FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

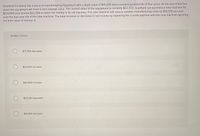

Transcribed Image Text:Granfield Company has a piece of manufacturing equipment with a book value of $41,500 and a remaining useful life of four years. At the end of the four

years the equipment will have a zero salvage value. The market value of the equipment is currently $22,300. Granfield can purchase a new machine for

$123,000 and receive $22,300 in return for trading in its old machine. The new machine will reduce variable manufacturing costs by $19,300 per year

over the four-year life of the new machine. The total increase or decrease in net income by replacing the current machine with the new machine (ignoring

the time value of money) is:

Multiple Choice

$77,200 decrease

$23,500 increase

$53,050 increase

$23,500 decrease

$19,200 decrease

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ivanhoe Company has a factory machine with a book value of $88,100 and a remaining useful life of 7 years. It can be sold for $33,800. A new machine is available at a cost of $510,700. This machine will have a 7-year useful life with no salvage value. The new machine will lower annual variable manufacturing costs from $576,600 to $470,500. Prepare an analysis showing whether the old machine should be retained or replaced. (In the first two columns, enter costs and expenses as positive amounts, and any amounts received as negative amounts. In the third column, enter net income increases as positive amounts and decreases as negative amounts. Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses e.g. (45).) Variable manufacturing costs $ New machine cost Sell old machine Total Retain Equipment The old factory machine should be replaced Replace Equipment 000 Net Income Increase (Decrease)arrow_forwardB2B Company is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment costs $379,200 and has a 12-year life and no salvage value. B2B Company requires at least an 8% return on this investment. The expected annual income for each year from this equipment follows: (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Sales of new product $ 237,000 Expenses Materials, labor, and overhead (except depreciation) 83,000 Depreciation—Equipment 31,600 Selling, general, and administrative expenses 23,700 Income $ 98,700 (a) Compute the net present value of this investment.(b) Should the investment be accepted or rejected on the basis of net present value?arrow_forwardThe annual operating costs of Machine A are $2,000. The machine will perform satisfactorily over the next five years and has an estimated market value (MV) of $3,000 at the end of its useful life. A salesperson for another company is offering a replacement, Machine B, for $14,000, with a MV of $1,400 after five years. Annual operating costs for Machine B will only be $1,500. It is believed that $10,000 could be obtained for the old machine A if it were sold now. If the before-tax MARR is 11% per year, determine whether the old machine A should be replaced by the new machine B.arrow_forward

- Starling Co. is considering disposing of a machine with a book value of $22,200 and estimated remaining life of five years. The old machine can be sold for $5,800. A new high-speed machine can be purchased at a cost of $72,200. It will have a useful life of five years and no residual value. It is estimated that the annual variable manufacturing costs will be reduced from $23,400 to $19,900 if the new machine is purchased. The differential effect on income for the new machine for the entire five years is a(n)arrow_forwardXYZ Co. is considering the purchase of a new machine. The machine will cost $250,000 and requires installation costs of $25,000. The existing machine can be sold currently for $25,070. It was purchased three years ago for $83,000 and depreciated using MACRS (5 years). It can be operated for another four years. Its market value at that time, if sold, would be $14,000. The new machine has expected life of five years and expected to provide operating cash savings of $88,000 a year for 2 years and $50,000 a year for the next two years before depreciation and taxes (EBD&T). After four years the new machine can be sold for $12,750. To support the increased business resulting from the purchase of new machine, A/R will increase by $12,000; inventory will increase by $25,000 and current liabilities by $41,000. The cost of capital is 17% and the tax rate is 40%. What is NPV? Question 9 options: $56,900 -$65,880 -$63,118 -$76,890arrow_forwardfirm is considering purchasing a machine that costs $77,000. It will be used for six years, and the salvage value at that time is expected to be zero. The machine will save $41,000 per year in labor, but it will incur $16,000 in operating and maintenance costs each year. The machine will be depreciated according to five-year MACRS. The firm's tax rate is 35%, and its after-tax MARR is 18%. What is the present worth of the project?arrow_forward

- K Company has purchased a new machine costing $27,000 and the machine is expected to reduce the operating expenses by $7,000 every year. The useful life of machine is 5 years and the machine is expected to have a zero-scrap! value at the end of its useful life. The company's required rate of return is 12%. Calculate the Net Present Value (NPV) of the machine. (Round intermediate calculations to 3 decimal places and final answer to the nearest dollar.)arrow_forwardA company sells Gizmos to consumers at a price of $117 per unit. The cost to produce Gizmos is $27 per unit. The company will sell 15,000 Gizmos to consumers each year. The fixed costs incurred each year will be $190,000. There is an initial investment to produce the goods $3,400,000 which will be depreciated straight line over the 10-year life of the investment to a salvage value of $0. The opportunity cost of capital is 6% and the tax rate is 34%. What is the operating cash flow each year?arrow_forwardCullumber Lumber, Inc; is considering purchasing a new wood saw that costs $65000. The saw will generate revenues of $100,000 per year for five years. The cost of materials and labor needed to generate these revenues will total $60,000 per year, and other cash expenses will be $10,000 per year. The machine is expected to sell for $4500 at the end of its five-year life and will be depreciated on a straight-line basis over five years to zero. Cullumber’s tax rate is 26 percent, and it’s opportunity cost of capital is 13.10 percent. What is the project’s NPV?arrow_forward

- Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $46,000 and a remaining useful life of five years. It can be sold now for $56,000. Variable manufacturing costs are $43,000 per year for this old machine. Information on two alternative replacement machines follows. The expected useful life of each replacement machine is five years. Purchase price Variable manufacturing costs per year Machine A $ 123,000 19,000 Machine B $136,000 15,000 (a) Compute the income increase or decrease from replacing the old machine with Machine A. (b) Compute the income increase or decrease from replacing the old machine with Machine B. (c) Should Lopez keep or replace its old machine? (d) If the machine should be replaced, which new machine should Lopez purchase? Complete this question by entering your answers in the tabs below. Req A Req B Req C and D Compute the income increase or decrease from replacing the old machine with Machine B. Note:…arrow_forwardSheridan Company has a factory machine with a book value of $150,000 and a remaining useful life of 4 years. A new machine is available at a cost of $245,000. This machine will have a 4-year useful life with no salvage value. The new machine will lower annual variable manufacturing costs from $590,000 to $490,000. Prepare an analysis that shows whether Sheridan should retain or replace the old machine. (If an amount reduces the net income then enter with a negative sign preceding the number or parenthesis, e.g. -15,000, (15,000).) Variable costs New machine cost $ $ Keep Equipment $ $ Replace Equipment $ $ Net Income Increase (Decrease) Activate Windo Go to Settings to acarrow_forwardHelp mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education