FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

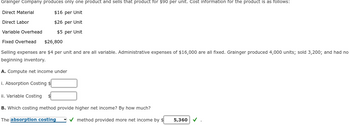

Transcribed Image Text:Grainger Company produces only one product and sells that product for $90 per unit. Cost information for the product is as follows:

Direct Material

$16 per Unit

Direct Labor

$26 per Unit

Variable Overhead

$5 per Unit

Fixed Overhead $26,800

Selling expenses are $4 per unit and are all variable. Administrative expenses of $16,000 are all fixed. Grainger produced 4,000 units; sold 3,200; and had no

beginning inventory.

A. Compute net income under

i. Absorption Costing $

ii. Variable Costing

B. Which costing method provide higher net income? By how much?

The absorption costing

✔method provided more net income by $

5,360

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Grainger Company produces only one product and sells that product for $110 per unit. Cost information for the product is as follows: Direct Material $16 per Unit Direct Labor $26 per Unit Variable Overhead $6 per Unit Fixed Overhead $27,200 Selling expenses are $5 per unit and are all variable. Administrative expenses of $20,000 are all fixed. Grainger produced 4,000 units; sold 3,200; and had no beginning inventory. A. Compute net income under i. Absorption Costing $fill in the blank 1 ii. Variable Costing $fill in the blank 2 B. Which costing method provide higher net income? By how much? The method provided more net income by $fill in the blank 4 .arrow_forwardMIUPI companies produce lanyards (cord). The cost of making a unit of product is $ 1.00 for direct materials, $ 0.50 for indirect labor, $ 1.25 for variable indirect costs. Indirect fixed overhead costs total $ 100,000. Commissions to sellers are $ 0.20 per unit sold. Other variable administrative and sales costs total $ 0.05 per unit. Fixed selling and administrative expenses total $ 200,000. The company taxes its earnings at 40%. Each unit sells for $ 5.00. 100. Management is considering increasing the vendors total cost of salary by $ 2,000, there are 4 vendors and eliminating the commission. Determine the new breakeven point and select which is best for the company, commission to sellersarrow_forwardA condensed income statement by product line for Crown Beverage Inc. indicated the following for King Cola for the past year: Sales $236,100 Cost of goods sold 112,000 Gross profit $124,100 Operating expenses 142,000 Loss from operations $(17,900) It is estimated that 13% of the cost of goods sold represents fixed factory overhead costs and that 21% of the operating expenses are fixed. Since King Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. Question Content Area a. Prepare a differential analysis, dated March 3, to determine whether King Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter zero "0". Use a minus sign to indicate a loss. Differential AnalysisContinue King Cola (Alt. 1) or Discontinue King Cola (Alt. 2)January 21 Continue KingCola (Alternative 1) Discontinue KingCola (Alternative 2) Differential Effecton Income(Alternative 2)…arrow_forward

- The Southern Corporation manufactures a single product and has the following cost structure: Variable costs per unit: Production $ 33 Selling and administrative $ 16 Fixed costs per year: Production $ 130,830 Selling and administrative $ 107,280 Last year, 6,230 units were produced and 6,030 units were sold. There was no beginning inventory. The carrying value on the balance sheet of the ending inventory of finished goods under variable costing would be:arrow_forwardJax Incorporated reports the following data for its only product. The company had no beginning finished goods inventory and it uses absorption costing. Sales price $ 56.20 per unit Direct materials $ 9.20 per unit Direct labor $ 6.70 per unit Variable overhead $ 11.20 per unit Fixed overhead $ 781,200 per year 1. Compute gross profit assuming (a) 62,000 units are produced and 62,000 units are sold and (b) 84,000 units are produced and 62,000 units are sold.2. By how much would the company’s gross profit increase or decrease from producing 22,000 more units than it sells?arrow_forwardA condensed income statement by product line for British Beverage Inc. indicated the following for King Cola for the past year: Sales $235,100 Cost of goods sold 112,000 Gross profit $123,100 Operating expenses 145,000 Loss from operations $(21,900) It is estimated that 16% of the cost of goods sold represents fixed factory overhead costs and that 19% of the operating expenses are fixed. Since King Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis, dated March 3, to determine whether to Continue King Cola (Alternative 1) or Discontinue King Cola (Alternative 2). If an amount is zero, enter zero "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential AnalysisContinue King Cola (Alt. 1) or Discontinue King Cola (Alt. 2)March 3 Continue KingCola (Alternative 1) Discontinue KingCola (Alternative 2) Differential…arrow_forward

