FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

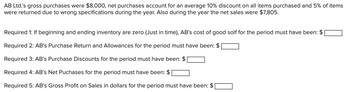

Transcribed Image Text:AB Ltd.'s gross purchases were $8,000, net purchases account for an average 10% discount on all items purchased and 5% of items

were returned due to wrong specifications during the year. Also during the year the net sales were $7,805.

Required 1: If beginning and ending inventory are zero (Just in time), AB's cost of good solf for the period must have been: $

Required 2: AB's Purchase Return and Allowances for the period must have been: $

Required 3: AB's Purchase Discounts for the period must have been: $

Required 4: AB's Net Puchases for the period must have been: $

Required 5: AB's Gross Profit on Sales in dollars for the period must have been: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Traylor Corporation began the year with three items in beginning inventory, each costing $5. During the year Traylor purchased five more items at a cost of $6 each and then two more items at a cost of $7 each. Traylor sold eight items for $10 each. If Traylor uses a periodic LIFO system, what would be Traylor’s gross profit for this year? 45 $45 $80 $80 $51 $51 $36arrow_forwardCARDO Company suspects that there is missing inventory in its warehouse at December 31, 2021. All sales and purchases were made on account. Also, the gross profit rate based on net sales is consistent every year. To aid in your investigation, you obtained the following: How much is the cost of sales based on the historical gross profit rate?arrow_forwardJC Manufacturing purchased inventory for $4,400 and also paid a $320 freight bill. JC Manufacturing returned 45% of the goods to the seller and later took a 1% purchase discount. Assume JC Manufacturing uses a perpetual inventory system. What is JC Manufacturing's final cost of the inventory that it kept? (Round your answer to the nearest whole number.) OA. $1,960 OB. $2,716 OC. $2,570 OD. $2,396arrow_forward

- HI, may i know why didn't record cost , $5000?arrow_forwardTefft Industires has an average inventory of $170,000, sells on term of 2/10, net 30, and its cost of sales is $540,000. What is Tefft's inventory conversion period? *show work* A) 85 days B) 115 days C) 105 days D) cannot be determined from the data givenarrow_forwardHelparrow_forward

- XYZ Company purchased inventory worth $50,000 on credit and later paid off the amount within the discount period. The terms were 2/10, net 30. Calculate the amount paid by XYZ Company after considering the discount.arrow_forwardJournalize each of the transactions In assuming a perlodic inventory system and PST at 7% along with 5% GST. Note: Any avallable cash discount is taken only on the sale price before taxes. Aug. 1 Purchased $2, 000 of merchandise for cash. 2 Purchased $6,800 of merchandise; terms 2/18, n/30. 5 Sold merchandise costing $3,690 for $5,200; terms 1/18, n/30. 12 Paid for the merchandise purchased on August 2. 15 Collected the amount owing from the customer of August 5. 17 Purchased $6,009 of merchandise; terms n/15. 19 Recorded $7,800 of cash sales (cost of sales $5,800). View transaction list Journal entry worksheet 3 4 5 6 7 > 1 2 Record the cash purchase. Note: Enter debits before credits. Date General Journal Debit Credit Aug. 01arrow_forwardPeterson Manufacturing purchased inventory for $5,900 and also paid a $330 freight bill. Peterson Manufacturing returned 40% of the goods to the seller and later took a 1% purchase discount. Assume Peterson Manufacturing uses a perpetual inventory system. What is Peterson Manufacturing's final cost of the inventory that it kept? (Round your answer to the nearest whole number.) OA. $3,505 OB. $3,835 OC. $3,701 OD. $2,336 RECORarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education