FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

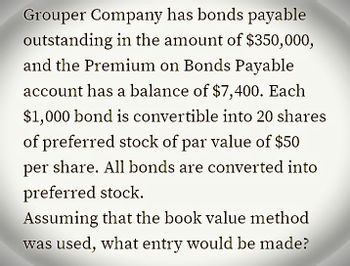

Transcribed Image Text:Grouper Company has bonds payable

outstanding in the amount of $350,000,

and the Premium on Bonds Payable

account has a balance of $7,400. Each

$1,000 bond is convertible into 20 shares

of preferred stock of par value of $50

per share. All bonds are converted into

preferred stock.

Assuming that the book value method

was used, what entry would be made?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Kk.342.arrow_forwardLangdon & Co. issues bonds with a face value of $50,000 for $51,000. Each $1,000 bond carries 10 warrants, and each warrant allows the holder to acquire one share of $1 par common stock for $40 per share. Immediately after the issuance, the bonds are quoted at 99 ex rights and the warrants are quoted at $5 each. Calculate the value to be assigned to the bonds and to the warrants. Round your answers to two decimal places. What is the value assigned to bonds and value assigned to warrantsarrow_forwardFor each of the unrelated transactions described below, present the entries required to record each transaction. 1. Bridgeport Corp. issued $18,800,000 par value 11% convertible bonds at 99. If the bonds had not been convertible, the company’s investment banker estimates they would have been sold at 95. 2. Indigo Company issued $18,800,000 par value 11% bonds at 98. One detachable stock purchase warrant was issued with each $100 par value bond. At the time of issuance, the warrants were selling for $4. 3. Suppose Sepracor, Inc. called its convertible debt in 2020. Assume the following related to the transaction. The 12%, $10,100,000 par value bonds were converted into 1,010,000 shares of $1 par value common stock on July 1, 2020. On July 1, there was $52,000 of unamortized discount applicable to the bonds, and the company paid an additional $75,000 to the bondholders to induce conversion of all the bonds. The company records the conversion using the book value method.…arrow_forward

- Blanca Company has the following independent bond issuances. a.) Issues $600,000 bonds at 96. b.) Issues $700,000 bonds at 102. c.) Issues $200,000 bonds at 100. Required: 1.) Prepare the journal entries to record the bond issuances under of the independent situations.arrow_forwardPeach Company has a $1,000 bond that is convertible into 10 shares of common stock (par value $10). At the time of conversion, the unamortized premium is $50. Please write the journal entry to record the conversion of the bonds.arrow_forwardIowa Corporation Issued $4,000,000 par value, 5% convertible bonds, at 101 for cash. If the bonds had not included the conversion feature, they would have sold for 99. Prepare the journal entry to record the issuance of the bonds for Iowa Corporation.arrow_forward

- Nolan Corporation has outstanding convertible bonds with a face value of $15,000 and a current book value of $17,500. Each $1,000 bond is convertible into 25 shares of common stock (par value $5 per share). All the bonds are converted into common stock on June 1 when the market value of Nolan’s common stock is $50 per share. Required: Using the book value method, prepare the journal entry for Nolan to record the conversion.arrow_forwardJames Company had bonds which are convertible into shares of common stock. There were two bonds, both issued at par. One was for $400,000 and was purchased on January 1st with an interest rate of 6%, this bond is convertible into 200,000 shares of common stock. The second bond was for $600,000 and had an interest rate of 8% and was purchased on May 1st, this bond is convertible into 400,000 shares of common stock. Interest on both bonds is paid annually. The overall tax rate for the organization is 20%. Additionally, net income is $800,000, but does not include interest expense or taxes. The organization currently has 460,000 shares of common stock outstanding. A. Calculate Earnings Per Share B. Calculate Dilutive Earnings Per Share using the if converted method. C. Is the organization anti-dilutive? Explain your answer.arrow_forwardGerard Corporation has the following convertible bonds. A $100,000 convertible bond was issued at par on January 1, 2021, at 4%. The bond is convertible into 30,000 shares of common stock. Additionally, there was a convertible bond that was purchased on November 1, 2021, at par, for $200,000 with an interest rate of 6%, this bond is convertible into 20,000 shares of common stock. Both bonds pay interest annually. Gerard Corporation has total revenue of 800,000 and expenses of 400,000, which does not include interest expense or taxes. The tax rate is 40%. Additionally, the organization currently has 300,000 shares of common stock outstanding for the entire year. No dividends were paid in 2021. Calculate Earnings per share. Calculate Dilutive Earnings per share using the if converted method.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education