FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

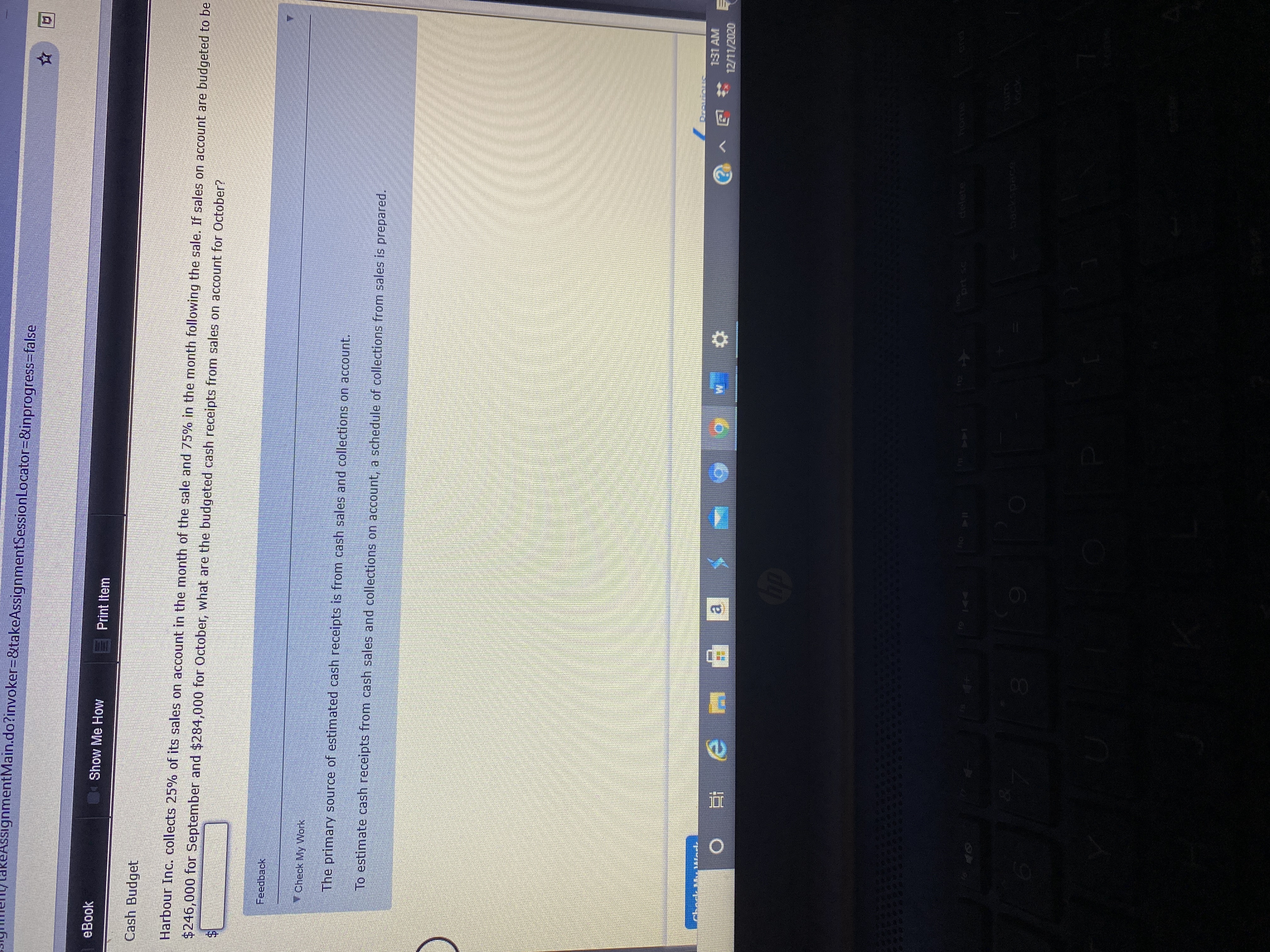

If sales on account are budgeted to be $246,000 for September and $284,000 for October, what are the budgeted cash receipts from sales on account for October?

Transcribed Image Text:Harbour Inc. collects 25% of its sales on account in the month of the sale and 75% in the month following the sale. If sales on account are budgeted to be

$246,000 for September and $284,000 for October, what are the budgeted cash receipts from sales on account for October?

