FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

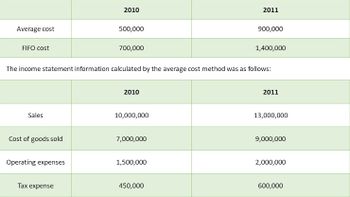

6. On January 1, 2011, Folk Company changed from the average cost method to the FIFO method to account for its inventory. Ending inventory for each method was given below. Folk Company accrues tax expense on December 31 of each year and pays the tax in April of the following year. The income tax rate is 30%. What is the net income to be reported in 2011 after the change to the FIFO inventory method?

a. 1,610,000

b. 2,300,000

c. 1,750,000

d. 1,890,000

Transcribed Image Text:2010

2011

Average cost

500,000

900,000

FIFO cost

700,000

1,400,000

The income statement information calculated by the average cost method was as follows:

2010

2011

Sales

10,000,000

13,000,000

Cost of goods sold

7,000,000

9,000,000

Operating expenses

1,500,000

2,000,000

Tax expense

450,000

600,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During 20x3, Pryor Company changed its inventory method from the LIFO to FIFO. The beginning inventory under FIFO is $20,000 higher than under LIFO. Prepare the journal entry to record this accounting change. Ignore income tax.arrow_forwardUramilabenarrow_forwardEsquire Incorporated uses the LIFO method to report its inventory. Inventory at the beginning of the year was $552,000 (23,000 units at $24 each). During the year, 86,000 units were purchased, all at the same price of $28 per unit. 88,000 units were sold during the year. Assuming an income tax rate of 25%, what is LIFO liquidation profit or loss that the company would report in a disclosure note accompanying its financial statements? LIFO liquidation profit (loss)arrow_forward

- A4arrow_forwardOn December 31, 20x2, Grayson Inc. changed its inventory valuation method to FIFO from weighted-average. The change will result in an $800,000 increase in the beginning inventory at January 1, 20x2. Assume a 30% income tax rate. The cumulative effect of this accounting change on prior periods that will be reported as an adjustment to the beginning balance of retained earnings is O $560,000 O $800,000 0$-0- O $40,000arrow_forwardSagararrow_forward

- Adrienne is a single mother with a six-year-old daughter who lived with her during the entire year. Adrienne paid $2,650 in child care expenses so that she would be able to work. Of this amount, $780 was paid to Adrienne’s mother, whom Adrienne cannot claim as a dependent. Adrienne had net earnings of $2,200 from her jewelry business. In addition, she received child support payments of $21,400 from her ex-husband. Use Child and Dependent Care Credit AGI schedule. Required: What amount, if any, of child and dependent care credit can Adrienne claim?arrow_forwardMassi pharmacies, Inc. started operations on January 1 2X11. The company used the average cost method t=o value inventory. Effective January 1 2X15, Massi elected to change its inventory method to the FIFO basis for reporting purposes. The following information is available for net income for average cost and for FIFO, Year ended Net Income Using Average cost Net Income Using FIFO After Tax Difference After Tax Cumulative Effect December 31, 2X11 $235,000 $310,000 $75,000 $75,000 December 31, 2X12 $300,000 $376,000 $76,000 $151,000 December 31, 2X13 $310,000 $400,500 $90,500 $241,000 December 31, 2X14 $425,000 $535,000 $109,500 $351,000 December 31, 2X15 $500,000 $585,000 $85,000arrow_forwardSpando Apparel uses the LIFO inventory method for external reporting and for income tax purposes but maintains its internal records using FIFO. The following disclosure note was included in a recent annual report: Inventories ($ in millions): Total inventories LIFO reserve 2024 $ 679 (119) $ 560 2023 $ 658 (69) $ 589 The company's income statement reported cost of goods sold of $3,300 million for the fiscal year ended December 31, 2024. Required: 1. Spando adjusts the LIFO reserve at the end of its fiscal year. Prepare the December 31, 2024, adjusting entry to record the cost of goods sold adjustment. 2. If Spando had used FIFO to value its inventories, what would cost of goods sold have been for the 2024 fiscal year? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Spando adjusts the LIFO reserve at the end of its fiscal year. Prepare the December 31, 2024, adjusting entry to record th goods sold adjustment. Note: Enter your answers in millions.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education