FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

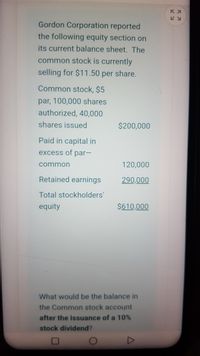

Transcribed Image Text:Gordon Corporation reported

the following equity section on

its current balance sheet. The

common stock is currently

selling for $11.50 per share.

Common stock, $5

par, 100,000 shares

authorized, 40,000

shares issued

$200,000

Paid in capital in

excess of par-

common

120,000

Retained earnings

290,000

Total stockholders'

equity

$610,000

What would be the balance in

the Common stock account

after the issuance of a 10%

stock dividend?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Raphael Corporation’s balance sheet shows the following stockholders’ equity section. Preferred stock—5% cumulative, $___ par value, 1,000 shares authorized, issued, and outstanding $ 50,000 Common stock—$___ par value, 4,000 shares authorized, issued, and outstanding 100,000 Retained earnings 350,000 Total stockholders' equity $ 500,000 2. If two years’ preferred dividends are in arrears at the current date and the board of directors declares cash dividends of $15,500, compute the total amount paid to (a) preferred shareholders and (b) common shareholders.arrow_forwardOn January 1, 2024, Dolar Incorporated had the following account balances in its shareholders' equity accounts. $ 241,000 482,000 195,000 1,950,000 3,900,000 20,500 Common stock, $1 par, 241,000 shares issued Paid-in capital-excess of par, common Paid-in capital-excess of par, preferred Preferred stock, $100 par, 19,500 shares outstanding Retained earnings Treasury stock, at cost, 4,100 shares During 2024, Dolar Incorporated had several transactions relating to common stock. January 15: February 17: April 10: July 18: December 1: December 20: Declared a property dividend of 100,000 shares of Burak Company (book value $11.9 per share, fair value $9.95 per share). Shareholders' equity Distributed the property dividend. A 2-for-1 stock split was declared and distributed on outstanding common stock and effected in the form of a stock dividend. (Dolar chose to reduce Paid-in capital-excess of par.) The fair value of the stock was $4 on this date. Declared and distributed a 4% stock dividend…arrow_forwardOn June 30, 2021, when ABC Co. stock was selling for $65 each, the equity accounts had the following balances: Common Stock ($50 par value, 50,000 issued) $2,500,000 Capital Contributed in Excess of Par Value—Common Stocks 600,000 Retained Earnings 4,200,000 How much will the Common Stock account balance be after declaring and distributing a 100% stock dividend? a. $5,000,000. b. $7,300,000. c. $2,500,000.arrow_forward

- The stockholders' equity section of Swifty Corporation consists of common stock ($10 par) $2,200,000 and retained earnings $523,000. A 10% stock dividend (22,000 shares) is declared when the market price per share is $15. Show the before-and-after effects of the dividend on the following. (a) (b) (c) The components of stockholders' equity. Shares outstanding. Par value per share. Stockholders' equity Outstanding shares Par value per share Before Dividend $ After Dividendarrow_forwardAt the end of the accounting period, Houston Company had $8,000 of par value common stock issued, additional paid-in capital in excess of par value – common of $10,300, retained earnings of $8,500, and $6,000 of treasury stock. What is the total amount of stockholders' equity?arrow_forwardLos Altos, Inc., disclosed the following information in a recent annual report: Year 1 Year 2 Net income $73,500 $123,750 Preferred stock dividends 6,300 6,750 Average common stockholders’ equity 2,700,000 3,150,000 Dividend per common share 2.70 2.52 Earnings per share 3.99 4.61 Market price per common share, year-end 41.00 47.30 Calculate the return on common stockholders’ equity for Los Altos, Inc. for both years.Round to two decimals. Year 1 Year 2 Return on Common Stockholders' Equity Answer Answer Did the return improve from Year 1 to Year 2? Answerarrow_forward

- The balance sheet for Chevelle Corp. is shown here in market value terms. There are 9,000 shares of stock outstanding. Market Value Balance Sheet Cash $43,700 Fixed assets 310,000 Total $353,700 Equity $353,700 Total $353,700 Instead of a dividend of $1.40 per share, the company has announced a share repurchase of $12,600 worth of stock. How many shares will be outstanding after the repurchase? (Do not round intermediate calculations and round your final answer to 2 decimal places. What will the price per share be after the repurchase? (Do not round intermediate calculations and round your final answer to 2 decimal places.arrow_forwardThe following accounts and their balances appear in the ledger of Goodale Properties Inc. on June 30 of the current year: Common Stock, $15 par Paid-In Capital from Sale of Treasury Stock Paid-In Capital in Excess of Par-Common Stock Retained Earnings Treasury Stock Retained Earnings Treasury Stock (715 Shares at Cost) Total Stockholders' Equity $657,000 27,000 17,520 Prepare the Stockholders' Equity section of the balance sheet as of June 30 using Method 1 of Exhibit 8. Eighty thousand shares of common stock are authorized, and 715 shares have been reacquired. ✓ 1,031,000 ✓ 13,585 Paid-In Capital: Common Stock, $45 Par (80,000 Shares Authorized, 14,600 Shares Issued) Excess Over Par Paid-in capital, common stock From Sale of Treasury Stock Total Paid-In Capital Goodale Properties Inc. Stockholders' Equity June 30 QOOQarrow_forwardneed correct and complete help please with workingarrow_forward

- A company with 100,000 authorized shares of $4 par common stock issued 40,000 shares at $8. Subsequently, the company declared a 4% stock dividend on a date when the market price was $12 a share. What is the amount transferred from the retained earnings account to paid-in capital accounts as a result of the stock dividend?arrow_forwardThe following data has been collected about Keller Company's stockholders' equity accounts: Common stock $10 par value 21,000 sharesauthorized and 10,500 shares issued, 1,100 shares outstanding $105,000 Paid-in capital in excess of par value, common stock 51,000 Retained earnings 26,000 Treasury stock 12,760 Assuming the treasury shares were all purchased at the same price, the number of shares of treasury stock is:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education