FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

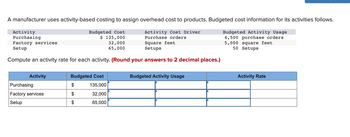

Transcribed Image Text:A manufacturer uses activity-based costing to assign overhead cost to products. Budgeted cost information for its activities follows.

Budgeted Cost

$ 135,000

Activity Cost Driver

Purchase orders

Budgeted Activity Usage

4,500 purchase orders

5,000 square feet

50 Setups

32,000

65,000

Activity

Purchasing

Factory services

Setup

Square feet

Setups

Compute an activity rate for each activity. (Round your answers to 2 decimal places.)

Activity

Purchasing

Factory services

Setup

Budgeted Cost

135,000

32,000

65,000

$

$

Budgeted Activity Usage

Activity Rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company uses activity-based costing to determine the costs of its three products: A, B, and C. The budgeted cost and activity for each of the company's three activity cost pools are shown in the following table: Budgeted Activity Activity Cost PoolBudgeted Cost Product AProduct BProduct Activity 1 7,500 10,500 21,500 Activity 2 8,500 16,500 9,500 Activity 3 4,000 2,500 3,125 How much overhead will be assigned to Product B using activity-based costing? 85,000 60,000 112,000arrow_forwardAssume a company's activity-based costing system Includes three activitles with the following activity rates: Activity Cost Pool Activity Rate $ 2 per mile driven $ 50 per delivery $ 22 per phone call Travel Deliveries Customer service Two of the company's many customers Include Customer A and Customer B. These two customers consumed the company's activitles as follows: Total Expected Activity Customer A Customer B Travel (number of miles driven) 300 250 Deliveries (number of deliveries) Customer service (number of phone calls) 15 5 20 12 How much total activity cost would be assigned to Customer A from the company's three activitles? Multiple Choice $1,680 $1,980 $1,790 $1,690arrow_forwardPlease help me with show all calculation thankuarrow_forward

- Assume a service company has implemented an activity-based costing system with five activities as shown below: Activity Cost Pool (Activity Measure) Total Cost Total Activity $ 400,000 $ 280,000 $ 150,000 $ 450,000 $ 300,000 Customer deliveries (Number of deliveries) Manual order processing (Number of manual orders) 8,000 deliveries 5,000 manual orders Electronic order processing (Number of electronic orders) 15,000 electronic orders Line item picking (Number of line items picked) Other organization-sustaining costs (None) 375,000 line items The company serves numerous customers, two of which include Hospital A and Hospital B. The activity demands pertaining to these two customers are as follows: Activity Activity Measure Hospital A Hospital B Number of deliveries 12 25 Number of manual orders 30 Number of electronic orders 15 Number of line items picked 130 250 How much total activity cost should be assigned to Hospital A for internal management purposes?arrow_forwardData concerning three of Kilmon Corporation’s activity cost pools appear below: Activity Cost Pools Estimated Overhead Cost Expected Activity Assembling products $ 86,070 4,530 assembly hours Designing products $ 605,412 3,012 product design hours Setting up batches $ 48,140 830 batch set-ups Required: Compute the activity rates for each of the three cost pools.arrow_forwardActivity-Based Costing: Selling and Administrative Expenses Jungle Junior Company manufactures and sells outdoor play equipment. Jungle Junior uses activity-based costing to determine the cost of the sales order processing and the customer return activity. The sales order processing activity has an activity rate of $20 per sales order, and the customer return activity has an activity rate of $100 per return. Jungle Junior sold 2,500 swing sets, which consisted of 750 orders and 80 returns. a. Determine the total sales order processing and customer return activity cost for swing sets. $ b. Determine the per-unit sales order processing and customer return activity cost for swing sets. Round your answer to the nearest cent. per unit ********* 200arrow_forward

- Dawson Company manufactures small table lamps and desk lamps. The following shows the activities per product and the total overhead information: Units Setups Inspections Assembly (dlh) 3,400 3,600 8,800 7,200 Small table lamps Desk lamps 8,400 14,000 43,200 43,200 Total Activity-Base Usage Budgeted Activity Cost 10,800 $109,080 22,400 114,240 75,600 340,200 Activity Setups Inspections Assembly (dlh) The total factory overhead (rounded to the nearest cent) to be allocated to each unit of small table lamps is O a. $80.47 O b. $136.80 O c. $48.28 O d. $104.61arrow_forward⦁ Use ABC to compute overhead cost assigned to an order.KCC Production Corporation uses an activity-based costing system and provided the following budget data: The distribution of resource consumption across activities is as follows: During the year, KCC completed one order from a new customer for 1,000 units, and the related data are as follows: direct labor hours= 0.5 /unit direct materials= $2.00/unit direct labor= $5.00/hour machine hour =1 machine hour per unit Requirements1. Compute the activity rates for each of the activity cost pools.2. Compute the overhead cost assigned to the order from the new customer.arrow_forwardPlease help me Thankyou.arrow_forward

- Product Costing and Decision Analysis for a Service Company Pleasant Stay Medical Inc. wishes to determine its product costs. Pleasant Stay offers a variety of medical procedures (operations) that are considered its “products.” The overhead has been separated into three major activities. The annual estimated activity costs and activity bases follow: Activity Budgeted Activity Cost Activity Base Scheduling and admitting $432,000 Number of patients Housekeeping 4,212,000 Number of patient days Nursing 5,376,000 Weighted care unit Total costs $10,020,000 Total “patient days” are determined by multiplying the number of patients by the average length of stay in the hospital. A weighted care unit (wcu) is a measure of nursing effort used to care for patients. There were 192,000 weighted care units estimated for the year. In addition, Pleasant Stay estimated 6,000 patients and 27,000 patient days for the year. (The…arrow_forwardA manufacturer uses activity-based costing to assign overhead cost to products. Budgeted cost information for its activities follows. Budgeted Cost $ 210,600 Activity Cost Driver Purchase orders Square feet Budgeted Activity Usage 5,400 purchase orders 5,900 square feet 50 Setups Factory services 104,250 Setup 67,750 Setups Compute an activity rate for each activity. (Round your answers to 2 decimal places.) Activity Purchasing Activity Purchasing Factory services Setup Budgeted Cost 210,600 104,250 67,750 $ $ $ Budgeted Activity Usage Activity Ratearrow_forwardi post these que. second time please provide workingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education