FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Ma3.

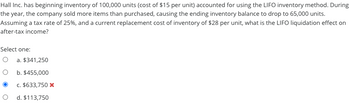

Hall Inc. has beginning inventory of 100,000 units (cost of $15 per unit) accounted for using the LIFO inventory method. During

the year, the company sold more items than purchased, causing the ending inventory balance to drop to 65,000 units.

Assuming a tax rate of 25%, and a current replacement cost of inventory of $28 per unit, what is the LIFO liquidation effect on

after-tax income?

Select one:

a. $341,250

b. $455,000

c. $633,750

d. $113,750

Transcribed Image Text:Hall Inc. has beginning inventory of 100,000 units (cost of $15 per unit) accounted for using the LIFO inventory method. During

the year, the company sold more items than purchased, causing the ending inventory balance to drop to 65,000 units.

Assuming a tax rate of 25%, and a current replacement cost of inventory of $28 per unit, what is the LIFO liquidation effect on

after-tax income?

Select one:

O

O

a. $341,250

b. $455,000

c. $633,750 *

d. $113,750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nord Store’s perpetual accounting system indicated ending inventory of $20,000, cost of goodssold of $100,000, and net sales of $150,000. A year-end inventory count determined that goodscosting $15,000 were actually on hand. Calculate (a) the cost of shrinkage, (b) an adjusted costof goods sold (assuming shrinkage is charged to cost of goods sold), (c) gross profit percentagebefore shrinkage, and (d) gross profit percentage after shrinkage. Round gross profit percentagesto one decimal placearrow_forwardEsquire Incorporated uses the LIFO method to report its inventory. Inventory at the beginning of the year was $552,000 (23,000 units at $24 each). During the year, 86,000 units were purchased, all at the same price of $28 per unit. 88,000 units were sold during the year. Assuming an income tax rate of 25%, what is LIFO liquidation profit or loss that the company would report in a disclosure note accompanying its financial statements? LIFO liquidation profit (loss)arrow_forwardThe following information was available for Bramble Company at December 31, 2020: beginning inventory $4000; ending inventory $96000; cost of goods sold $2500000; and sales $1280000. Bramble's days in inventory in 2020 was O 0.6 days. O 14.3 days. O 7.3 days. O 14.0 days. Save for Later Attempts: 0 of 1 used Submit Answerarrow_forward

- 6. On January 1, 2011, Folk Company changed from the average cost method to the FIFO method to account for its inventory. Ending inventory for each method was given below. Folk Company accrues tax expense on December 31 of each year and pays the tax in April of the following year. The income tax rate is 30%. What is the net income to be reported in 2011 after the change to the FIFO inventory method? a. 1,610,000 b. 2,300,000 c. 1,750,000 d. 1,890,000arrow_forwardAnswer each of the questions In the following unrelated situations. (@) The curTent ratio of a company Is 6:1 and Its acid-test ratio is 1:1. If the Inventories and prepald items amount to $523,000, what Is the amount of current llabillitles? Current Llabilities (b) A company had an aVerage Inventory last year of $210,000 and Its Inventory tumover Was 5. If sales volume and unit cost remaln the samne this year as last and Inventory turnover Is 8 this year, what will average Inventory have to be during the current year? (Nound answer do 0 decimal places, e.g.125. Average Inventory (c) A company has current assets of S95,000 (of which $38,000 15 Inventory and prepaid tems) and current llabilities of $38,000, What Is the Current ratlo? What Is the aeid-test rabo? IF the company borows $13,000 cash from a bank on a 120-day loan, what will its current ratlo be? What will the add-test ratio bez (Round answers to 2 decimalplaces, c.0. 2.50.) Current Ratlo Add Test Ratio New Current Ratio New…arrow_forwardAlpesharrow_forward

- SLR Corporation has 1,200 units of each of its two products in its year-end inventory. Per unit data for each of the products are as follows: Product 1 Product 2 Cost $ 54 $ 36 Selling price 80 38 Costs to sell 4 5 Determine the carrying value of SLR’s inventory assuming that the lower of cost or net realizable value (LCNRV) rule is applied to individual products. What is the before-tax income effect of the LCNRV adjustment? What is the before-tax income effect of the LCNRV adjustment?arrow_forwardSagararrow_forwardWard Distribution Company has determined its year-end inventory on a LIFO basis at $320,000. Information pertaining to that inventory follows. Item Amount Estimated selling price $332,800 Estimated cost of disposal 16,000 Normal profit margin 48,000 Current replacement cost 304,000 What is the loss that Ward should recognize? Assume no previously recorded inventory holding loss. Select one: a. $0 b. $3,200 c. $16,000 d. $51,200 Oarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education