FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

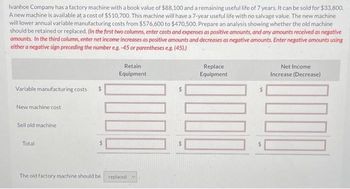

Transcribed Image Text:Ivanhoe Company has a factory machine with a book value of $88,100 and a remaining useful life of 7 years. It can be sold for $33,800.

A new machine is available at a cost of $510,700. This machine will have a 7-year useful life with no salvage value. The new machine

will lower annual variable manufacturing costs from $576,600 to $470,500. Prepare an analysis showing whether the old machine

should be retained or replaced. (In the first two columns, enter costs and expenses as positive amounts, and any amounts received as negative

amounts. In the third column, enter net income increases as positive amounts and decreases as negative amounts. Enter negative amounts using

either a negative sign preceding the number eg. -45 or parentheses e.g. (45).)

Variable manufacturing costs $

New machine cost

Sell old machine

Total

Retain

Equipment

The old factory machine should be replaced

Replace

Equipment

000

Net Income

Increase (Decrease)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required Supply the missing information in the following table for Vernon Company. (Do not round intermediate calculations. Round "ROI" answer to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).) Sales $369,600 ROI % Operating assets Operating income Turnover 2.1 Residual income Operating profit margin 14 % Desired rate of return 17 %arrow_forwardComplete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Compute the company's margin, turnover, and return on investment (ROI) for the period. Note: Round your intermediate calculations and final answer to 2 decimal places. Margin % Turnover ROI %arrow_forwardH1.arrow_forward

- Complete this question by entering your answers in the tabs below. Required A Assume that only one product is being sold in each of the four following case situations: (Loss amounts should be indicated by a minus sign.) Case 1 Case 2 Case 3 Case 4 Units sold 8,700 19,200 5,100 Sales $261,000 $300,000 $173,400 Variable expenses 174,000 211,200 Fixed expenses 91,000 174,000 75,000 Net operating income (loss) $6,000 $145,400 $1,500 Contribution margin per unit $12 $12arrow_forwardd Required information [The following information applies to the questions displayed below.] Use the following information: Department Service 1 (S1) Service 2 (52) Production 1 (P1) Production 2 (P2) P1 P2 Total Service Department 2's Costs Cost $ 121,000 53,000 435,000 306,000 $ 915,000 3/8 x 5/8 X Percentage Service Provided to S1 0% 20 52 20% 0 What percentage of S2's costs is allocated to P1 and to P2 under the direct method? (Round your answer to the nearest fraction.) P1 30% 20 P2 50% 60arrow_forwardDetermine the missing amounts. Unit SellingPrice Unit VariableCosts Unit ContributionMargin Contribution MarginRatio 1. $750 $375 $ (a) % (b) 2. $450 $ (c) $153 % (d) 3. $ (e) $ (f) $760 40 %arrow_forward

- Please do not give solution in image format thankuarrow_forwardPlease do not give solution in image format thankuarrow_forwardb. Assume that more than one product is being sold in each of the four following case situations:AverageContribution Net OperatingVariable Margin Fixed IncomeCase Sales Expenses Ratio Expenses (Loss)1 ........................ $500,000 ? 20% ? $7,0002 ........................ $400,000 $260,000 ? $100,000 ?3 ........................ ? ? 60% $130,000 $20,0004 ........................ $600,000 $420,000 ? ? $(5,000)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education