 42 Extra-Large 220 64 67 How much is the inventory if the lower of cost or market rule is applied to each item of inventory?arrow_forwardIf beginning inventory is understated by $11800, the effect of this error in the current period is Cost of Goods Sold Net Income Net Income overstated understated understated overstated understated understated overstated overstatedarrow_forward

- If the ending inventory is overstated in the current year: Net income will be understated in the current year. Next year's beginning inventory will also be overstated. Next year's net income will be overstated. Next year's beginning inventory will be understated.arrow_forwardfast urgent.arrow_forwardRefer to the photoarrow_forward

- Applying the lower-of-cost-or-market method to each item of inventory, what should the total inventory value be for the following items? Total Cost Total Market Inventory Item Quantity Cost per Unit Market Value Total per Unit Price Price LCM A 181 $12 $17 $2,172 $3,077 $ B 91 18 16 1,638 1,456 C 70 10 22 25 1,540 1,750 Previous Nextarrow_forwardIvanhoe Inc. has the following information related to an item in its ending inventory. Packit (Product # 874) has a cost of $93, a replacement cost of $81, a net realizable value of $87, and a normal profit margin of $5. What is the final lower-of-cost-or-market inventory value for Packit? $82. $87. $93. $81.arrow_forwardHow many units must be in ending inventory if beginning inventory was 16,924 units, 31,777 units were started, and 34,076 units were completed and transferred out?arrow_forward

- Given the following: Numberpurchased Costper unit Total January 1 inventory 32 $ 4 $ 128 April 1 52 6 312 June 1 42 7 294 November 1 47 8 376 173 $ 1,110 a. Calculate the cost of ending inventory using the FIFO (ending inventory shows 53 units). b. Calculate the cost of goods sold using the FIFO (ending inventory shows 53 units).arrow_forwardAn error in the physical count of goods on hand at the end of a period resulted in a $18,000 overstatement of the ending inventory. The effect of this error in the current period is Cost of Goods Sold Net Income Understated Overstated Understated Understated Overstated Overstated Overstated Understatedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education