FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

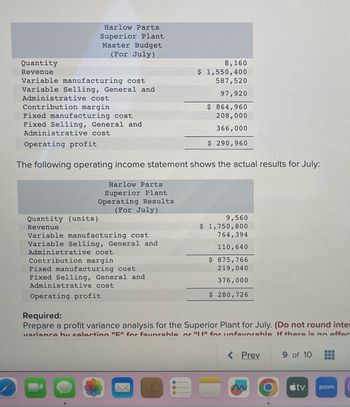

Transcribed Image Text:Harlow Parts

Superior Plant

Master Budget

(For July)

Quantity

Revenue

Variable manufacturing cost

Variable Selling, General and

Administrative cost

Contribution margin

Fixed manufacturing cost

Fixed Selling, General and

Administrative cost

Operating profit

The following operating income statement shows the actual results for July:

Harlow Parts

Superior Plant

Operating Results

(For July)

Quantity (units)

Revenue

Variable manufacturing cost

Variable Selling, General and

Administrative cost

Contribution margin

8,160

$ 1,550,400

587,520

97,920

$ 864,960

208,000

366,000

$ 290,960

Fixed manufacturing cost

Fixed Selling, General and

Administrative cost

Operating profit

9,560

$ 1,750,800

764,394

110,640

$ 875,766

219,040

376,000

$ 280,726

Required:

Prepare a profit variance analysis for the Superior Plant for July. (Do not round inter

variance hy selecting "F" for favorable or "II" for unfavorahle If there is no affar

< Prev

9 of 10

tv

‒‒‒

T

zoom

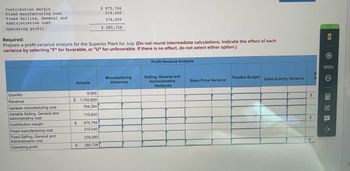

Transcribed Image Text:Contribution margin.

Fixed manufacturing cost

Fixed Selling, General and

Administrative cost

Operating profit

Required:

Prepare a profit variance analysis for the Superior Plant for July. (Do not round intermediate calculations. Indicate the effect of each

variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.)

Quantity

Revenue

Variable manufacturing cost

Variable Selling, General and

Administrative cost

Contribution margin

Fixed manufacturing cost

Fixed Selling, General and

Administrative cost

Operating profit

Actuals

9,560

$1,750,800

764,394

110,640

875,766

219,040

$

$

$ 875,766

219,040

376,000

$ 280,726

376,000

280,726

Manufacturing

Variances

Profit Variance Analysis

Selling, General and

Administrative

Variances

Sales Price Variance

Flexible Budget Sales Activity Variance

$

$

M

B

:::

(+

100%

e

NI+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardQuestion Content Area Pinnacle Corp. budgeted $265,170 of overhead cost for the current year. Actual overhead costs for the year were $245,850. Pinnacle's plantwide allocation base, machine hours, was budgeted at 49,430 hours. Actual machine hours were 49,970. A total of 104,380 units was budgeted to be produced and 98,000 units were actually produced. Pinnacle's plantwide factory overhead rate for the current year is: a.$2.36 per machine hour b.$2.54 per machine hour c.$4.97 per machine hour d.$5.36 per machine hourarrow_forwardPlease do not give solution in image format thankuarrow_forward

- Quantity 9,900 Revenue $ 1,615,000 Variable manufacturing cost 947,925 Variable Selling, General and Administrative cost 99,800 Contribution margin $ 567,275 Fixed manufacturing cost 237,600 Fixed Selling, General and Administrative cost 122,000 Operating profit $ 207,675 The following operating income statement shows the actual results for July: Harlow Parts Superior Plant Operating Results (For July) Quantity (units) 11,300 Revenue $ 1,748,800 Variable manufacturing cost 1,157,572 Variable Selling, General and Administrative cost 112,840 Contribution margin $ 478,388 Fixed manufacturing cost 244,080 Fixed Selling, General and Administrative cost 168,000 Operating profit $ 66,308 Variable overhead is applied on the basis of machine-hours. The standard cost sheet follows: Standard production costs Direct materials 5.00 kilo grams @ $ 6.95 $ 34.750 Direct labor 0.50 direct labor-hours @ 39.50 19.750 Variable overhead…arrow_forwardPlease do not give solution in image format and show calculation thankuarrow_forwardSubject: accountingarrow_forward

- A report for a company's Assembly Department for the month of March follows: Assembly Department Cost Report For the Month Ended March 31 Machine-hours Variable costs: Supplies Scrap Indirect materials Fixed costs: Wages and salaries Equipment depreciation Total cost Actual Results 15,000 Master Budget Variances 20,000 $ 10,800 39,200 $ 11,400 42,000 $ 600 F 2,800 F 111,800 133,500 21,700 F 83,500 108,000 78,000 108,000 5,500 U 0 $ 353,300 $ 372,900 $ 19,600 F Required: Prepare a flexible budget performance report for the month of March.arrow_forwardPlease do not give solution in image format thankuarrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education