Understanding Business

12th Edition

ISBN: 9781259929434

Author: William Nickels

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

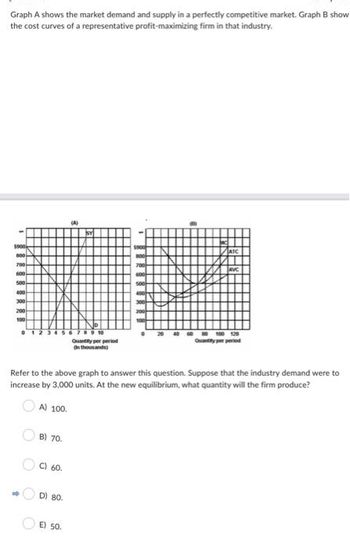

Transcribed Image Text:Graph A shows the market demand and supply in a perfectly competitive market. Graph B show

the cost curves of a representative profit-maximizing firm in that industry.

$900k

800

700

600

500

400

300

200

100

(A)

ATC

AVC

Quantity per period

20 40 60 100 120

Quantity per period

Refer to the above graph to answer this question. Suppose that the industry demand were to

increase by 3,000 units. At the new equilibrium, what quantity will the firm produce?

A) 100.

B) 70.

會

C) 60.

D) 80.

E) 50.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Ray Holt seeks an investment for his new business. The investor will bear all the costs(fixed + variable) and wants a rate of return of at least Y%. For the business fixed cost is Fc, selling price of a unit is Sp, and Cost of production of a unit is Cp. How many units, x, should Ray Holt maketo meet the investor’s rate of return requirement? If the requested rate of return is 10%, fixed cost is $10,000, selling price is $5, and cost of production is $3, how many units should be made?arrow_forwardTable 24-1 Price Quantity Total Cost $10 10 $80 9 15 85 8 20 95 7 25 110 6 30 140 5 35 175 40 215 Refer to Table 24-1. A monopolistic competitive firm earns a total profit of a. $65 Ob. $20 ○ c. $50 Od. $40 when it produces the profit maximizing level of output.arrow_forwardI need question D solved please (a) What was their average aggregate inventory value? =46,410,239(b) What was their average inventory (measured in weeks of supply)? =6.97(c) What was their inventory turnover?=7.1771BIT operates on a build-to-stock policy, and therefore stores its finishedgoods in a warehouse capable of housing up to 70,000 units. Its annual overhead cost (fixed cost) is $117,000; and it costs $3/unit to house the finished goods. BIT has been approached by a warehouse company offering to house the finished goods for a unit cost of $4.5/unit, with an annual contract cost of $30,000. (d) Should BIT continue operating its own warehouse, or should it employthe warehouse company? Why?arrow_forward

- .Substitue for Mandatory problem #2 on exam in attachment )-Calculate the Tracking Signal(RSFE/MAD t) given the following data and an alpha=0.4.MAD t-1=15: Period Actual Demand Forecast Demand Error ................... RSFE MAD t TS 0 Start up Start Up Start Up 15 1 30 45 2 43 3 38 4 37 5 40arrow_forwardUse a single excel file with formulas within answer cells. Show formulas for how to get the answer. The ticketing office at a professional sports venue has noticed that ticket sales seem to fluctuate. The manager wants to introduce the strategy of demand-pricing in order to maximize attendance and therefor revenue. Based on historical sales, manager wonders if there is a connection between winning percentage (in decimal form) of the team and attendance (seats). Attendance (seats) Winning Percentage (decimal form) 78,000 0.6 89,000 0.67 93,000 0.7 59,000 0.5 65,000 0.55 97,000 0.9 86,000 0.6 75,000 0.55 91,000 0.8 61,000 0.52 What is the forecasted attendance if winning percentage is 0.67?arrow_forwardSuppose a farmer is a price taker for soybean sales with cost functions given by the following:TC = 0.197 +29 + 30MC = 0.2q +223. The firm's supply curve is given by? a) q = 5 P-10b)9 = 0.2P+2c)9 = 10P-2d) q = 2P-524. If P = 6, the profit - maximizing level of profits isA)$10 b) $20. c)$30. d) - $10.arrow_forward

- Under the last-in, first-out (LIFO) inventory valuation method, a price index for inventory must be established for tax purposes. The quantity weights are based on year-ending inventory levels. Unit Price ($) Product EndingInventory Beginning Ending A 500 0.15 0.19 B 50 1.40 1.80 C 100 4.50 4.20 D 60 12.00 13.60 Use the beginning-of-the-year price per unit as the base-period price and develop a weighted aggregate index for the total inventory value at the end of the year. (Round your answer to the nearest integer.) I = ?? What type of weighted aggregate price index must be developed for the LIFO inventory valuation? -Paasche index -Laspeyres Indexarrow_forwardAssume that the 4-year spot rate is k4=2.437% and the 3-year spot rate is k3 = 2.25%. What is the forward rate in the fourth year? Express your answer in percentage form. %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON