Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Hale's Productions is considering producing a pilot for a comedy series in the hope of selling it to a major streaming service. The streaming service may decide to reject the series, but it may also decide to purchase the rights to the series

for either one or two years. At this point in time, Hale may either produce the pilot and wait for the streaming service's decision or transfer the rights for the pilot and series to a competitor for $100,000. Hale's decision alternatives and

profits (in thousands of dollars) are as follows:

State of Nature

Decision Alternative

Reject, $1

1 Year, S₂ 2 Years, 53

Produce pilot, d₁

-100

50

150

Sell to competitor, d₂

100

100

100

The probabilities for the states of nature are P(s₁) = 0.1947, P(s2) = 0.3141, and P(53) = 0.4912. For a consulting fee of $5,000, an agency will review the plans for the comedy series and indicate the overall chances of a favorable

streaming service reaction to the series. Assume that the agency review will result in a favorable (F) or an unfavorable (U) review and that the following probabilities are relevant.

P(F) = 0.69

P(U) = 0.31

P(S₁|F) = 0.08

P(s₂IF) = 0.28

P(S3|F) = 0.64

P(s₁IU) = 0.45

P(52) = 0.39

Pls U)-0.16

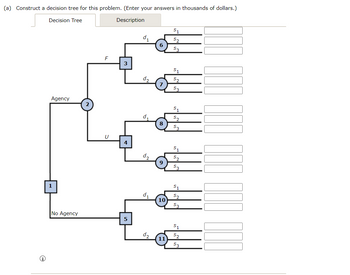

Transcribed Image Text:(a) Construct a decision tree for this problem. (Enter your answers in thousands of dollars.)

Decision Tree

Description

Agency

2

1

51

d1

$2

6

$3

F

3

$1

d2

52

7

$3

U

4

51

d₁

52

8

53

$1

d2

52

9

$3

$1

d1

52

10

$3

No Agency

5

$1

d2

52

11

53

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hale's TV Production is considering producing a pilot for a comedy series in the hope of selling it to a major television network. The network may decide to reject the series, but it may also decide to purchase the rights to the series for either one or two years. At this point in time, Hale may either produce the pilot and wait for the network's decision or transfer the rights for the pilot and series to a competitor for $100,000. Hale's decision alternatives and profits (in thousands of dollars) are as follows: The probabilities for the states of nature are P(S1) = 0.20, P(S2) = 0.30, and P(S3) = 0.50. For a consulting fee of $5000, an agency will review the plans for the comedy series and indicate the overall chances of a favorable network reaction to the series. Assume that the agency review will result in a favorable (F) or an unfavorable (U) review and that the following probabilities are relevant: Construct a decision tree for this problem What is the recommended decision if…arrow_forwardHale's TV Productions is considering producing a pilot for a comedy series in the hope of selling it to a major television network. The network may decide to reject the series, but it may also decide to purchase the rights to the series for either one or two years. At this point in time, Hale may either produce the pilot and wait for the network's decision or transfer the rights for the pilot and series to a competitor for $150,000. Hale's decision alternatives and profits (in thousands of dollars) are as follows: State of Nature Decision Alternative Reject, S1 1 Year, S2 2 Years, S3 Produce pilot, d1 -100 50 250 Sell to competitor, d2 150 150 150 The probabilities for the states of nature are P(S1) = 0.20, P(S2) = 0.30, and P(S3) = 0.50. For a consulting fee of $55,000, an agency will review the plans for the comedy series and indicate the overall chances of a favorable network reaction to the series. Assume that the agency review will result in a favorable (F) or an…arrow_forwardHale's Productions is considering producing a pilot for a comedy series in the hope of selling it to a major streaming service. The streaming service may decide to reject the series, but it may also decide to purchase the rights to the series for either one or two years. At this point in time, Hale may either produce the pilot and wait for the streaming service's decision or transfer the rights for the pilot and series to a competitor for $100,000. Hale's decision alternatives and profits (in thousands of dollars) are as follows: Decision Alternative Produce pilot, d₁ Sell to competitor, d₂ 100 P(F) = 0.69 P(U)= 0.31 P(S₁IF) = 0.08 P(S₂IF) = 0.28 P(S3|F) = 0.64 i Decision Tree Agency 1 Reject, S₁ The probabilities for the states of nature are P(S₁) = 0.1947, P(S₂) = 0.3141, and P(S3) = 0.4912. For a consulting fee of $5,000, an agency will review the plans for the comedy series and indicate the overall chances of a favorable streaming service reaction to the series. Assume that the…arrow_forward