- lagan, Inc. has collected the following data. (There are no beginning inventories.) Units produced Sales price 700 units $120 per unit Direct materials $50 per unit Direct labor Fixed manufacturing overhead $12 per unit Variable manufacturing overhead $9 per unit $17,500 per year Variable selling and administrative costs $4 per unit $18,000 per year Fixed selling and administrative costs What is the ending balance in Finished Goods Inventory using variable costing if 400 units are sold? OA. $21,300 OB. $15,000 C. $18,600 D. $6,300arrow_forwardA condensed income statement by product line for British Beverage Inc. indicated the following for Royal Cola for the past year: Sales $233,300 Cost of goods sold 111,000 Gross profit $122,300 Operating expenses 145,000 Loss from operations $(22,700) It is estimated that 12% of the cost of goods sold represents fixed factory overhead costs and that 23% of the operating expenses are fixed. Since Royal Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis, dated March 3, to determine whether Royal Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter zero "0". Use a minus sign to indicate a loss. Differential Analysis Continue Royal Cola (Alt. 1) or Discontinue Royal Cola (Alt. 2) January 21 Continue RoyalCola (Alternative 1) Discontinue RoyalCola (Alternative 2) Differential Effecton Income(Alternative 2)…arrow_forwardCc. 188.arrow_forward

- Jax Incorporated reports the following data for its only product. The company had no beginning finished goods inventory and it uses absorption costing. Sales price Direct materials Direct labor Variable overhead Fixed overhead $ 56.60 per unit $ 9.60 per unit $ 7.10 per unit $ 11.60 per unit $ 910,800 per year 1. Compute gross profit assuming (a) 66,000 units are produced and 66,000 units are sold and (b) 92,000 units are produced and 66,000 units are sold. 2. By how much would the company's gross profit increase or decrease from producing 26,000 more units than it sells? Complete this question by entering your answers in the tabs below. es Required 1 Required 2 Compute gross profit assuming (a) 66,000 units are produced and 66,000 units are sold and (b) 92,000 units are produced and 66,000 units are sold. (a) 66,000 Units Produced and 66,000 (b) 92,000 Units Produced and 66,000 Units Sold Units Sold Sales $ 3,735,600 $ 5,207,200 Cost of goods sold 2,838,000 3,514,400 Gross profit $…arrow_forwardTrainor Incorporated, which has only one product, has provided the following data concerning its most recent month of operations: Selling price $ 112 Units in beginning inventory 0 Units produced 4,900 Units sold 4,500 Units in ending inventory 400 Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative $ 19 $ 45 $ 6 $ 9 Fixed costs: Fixed manufacturing overhead $ 1,17,600 Fixed selling and administrative $ 22,500 What is the net operating income for the month under absorption costing? A. ($19,600) B. $9,600 C. $8,400 D. $18,000arrow_forward1. Cabaret Corporation produces a single product. Data concerning the company's operations last year appear below: Units in beginning inventory... Units produced. Units sold....... Selling price per unit.. Variable costs per unit: Direct materials. Direct labor. Variable manufacturing overhead.. Variable selling and administrative. Fixed costs in total: Fixed manufacturing overhead... Fixed selling and administrative... Assume direct labor is a variable cost. 10,000 9,000 $60 $15 $5 $2 $4 $200,00 0 $70,000 Required: a. Compute the unit product cost under both absorption and variable costing. b. Prepare an income statement for the year using absorption costing. c. Prepare an income statement for the year using variable costing. d. Prepare a report reconciling the difference in net operating income between absorption and variable costing for the year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education