Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

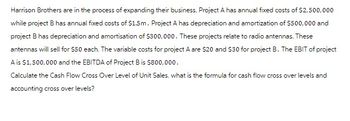

Transcribed Image Text:Harrison Brothers are in the process of expanding their business. Project A has annual fixed costs of $2,500,000

while project B has annual fixed costs of $1.5m. Project A has depreciation and amortization of $500,000 and

project B has depreciation and amortisation of $300,000. These projects relate to radio antennas. These

antennas will sell for $50 each. The variable costs for project A are $20 and $30 for project B. The EBIT of project

A is $1,500,000 and the EBITDA of Project B is $800,000.

Calculate the Cash Flow Cross Over Level of Unit Sales. what is the formula for cash flow cross over levels and

accounting cross over levels?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- McSwing Inc. has decided to sell a new line of golf clubs. They will sell for $925 per set and have a variable cost of $480 per set. The company has determined that they will sell 75,000 units per year for the next 5 years. The fixed cost each year will be $14 million dollars. The company has to spend $1 million dollars on R&D for the club as a one time expense. The plant and equipment required will cost $50 million and will depreciate straight line to zero over five years. The expected salvage value of the plant and equipment is $3 million dollars. The new clubs will require an increase in net working capital of $3.5 million. The tax rate is 23% and the cost of capital is 14%. Calculate NPV. Based on this information, will you do the project?arrow_forwardYou are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice. You estimate the sales price of The Farstroke to be $490 per unit and sales volume to be 1,200 units in year 1; 1,125 units in year 2; and 1,000 units in year 3. The project has a 3-year life. Variable costs amount to $270 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $138,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $26,000. NWC requirements at the beginning of each year will be approximately 30 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 11 percent. What is the operating cash flow for the project in year 2? Note: Enter your answer as a whole number. Operating cash flowarrow_forwardVandelay Industries is considering the purchase of a new machine for the production of latex. Machine A costs $ 3,210,000 and will last for six years. Variable costs are 37 percent of sales, and fixed costs are $350,000 per year. Machine B costs $5,455,000 and will last for nine years. Variable costs for this machine are 32 percent of sales and fixed costs are $240,000 per year. The sales for each machine will be $12.4 million per year. The required return is 9 percent, and the tax rate is 24 percent. Both machines will be depreciated on a straight-line basis. The company plans to replace the machine when it wears out on a perpetual basis. Calculate the EAC for each machine.arrow_forward

- You are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice. You estimate the sales price of The Farstroke to be $400 per unit and sales volume to be 1,000 units in year 1; 1,500 units in year 2; and 1,325 units in year 3. The project has a 3-year life. Variable costs amount to $225 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $165,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $35,000. NWC requirements at the beginning of each year will be approximately 20 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 10 percent. What change in NWC occurs at the end of year 1?arrow_forwardYou are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice. You estimate the sales price of The Farstroke to be $450 per unit and sales volume to be 1,200 units in year 1; 1,325 units in year 2; and 1,000 units in year 3. The project has a 3-year life. Variable costs amount to $250 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $150,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $30,000. NWC requirements at the beginning of each year will be approximately 20 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 10 percent. What is the operating cash flow for the project in year 2? Note: Enter your answer as a whole number. Operating cash flowarrow_forwardYou are evaluating a product for your company. You estimate the sales price of product to be $150 per unit and sales volume to be 10,500 units in year 1; 25,500 units in year 2; and 5,500 units in year 3. The project has a 3 year life. Variable costs amount to $75 per unit and fixed costs are $205,000 per year. The project requires an initial investment of $339,000 in assets which will be depreciated straight-line to zero over the 3 year project life. The actual market value of these assets at the end of year 3 is expected to be $45,000. NWC requirements at the beginning of each year will be approximately 15% of the projected sales during the coming year. The tax rate is 21% and the required return on the project is 12%. What will the year 2 free cash flow for this project be?arrow_forward

- Atlantic Manufacturing is considering a new investment project that will last for four years. The delivered and installed cost of the machine needed for the project is $23,957 and it will be depreciated according to the three-year MACRS schedule. The project also requires an initial increase in net working capital of $300. Financial projections for sales and costs are in the table below. In addition, since sales are expected to fluctuate, NWC requirements will also fluctuate. The end-of- year NWC requirements are included below (hint: these NWC capital requirements DO NOT represent the change in NWC for the period). The $0 requirement for NWC at the end of year 4 means that all NWC is recovered by the end of the project. The corporate tax rate is 35% and the required return on the project is 12%. Year 1 2 3 4 Sales $11,653 $12,746 $13,973 $10,638 Costs 2,322 2,536 3,456 1,434 NWC 324 352 231 0 Requirements What is the project's NPV? (Round answer to O decimal places. Do not round…arrow_forwardFirm Z has invested $4 million in marketing campaign to assess the demand for the product Minish. This product will be in the market next year and will last five years. Revenues are projected to be $50 million per year along with expenses of $20 million. The firm spends $15 million immediately on equipment that will be depreciated using MACRS depreciation to zero. Additionally, it will use some fully depreciated existing equipment that has a market value of $4 million. Finally, Minish will have no incremental cash or inventory requirements (products will be shipped directly from the contract manufacturer to customers). But, receivables are expected to account for 15% of annual sales. Payables are expected to be 15% of the annual cost of goods sold (COGS) between year 1 and year 4. All accounts payables and receivables will be settled at the end of year 5. Based on this information and WACC in the first part of the question, find the NPV of the project. Identify the IRR of the…arrow_forwardYou are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice. You estimate the sales price of The Farstroke to be $490 per unit and sales volume to be 1,200 units in year 1; 1,125 units in year 2; and 1,000 units In year 3. The project has a 3-year life. Variable costs amount to $270 per unit and fixed costs are $100,000 per year. The project requires an initial Investment of $138,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $26,000. NWC requirements at the beginning of each year will be approximately 30 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 11 percent. What change in NWC occurs at the end of year 1? (Enter a decrease as a negative amount using a minus sign.) Decrease ofarrow_forward

- Oahu Inc. is considering an investment in new equipment that will be used to manufacture a smartphone. The phone is expected to generate additional annual sales of 5,100 units at $276 per unit. The equipment has a cost of $521,700, residual value of $39,300, and an 8-year life. The equipment can only be used to manufacture the phone. The cost to manufacture the phone follows: Line Item Description Amount Cost per unit: Direct labor $47.00 Direct materials 182.00 Factory overhead (including depreciation) 31.60 Total cost per unit $260.60 Determine the average rate of return on the equipment. If required, round to the nearest whole percent.arrow_forwardUse the following base case information to evaluate the project: PT Kolam Makara has a project costs $900,000, has a five-year life, and has a salvage value of $130,000. Depreciation is straight-line to zero. The required return is 14% and tax rate is 34%. Sales are projected at 2350 units per year. Price per unit is $400. Variable cost per unit is $200 and fixed costs are $150,000 per year. It is known that the depreciation expense is $180,000 per year. The engineering department estimates you will need an initial net working capital investment of $50,000. What is the sensitivity of OCF to changes in the variable cost figure at base case?arrow_forwardYou are evaluating two different silicon wafer milling machines. The Techron I costs $267,000, has a three-year life, and has pretax operating costs of $72,000 per year. The Techron II costs $465,000, has a five-year life, and has pretax operating costs of $45,000 per year. For both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $49,000. If your tax rate is 23 percent and your discount rate is 13 percent, compute the EAC for both machinesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education