Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

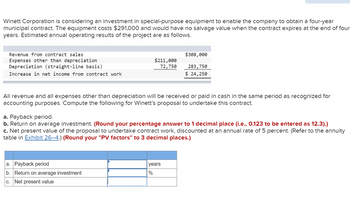

Transcribed Image Text:Winett Corporation is considering an investment in special-purpose equipment to enable the company to obtain a four-year

municipal contract. The equipment costs $291,000 and would have no salvage value when the contract expires at the end of four

years. Estimated annual operating results of the project are as follows.

Revenue from contract sales

Expenses other than depreciation

Depreciation (straight-line basis)

Increase in net income from contract work

$211,000

72,750

All revenue and all expenses other than depreciation will be received or paid in cash in the same period as recognized for

accounting purposes. Compute the following for Winett's proposal to undertake this contract.

a. Payback period

b. Return on average investment

c. Net present value

$308,000

283,750

$ 24,250

a. Payback period.

b. Return on average investment. (Round your percentage answer to 1 decimal place (i.e., 0.123 to be entered as 12.3).)

c. Net present value of the proposal to undertake contract work, discounted at an annual rate of 5 percent. (Refer to the annuity

table in Exhibit 26-4.) (Round your "PV factors" to 3 decimal places.)

years

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Which proposal should the company accept? Why?arrow_forwardA division is considering the acquisition of a new asset that will cost $2,960,000 and have a cash flow of $790,000 per year for each of the four years of its life. Depreciation is computed on a straight-line basis with no salvage value. Ignore taxes. Required: a. & b. What is the ROI for each year of the asset's life if the division uses beginning-of-year asset balances and net book value for the computation? What is the residual income each year if the cost of capital is 8 percent? (Enter "ROI" answers as a percentage rounded to 1 decimal place (i.e., 32.1). Negative amounts should be indicated by a minus sign.) Year Investment Base ROI Residual Income 1 $2,960,000 % 2 % 3 % 4 %arrow_forwardHarbor Division has total assets (net of accumulated depreciation) of $542,000 at the beginning of year 1. Harbor also leases a machine for $23,000 annually. Expected divisional income in year 1 is $81,000 including $5,500 in income generated by the leased machine (after the lease payment). Harbor’s cost of capital is 10 percent. Harbor can cancel the lease on the machine without penalty at any time and is considering disposing of it today (the beginning of year 1). Required: a. Harbor computes ROI using beginning-of-the-year net assets. What will the divisional ROI be for year 1 assuming Harbor retains the leased machine? (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).) b. What would divisional ROI be for year 1 assuming Harbor disposes of the leased machine? (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).) c. Harbor computes residual income using beginning-of-the-year net assets. What will the divisional residual income be for…arrow_forward

- A company is considering a 3-year project with an initial cost of $876,000. The project will not directly produce any sales but will reduce operating costs by $195,000 a year. The equipment is classified as MACRS 7-year property. The MACRS table values are .1429, .2449, .1749, .1249, .0893, .0892, .0893, and .0446 for Years 1 to 8, respectively. At the end of the project, the equipment will be sold for an estimated $410,000. The tax rate is 25 percent and the required return is 10 percent. An extra $42,000 of inventory will be required for the life of the project. What is the total cash flow for Year 3? $638,821.80 $629,821.80 $620,821.80 $611,821.80 $602,821.80arrow_forwardThe Market Company won a contract to build a shopping center at a price of $300 million. The following schedule details the estimated and actual costs of construction each year as well as the total estimated cost. What amount of revenue will be recognized in Yr. 1 using the percentage completion method? Yr 1 $40,000,000 Yr. 2 $60,000,000 Yr. 3 $70,000,000 Yr. 4 $30,000,000 Total $200,000,000 Select one: a. $60,000,000 b. $50,000,000 c. $0 d. $40,000,000 e. $300,000,000arrow_forwardA construction company is considering the proposed acquisition of a newearthmover. The purchase price is $100,000, and an additional $25,000 is required to modify the equipment for special use by the company. The equipment falls into the MACRS five-year classification (tax life). and it will be sold after five year. (project life) for $50,000. Purchase of the earthmover will have no effect on revenues. but it is expected 10 save the firm $60,000 per year in before-tax operating costs-mainly labor.The firm's marginal tax rate is 40%. Assume that the initial investment is to be financed. by a bank loan at an intrest rate of 10% payable annually. Determine that after-tax cash flow and the worth of investment for this project if the firm's MARR is known to be 12°o.arrow_forward

- Information for two alternative projects involving machinery investments follows. Project 1 requires an initial investment of $229,500. Project 2 requires an initial investment of $156,000. Annual Amounts Project 1 Project 2 Sales of new product $ 148,000 $ 128,000 Expenses Materials, labor, and overhead (except depreciation) 77,000 44,000 Depreciation—Machinery 32,000 30,000 Selling, general, and administrative expenses 20,000 32,000 Income $ 19,000 $ 22,000 (a) Compute each project’s annual net cash flow.(b) Compute payback period for each investment.arrow_forwardRequired information [The following information applies to the questions displayed below.] Cardinal Company is considering a five-year project that would require a $2,975,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out- of-pocket costs Depreciation Total fixed expenses Net operating income $ 735,000 595,000 $ 2,735,000 1,000,000 1,735,000 1,330,000 $ 405,000 Click here to view Exhibit 148-1 and Exhibit 148-2. to determine the appropriate discount factor(s) using table. O Higher O Lower O Same 10. If the equipment had a salvage value of $300,000 at the end of five years, would you expect the project's payback period to be higher, lower, or the same?arrow_forwardRequired information [The following information applies to the questions displayed below.] Cardinal Company is considering a five-year project that would require a $2,810,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 16%. The project would provide net operating income in each of five years as follows: Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses Net operating income $782,000 562,000 Simple rate of return $2,847,000 1,121,000 1,726,000 Click here to view Exhibit 128-1 and Exhibit 128-2, to determine the appropriate discount factor(s) using table. % 1,344,000 $ 382,000 15. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio. which actually turned out to be 45%. What was the project's actual simple rate of return? (Round your answer to 2…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education