Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

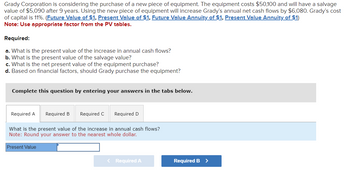

Transcribed Image Text:Grady Corporation is considering the purchase of a new piece of equipment. The equipment costs $50,100 and will have a salvage

value of $5,090 after 9 years. Using the new piece of equipment will increase Grady's annual net cash flows by $6,080. Grady's cost

of capital is 11%. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1)

Note: Use appropriate factor from the PV tables.

Required:

a. What is the present value of the increase in annual cash flows?

b. What is the present value of the salvage value?

c. What is the net present value of the equipment purchase?

d. Based on financial factors, should Grady purchase the equipment?

Complete this question by entering your answers in the tabs below.

Required A

Required B Required C Required D

What is the present value of the increase in annual cash flows?

Note: Round answer to the nearest whole dollar.

Present Value

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A company buys a solar panel unit for P105,000. The shipping and installation fees amount to P15,000. If the unit is expected to last for 15 years, with a salvage value of P3,000, what is the depreciation charge during the 12 th year, and the book value at the end of 14 years by the (c) sinking fund method given interest rate at 12.5 percent, and (d) Sum-of-the-Years Digit (SYD) Method.arrow_forwardHomer Corp. is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual increase in net Income after tax of $169,650. The equipment will have an initial cost of $585,000 and have a 5-year life. If the salvage value of the equipment is estimated to be $25,000, what is the annual net cash flow? Multiple Choice $144,650 $57,650 $281650 $194,650arrow_forwardA corporation is considering purchasing a new plant asset. The asset will cost $30,000. The corporation requires a 10% return on similar investments. The corporation plans to use the asse for 4 years and then sell it for the salvage value. The estimated salvage value of the asset in 4 years is $5,000. The corporation estimates that if purchased the new asset will provide addition net cash flows of $9,000 each year for 4 years (assume the cash flows occur at the end of the year): Calculate the net present value (you must include the calculation in order to receive credit) Should the business purchase the asset?arrow_forward

- Nikularrow_forwardBassinger Company plans to buy a new machine for $60,000 that will have an estimated useful life of 3 years and no salvage value. The expected cash inflow is $24,000 annually. Bassinger Company has a cost of capital of 12%. Given that the present value of $1 after 3 periods at 12% is 0.71178, and the present value of an annuity for 3 periods at 12% is 2.40183, the profitability index is: 000 0.04 1.96 1.04 0.28 0.96arrow_forwardSpanish Peaks Railroad Inc. is considering acquiring equipment at a cost of $68,000. The equipment has an estimated life of 10 years and no residual value. It is expected to provide yearly net cash flows of $34,000. The company's minimum desired rate of return for net present value analysis is 12%. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Compute the following: a. The average rate of return, giving effect to straight-line depreciation on the investment. If required, round your answer to one decimal place. c. The net present value. Use the above table of the present value of an annuity of $1. Round to…arrow_forward

- A company wants to purchase a piece of equipment that costs $18,000. In 8 years, that same piece of equipment is expected to have a salvage value of $5,000. The estimated annual maintenece cost is $1,000 in the first year, but is expected to increase by $300 each year thereafter. What is the present worth of the project, using a 10% interest rate.arrow_forwardealthy Food Ltd is considering to invest in one of the two following projects to buy new machinery. Each option will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 7%. The cash flows of the projects are provided below. Machinery 1 Machinery 2 Cost $396,000 $415,000 Future Cash Flows Year 1 Year 2 Year 3 Year 4 Year 5 123,000 194,000 205,000 215,000 228,000 196, 000 204,000 212,000 217,000 233,000 Required: Identify which option of machinery should the company accept based on the simple payback period method if the firm maintains a policy that every investment project should recover the initial investment within 2 years.arrow_forwardKanye Company is evaluating the purchase of a rebuilt spot-welding machine to be used in the manufacture of a new product. The machine will cost $166,000, has an estimated useful life of 7 years, a salvage value of zero, and will increase net annual cash flows by $32,982. Click here to view the factor table. What is its approximate internal rate of return? (Round answer to O decimal place, e.g. 13%.) Internal rate of return %arrow_forward

- Please help me. Thankyou.arrow_forwardNOVA Company is considering a long-term investment project called STUDY. STUDY will require an investment of $125,190. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $79,000, and annual cash outflows would increase by $40,000. Compute the cash payback period. O 3.21 years O 1.23 years O 1.58 years O 4 yearsarrow_forwardBunnings Ltd is considering to invest in one of the two following projects to buy a new equipment. Each equipment will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 8%. The cash flows of the projects are provided below. Equipment 1 Equipment 2 Cost $186000 $195000 Future Cash Flow Year 1 86000 97000 Year 2 93000 84000 Year 3 83000 86000 Year 4 75000 75000 Year 5 55000 63000 Required:a) Identify which option of equipment should the company accept based on Profitability Index? b) Identify which option of equipment should the company accept based on discounted pay back method if the payback criterion is maximum 2 years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education