FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

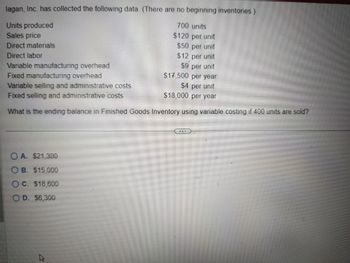

Transcribed Image Text:lagan, Inc. has collected the following data. (There are no beginning inventories.)

Units produced

Sales price

700 units

$120 per unit

Direct materials

$50 per unit

Direct labor

Fixed manufacturing overhead

$12 per unit

Variable manufacturing overhead

$9 per unit

$17,500 per year

Variable selling and administrative costs

$4 per unit

$18,000 per year

Fixed selling and administrative costs

What is the ending balance in Finished Goods Inventory using variable costing if 400 units are sold?

OA. $21,300

OB. $15,000

C. $18,600

D. $6,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please answer all reiuirements without handwritten thnkuarrow_forwardThe following information is for a company that produced 10,000 units and sold 9,000 units during its first year of operations: Per Unit Per Year Selling price Direct materials $200 $ 70 $ 50 Direct labor $ 10 $ 8 Variable manufacturing overhead Sales commission Fixed manufacturing overhead $285,000 0:36:03 Which of the following choices explains the relationship between the absorption costing net operating income and the variable costing net operating Income? Multiple Choice The absorption costing net operating income will be lower than the variable costing net operating income by $100,500.arrow_forwardPlease do not give image formatarrow_forward

- Please do not give image format and explanationarrow_forwardOber Corporation, which has only one product, has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense Required: $ 127 0 8,970 8,540 430 $ 37 $ 36.50 $ 5.50 $ 12.50 $ 183,885 $ 109,900 a. Prepare a contribution format income statement for the month using variable costing. b. Prepare an income statement for the month using absorption costing.arrow_forwardHayes Incorporated provided the following information for the current year: Beginning inventory Units produced Units sold Selling price Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling/administrative costs Fixed selling/administrative costs What is the product cost per unit for the year using variable costing? Multiple Choice $162 $114 $138 260 units 910 units 960 units $ 310/unit $ 51/unit $ 32/unit $ 31/unit $ 43,680/year $ 24/unit $ 31,500/yeararrow_forward

- Answer all <>arrow_forwardThe following information is available for Barnes Company for the fiscal year ended December 31: Beginning finished goods inventory in units Units produced Units sold Sales 0 8,600 5,900 $ 767,000 $ 172,000 $ 86,000 Materials cost Variable conversion cost used Fixed manufacturing cost Indirect operating costs (fixed) $ 946,000 $ 118,000 The difference between the variable costing ending inventory and the absorption costing ending inventory is: Multiple Choice O 2,700 units times $115 per unit variable conversion cost plus $110 per unit fixed manufacturing cost 4 2,700 units times $115 per unit variable conversion cost plus $110 per unit fixed manufacturing cost plus $111.67 per unit indirect operating c 2,700 units times $105 per unit materials costarrow_forwardFarris Corporation, which has only one product, has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced $ 172 0 9,700 9,300 400 Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense What is the net operating income (loss) for the month under variable costing? $6,000 $11,600 $17,600 ($40,000) $ 33 $75 $21 $ 25 $ 145,500 $ 10,300arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Chuck Wagon Grills, Incorporated, makes a single product-a handmade specialty barbecue grill that it sells for $210. Data for last year's operations follow: Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Total variable cost per unit Fixed costs: Fixed manufacturing overhead Fixed selling and administrative Total fixed costs 0 20,000 19,000 1,000 $ 50 80 20 10 $ 160 $ 700,000 285,000 $ 985,000 Required: 1. Assume that the company uses absorption costing. Compute the unit product cost for one barbecue grill. 2. Assume that the company uses absorption costing. Prepare an income statement for last year.arrow_forwardMenk Corporation has provided the following information: Cost per Unit Cost per Period Direct materials $ 6.80 Direct labor $ 3.80 Variable manufacturing overhead $ 2.00 Fixed manufacturing overhead $ 20,200 Sales commissions $ 0.50 Variable administrative expense $ 0.40 Fixed selling and administrative expense $ 10,100 Required: a. If 5,220 units are sold, what is the variable cost per unit sold? Note: Round "Per unit" answer to 2 decimal places. b. If 5,220 units are sold, what is the total amount of variable costs related to the units sold? c. If 5,220 units are produced, what is the total amount of manufacturing overhead cost incurred? a. Variable cost per unit sold b. Total variable costs c. Total manufacturing overhead costarrow_forwardHanshabenarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education