- Hale's Productions is considering producing a pilot for a comedy series in the hope of selling it to a major streaming service. The streaming service may decide to reject the series, but it may also decide to purchase the rights to the series for either one or two years. At this point in time, Hale may either produce the pilot and wait for the streaming service's decision or transfer the rights for the pilot and series to a competitor for $100,000. Hale's decision alternatives and profits (in thousands of dollars) are as follows: Decision Alternative P(F) = 0.69 P(U) = 0.31 P(S₁IF) = = 0.07 P(S₂IF) = 0.29 P(S3IF) = 0.64 Produce pilot, d₁ Sell to competitor, d₂ The probabilities for the states of nature are P(S₁) = 0.1878, P(S₂) 0.3210, and P(S3) = 0.4912. For a consulting fee of $5,000, an agency will review the plans for the comedy series and indicate the overall chances of a favorable streaming service reaction to the series. Assume that the agency review will result in a favorable…arrow_forwardWhich instance is an example of disparate treatment? Select a Choice Below OptionARequiring a high school diploma, even though it is not relevant to the occupation OptionBSpecifying a height requirement that limits the ability of women or persons of certain races to qualify for the position that is advertised OptionCAsking candidates to take written tests which do not relate directly to the job OptionDRejecting people of a certain race without identifying a valid "bona fide occupational qualification" (BFOQ)arrow_forwardThe Jones Manufacturing Company is competing for a production contract that requires that work begin in January 2018. The cost package for the proposal must be submitted by July 2017. The business base, and therefore the overhead rates, are uncertain because Jones has the possibility of winning another contract, to be announced in September 2017. How can the impact of the announcement be included in the proposal? How would you handle a situation where another contract may not be renewed after January 2018, i.e., assume that the announcement would not be made until March?arrow_forward

- In which of the following situations will an adverse selection problem likely become more serious? In which of the following situations will an adverse selection problem likely become more serious? Government restricts the use of certain underwriting factors and mandates the purchase of that insurance Government restricts the use of certain underwriting factors but does not mandate the purchase of that insurance Government mandates the purchase of a particular insurance but does not restrict the use of certain underwriting factors Both the first and the second sentences abovearrow_forwardPlease don't hand writing suliutioarrow_forwardScenario Jamie picks Wanda up from the mall. When Wanda gets into the car, Jamie has the radio tuned to Public Radio. When Wanda reaches to change the station, Jamie stops her, explaining that she is listening to a report about a meeting of the Federal Reserve earlier that day. The reporter is talking about how the Federal Reserve is considering a potential increase in interest rates. Several economists are giving their opinions regarding the announcement. When the segment ends, Jamie changes the station. After thinking about what she has heard, Wanda asks Jamie, "Why do you and I care what the Federal Reserve does?" For Discussion • In this discussion forum, you need to answer Wanda's question. When putting together your response, consider the possible impact that increases/decreases in interest rates and the tightening/loosening of the money supply might have on Salty Pawz. Moreover, how might such decisions affect Wanda personally and as a business owner?arrow_forward

- Your friend recently had an unpleasant experience at a local eatery where the service was poor and the food overpriced. In addition, she became ill with severe stomach cramps within hours of eating at the restaurant. She has drafted a scathing review and plans to post it on Yelp, accusing the restaurant of giving her food poisoning. She has asked you to look over her review before posting it. What would you say?arrow_forwardWhich statement about allocation of risk regarding differing site conditions and bidding is not correct? A contractor bids higher for a project on which he assumes more risk regarding differing site conditions. Unit prices in a bid help to mitigate the risk of differing site conditions to an owner and a contractor. A contractor’s bid will be affected by the allocation of risk. Differing site conditions are typically less of a source of contention for cost-plus contracts than for lump-sum contracts. An owner should expect higher bids if he accepts more of the risk for himself regarding differing site conditionsarrow_forwardAs a member of a local Realtors® association, Broker Mel is generally obligated to place all her listings on the MLS. On one recent occasion, she did not. Evaluate the following scenarios and select the one that provides a justifiable reason for Mel's actions. Mel's client lives in a high-traffic area where a yard sign will bring in all the buyer prospects they could hope for, so an MLS listing is unnecessary. Mel's seller-client is a professional athlete who wants to keep his transaction very private and has asked that his property not be put on the MLS. Mel's client has an immaculate home that will sell easily and fast without being published on the MLS. Mel's client is on a very tight budget and is not willing to pay much in the way of commission on the sale of their home.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,