Feedback

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following information to prepare the September cash budget for PTO Company. Ignore the "Loan activity" section of the budget. a. Beginning cash balance, September 1, $44,000. b. Budgeted cash receipts from September sales, $261,000. c. Direct materials are purchased on credit. Purchase amounts are August (actual), $78,000; and September (budgeted), $106,000. Payments for direct materials follow: 65% in the month of purchase and 35% in the first month after purchase. d. Budgeted cash payments for direct labor in September, $34,000. e. Budgeted depreciation expense for September, $3,300. f. Budgeted cash payment for dividends in September, $54,000. g. Budgeted cash payment for income taxes in September, $10,200. h. Budgeted cash payment for loan interest in September, $1,200. PTO COMPANY Cash Budget September Beginning cash balance Total cash available 0 Total cash payments 0 Ending cash balance $ 0arrow_forwardCompany L charges all operating expenses to credit. They pay 70% of their accounts payable in the month following the expense, and 30% two months following the expense. Expenses (all paid for on credit) for the last three months have been provided below: August: $80,000 September: $120,000 October: $94,000 What is the budgeted cash outflow for October?arrow_forward31arrow_forward

- Big Wheel, Inc. collects 25% of its sales on account in the month of the sale and 75% in the month following the sale. Sales on account are budgeted to be $20,800 for March and $65,700 for April. What are the budgeted cash receipts from sales on account for April?arrow_forwardDaybook Inc. collects 30% of its sales on account in the month of the sale and 70% in the month following the sale. If sales on account are budgeted to be $105,000 for September and $116,000 for October, what are the budgeted cash receipts from sales on account for October?$fill in the blank 1arrow_forwardUsing the same above information, what would it look like to complete the following? Schedule of cash payments for direct materials.Cash budget.Budgeted income statement for entire second quarter (not monthly).arrow_forward

- I ne Tollowing information is available from various budgets for the current period: Account Cash Accounts Receivable Merchandise Inventory Insurance Expense (expense incurred during the period) Equipment Depreciation Expense - Equipment (expense incurred during the period) Budget Cash budget Amount $20,000 Schedule of cash receipts from customers 38,000 Inventory, purchases, and cost of goods sold budget 47,000 Selling and administrative expense budget 2,000 Capital expenditures budget 31,000 Selling and administrative expense budget 1,000 The following balances are available from the balance sheet at the end of the previous year: Prepaid Insurance Equipment Accumulated Depreciation Equipment $6,000 22,000 1,000 What would be the amount of total assets on the budgeted balance sheet?arrow_forwardMcMichael Inc. collects 90% of its sales on account in the month of the sale and 10% in the month following the sale. If sales on account are budgeted to be $495,000 for September and $431,000 for October, what are the budgeted cash receipts from sales on account for October?$arrow_forwardWhat about preparing a schedule of expected cash disbursement for merchandise purchases, by month and the total and budgeted income statement for the three-month period ending June 30.arrow_forward

- The following information is available from various budgets for the current period: Amount Budget Cash budget Account Cash Accounts Receivable Prepaid Insurance Equipment Accumulated Depreciation - Equipment Schedule of cash receipts from customers Inventory, purchases, and cost of goods sold budget Selling and administrative expense budget Capital expenditures budget OA. $173,000 OB. $164,000 OC. $159,000 O D. $162,000 $28,000 Merchandise Inventory Insurance Expense (expense incurred during the period) Equipment Depreciation Expense Equipment (expense incurred during the period) Selling and administrative expense budget 2,000 The following balances are available from the balance sheet at the end of the previous year: $5,000 28,000 7,000 What would be the amount of total assets on the budgeted balance sheet? 35,000 41,000 2,000 36,000arrow_forwardLB Enterprises (LB) is preparing its budget for the first quarter of 2019. LB's balance sheet as of December 31, 2018 is as follows: Assets Liabilities Cash $5,000 Accounts Payable $9500 Accounts Recievable 28,000 Inventories Direct Materials 8,100 Finished Goods (500 Units) 16,870 Stockholders Equity Equipment - gross 45,000 Accumulated depreciation 15.000 Common Stock $15,000 Net Equipment 30,000 Retained Earnings 63,470 Total Assets $87,970 Total Liabilities and $87,960 Equity LB sells one product for $45/unit. The Company forecasts that it will sell 2,000; 1,500; 1,600; and 1,700 units in January, February, March and April, respectively. • Sales to customers are all on credit. 40% of the cash for these sales is collected in the month of the sale and the remaining 60% is collected in the following month. LB wants finished goods inventory equal to 25% of the next month's sales on hand at the end of each month. LB wants direct materials equal to 75% of the current month's production…arrow_forwardnot graded... please help Prepare Cash Budget from Budgeted Transactions Prepare a cash budget for the month ended May 31, 2019. Campton Company anticipates a cash balance of $74,000 on May 1, 2019. The following budgeted transactions for May 2019 present data related to anticipated cash receipts and cash disbursements: 1. For May, budgeted cash sales are $50,000 and budgeted credit sales are $490,000. (Credit sales for April were $450,000.) In the month of sale, 40% of credit sales are collected, with the balance collected in the month following sale. 2. Budgeted merchandise purchases for May are $270,000. (Merchandise purchases in April were $240,000.) In the month of purchase, 70% of merchandise purchases are paid for, and the balance is paid for in the following month. 3. Budgeted cash disbursements for salaries and operating expenses for May total $155,000. 4. During May, $25,000 of principal repayment and $4,000 of interest payment are due to the bank. 5. A $20,000 income…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education