Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

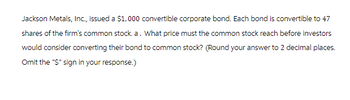

Transcribed Image Text:Jackson Metals, Inc., issued a $1,000 convertible corporate bond. Each bond is convertible to 47

shares of the firm's common stock. a. What price must the common stock reach before investors

would consider converting their bond to common stock? (Round your answer to 2 decimal places.

Omit the "S" sign in your response.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- James Company had bonds which are convertible into shares of common stock. There were two bonds, both issued at par. One was for $400,000 and was purchased on January 1st with an interest rate of 6%, this bond is convertible into 200,000 shares of common stock. The second bond was for $600,000 and had an interest rate of 8% and was purchased on May 1st, this bond is convertible into 400,000 shares of common stock. Interest on both bonds is paid annually. The overall tax rate for the organization is 20%. Additionally, net income is $800,000, but does not include interest expense or taxes. The organization currently has 460,000 shares of common stock outstanding. A. Calculate Earnings Per Share B. Calculate Dilutive Earnings Per Share using the if converted method. C. Is the organization anti-dilutive? Explain your answer.arrow_forwardVinubhaiarrow_forward1) Kameela Inc. has $ 3,000,000 (par value), 8% convertible bonds outstanding. Each $ 1,000 bond is convertible into thirty no par value common shares. The bonds pay interest on January 31 and July 31. On July 31, 2020, the holders of $ 900,000 worth of bonds exercised the conversion privilege. On that date the market price of the bonds was 105, the market price of the common shares was $ 36, the carrying value of the common shares was $ 18 and the Contributed Surplus Conversion Rights account balance was $ 450,000. The total unamortized bond premium at the date of conversion was $ 210,000. Using the book value method, Kameela should record, as a result of this conversion? Calculate the amount and present it in the books!arrow_forward

- 25) Harrell's Barrels issued $100 million of 6% convertible bonds at 101. Each $1,000 bond is convertible into 45 shares of Harrell's no par common stock. Bonds that are similar in all respects, except that they are nonconvertible, currently are selling at 98. Harrell applies International Financial Reporting Standards. Recording the issuance of the bonds would cause an increase in Harrell's: A) shareholders' equity of $1,000,000. B) shareholders' equity of $3,000,000. C) assets of $98,000,000. D) liabilities of $101,000,000.arrow_forwardA $1,000 corporate bond is convertible to 40 shares of the corporation's common stock. What is the minimum price that the stock must obtain before bondholders would consider converting the bond to stock?arrow_forwardA4arrow_forward

- Whispering Company issued $9,000,000 par value 5% bonds at 97. One detachable stock purchase warrant was issued with each $100 par value bond. At the time of issuance, the warrants were selling for $2. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forwardThe following data on the Bond Record Company are available: Earnings available for common stockholders $700,000 Number of shares of common stock outstanding 350,000 Earnings per share ($700,000÷350,000) $2 Market price per share $36 Price/earnings (P/E) ratio ($36÷$2) 18 The firm is currently considering whether it should use $350,000 (not included in the $$700,000 earnings listed in the financial data) of its earnings to help pay cash dividends of $1.00 per share or to repurchase stock at $36 per share. a. Approximately how many shares of stock can the firm repurchase at the $36-per-share price, using the funds that would have gone to pay the cash dividend? b. Calculate the EPS after the repurchase. c. In a perfect market, what is the stock price after the repurchase and what is the P/E ratio? d. Compare the pre- and post-repurchase earnings per share.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education